NFL approves 2 more purchases of ownership in Raiders

DALLAS — NFL owners unanimously approved the Raiders’ limited partnership ownership sale to businessmen Egon Durban and Michael Meldman on Wednesday.

Durban, Silver Lake co-CEO and Endeavor board chairman, and Meldman, Discovery Land Company founder and chairman, purchased a 15 percent stake in the Raiders in separate 7.5 percent transactions. The NFL signed off on the deals at its winter meetings.

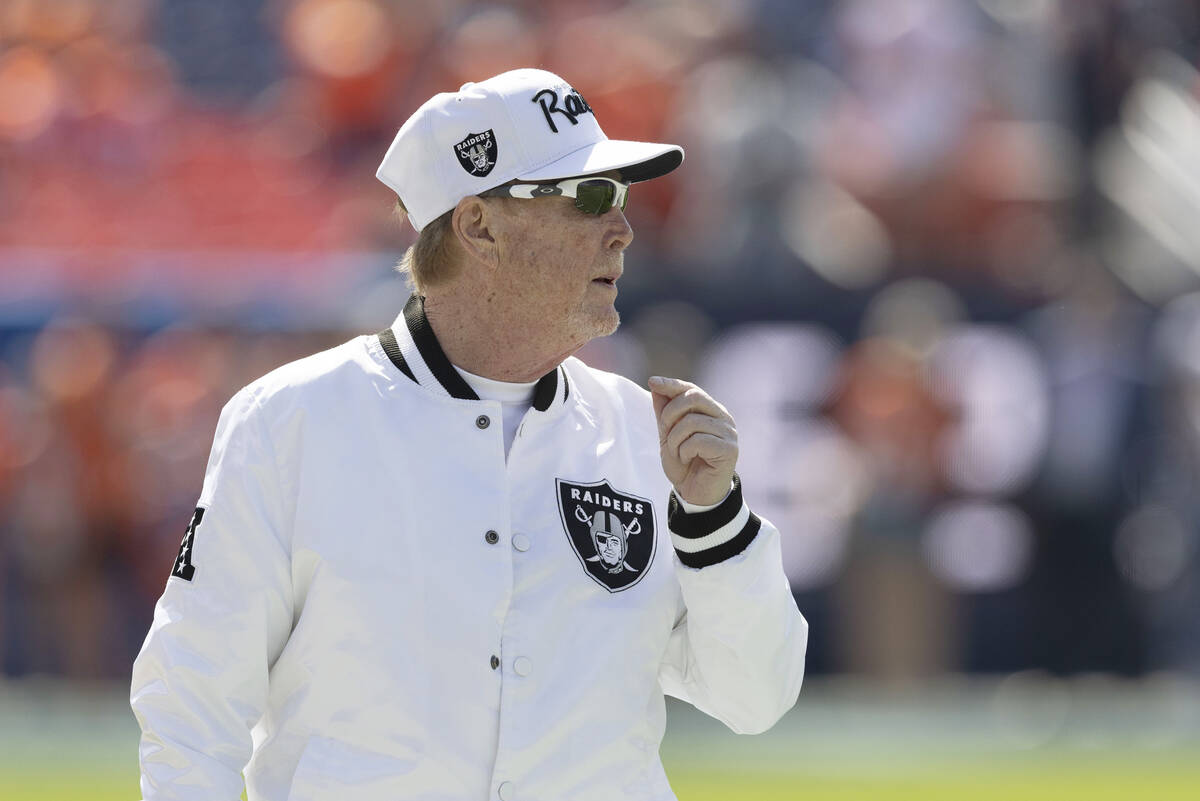

Raiders owner Mark Davis said Wednesday the additions of Durban and Meldman go beyond a financial transaction. He expects both to play a role in the future of the franchise. The Raiders’ valuation since moving from Oakland to Las Vegas has soared to $7.8 billion, but Davis believes there is still untapped potential.

“They’re going to help us immensely on the business side of the organization,” Davis said.

The deals come two months after Tom Brady, his business partner Tom Wagner and former NFL great Richard Seymour purchased about 10 percent of the franchise. Brady and Wagner each bought a 5 percent stake, while Seymour purchased a 0.5 percent stake.

Brady is expected to eventually run the football operations. Wagner, Durban and Meldman will provide insight into the franchise’s overall growth.

“I think at this point we have the infrastructure that we’re going to need to move forward with some young, energetic people that are very brilliant,” Davis said.

Still in charge

Davis will remain in firm control of the team. Davis and his mother, Carol, own more than 40 percent of the Raiders. Mark Davis, as the controlling owner, has full decision-making power and sole voting rights at league meetings.

None of the new minority owners will have official roles or decision-making power.

“The financial part of it wasn’t as big as bringing the infrastructure,” Davis said. “As I said originally, this is something that had been planned for quite a while.”

It’s all part of the plan to take advantage of the Raiders’ opportunities in Las Vegas.

“It’s exciting to have that being brought in as part of the infrastructure,” Davis said. “They have great abilities to do a lot of things. And we have a lot of things on the horizon that are off the field.”

Financial implications

Beyond infusing his organization with new football and business insight, Davis has other reasons to sell stakes in his team.

While the sales price the newest owners are paying will not reflect the club’s full $7.8 billion worth, the transactions are still generating millions of dollars for Davis.

There also are tax implications looming.

With Davis’ mother in her 90s, he has to plan for the inevitable. Davis, 69, is an only child, and at some point, he will have to pay an inheritance tax based on the increased value of the franchise when his mother dies.

By liquidating a percentage of the team now, he gets the financial gain today and is in better position to plan for the capital gains tax he will eventually pay.

Contact Vincent Bonsignore at vbonsignore@reviewjournal.com. Follow @VinnyBonsignore on X.