Help for struggling homeowners?

The economy’s dependence on a healthy housing market has been laid bare by the foreclosure crisis. And with millions more Americans poised to walk away from depreciating homes financed by costly subprime mortgages, the threat of a prolonged recession is scaring policymakers.

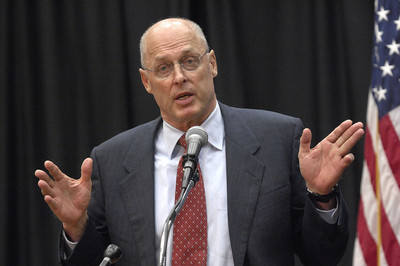

Treasury Secretary Henry Paulson joined the chorus of cries for action on Tuesday. In a speech at Georgetown University’s law school, he called on government and the financial sector to find ways to keep struggling borrowers in their houses.

“We must help as many able homeowners as possible stay in their homes,” Mr. Paulson said. “Foreclosures are costly and painful for homeowners.”

At the same time, Mr. Paulson expressed no concern for the other parties responsible for the nation’s housing slump: lenders and speculators.

“When investors are relieved of the cost of bad decisions, they are more likely to repeat their mistakes,” he said.

But what about homeowners? Giving relief to folks who took on mortgages that broke their household budgets sends a bad message, too.

Most of these people “bought” their homes with no money down, no assets and sketchy income and credit histories. Are they less likely to over-extend themselves again if their delinquency is rewarded with lending terms usually reserved for more responsible borrowers?

Already, Congress is moving to provide some help to people who’ve abandoned their homes or filed for bankruptcy as a result of housing debts. The House has passed legislation that would make forgiven mortgage debt, currently taxable as income, tax-exempt.

But beyond tax relief, government should get out of the way and let this market correction work itself out. Allowing people to remain in homes they can’t afford keeps prices artificially high and makes ownership more difficult for those with median-to-lower incomes. As this week’s three-part Review-Journal series documented — contrary to Mr. Paulson’s statement — foreclosures are “costly and painful” for everyone.

If things get bad enough, lenders may very well decide that renegotiating current mortgages — especially those about to adjust to unimaginably expensive payments — is in their best interest. Taxpayers must not be put on the hook for those costs, however.

As Gov. Jim Gibbons said in ruling out state subsidies for homeowners facing foreclosure, “The way out is addressing each individual problem, one at a time.”