VICTOR JOECKS: Mom hopes lawsuit will save her daughters’ Opportunity Scholarships

What happened to Bonnie Ybarra’s daughters at Hal Smith Elementary School is a parent’s worst nightmare.

Elia Ybarra, who’s now 9, attended Hal Smith from kindergarten to second grade. Trinity Ybarra, now 7, went there for kindergarten. Attending Hal Smith doesn’t usually end well. Less than 20 percent of the school’s students are proficient in reading, according to state data. Less than 13 percent are proficient in math.

Mrs. Ybarra said her daughters were “failing badly.” She tried to get her girls help. No one had time to help her daughters, offering excuses instead of solutions.

Then it got worse. “There are a lot of behavioral problems there,” Mrs. Ybarra said. That included boys “exposing themselves in the classroom.”

Elia and Trinity were on their way to becoming statistics. Then a miracle happened — Mrs. Ybarra learned about Opportunity Scholarships. Passed in 2015, the program gives low-income families scholarships they can use for private school tuition. Businesses receive a dollar-for-dollar tax credit for donations to scholarship-granting organizations, up to a limit established by the Legislature.

Her family applied and received partial scholarships from the Education Fund of Northern Nevada and AAA Scholarship Foundation. Her daughters have gone to Mountain View Christian School for two years and are thriving.

The teachers “have a relationship with our family,” Mrs. Ybarra said. “They’ve been giving our daughter tutoring. Elia needed to re-learn everything because she was so behind.

“Trinity feels safe. Kids aren’t bullying her and biting her. We feel like we’re part of a family. It’s been wonderful.”

This year, Mrs. Ybarra planned to enroll her daughter, Nala, 5, at Mountain View for kindergarten.

This story is a win-win. Ybarra’s daughters are thriving thanks to Opportunity Scholarships, which are limited to $8,300 a student. That makes this program a good deal for taxpayers, too. Spending at Hal Smith is $9,500 a student, not including capital expenses.

But legislative Democrats want Elia and Trinity to return to a school where they were bullied, abused and failing to learn.

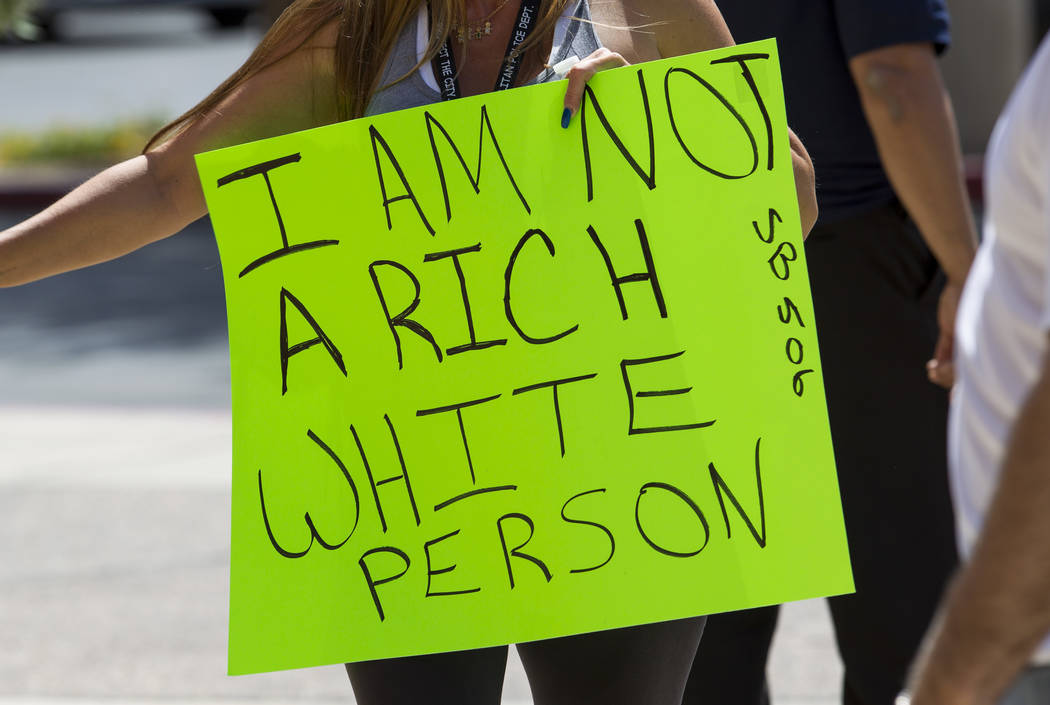

The Opportunity Scholarship program had $5 million of tax credits available for the 2015-16 school year. The law required the amount to grow by 10 percent a year. But legislative Democrats voted last session to eliminate the growth provision.

As a result, the Education Fund of Northern Nevada informed Mrs. Ybarra that it couldn’t provide any scholarship money this year. AAA Scholarship Foundation provided only half of what it had offered the family last year.

Mrs. Ybarra was “devastated” by the news. She sought a zone variance, trying to send her girls to a better school. The district denied her. Just when it looked hopeless, Mountain View offered her girls one year of discounted tuition.

To help her girls continue attending the school that’s best for them, Mrs. Ybarra is a plaintiff in a lawsuit filed last week by the Institute for Justice contending that eliminating the growth in tax credits increased state revenues and thus required a two-thirds majority in both houses. The bill didn’t receive a supermajority in the Senate.

IJ is right on the merits — as are Senate Republicans challenging, in a separate lawsuit, the constitutionality of extending a tax without a two-thirds vote.

But this case also has important implications for Elia, Trinity and Nala. “Our children don’t want to leave their school,” Mrs. Ybarra said. “They love their school.”

Contact Victor Joecks at vjoecks@reviewjournal.com or 702-383-4698. Follow @victorjoecks on Twitter.