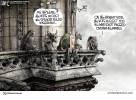

Mini TARP

With help from two Republican senators who cannot be voted out of office for several more years — George LeMieux of Florida and George Voinovich of Ohio — and after months of impasse, the Senate on Thursday broke the 60-vote barrier and passed “mini-TARP” legislation that creates a $30 billion small-business loan fund, 61-38.

The measure, expected to breeze through the House, contains some useful provisions: The self-employed, for instance, would be able to deduct health-care costs from their self-employment tax.

But the bill’s main feature, the $12 billion in tax breaks touted as “encouraging investment and hiring,” are, of course, “targeted,” temporary tax breaks designed to reward only the types of investment favored by the administration — windmills, guys stapling plastic over your windows, whatever — investments which by definition would not pencil out as profitable on their own, else they would have been made without this massive new infusion of government red tape.

Why not, instead, just slash taxes across the board and allow true entrepreneurs to invest and create jobs as they see fit, instead of phoning up the government to ask which bizarre, make-work investments are to be temporarily subsidized, this time?

The bill would “allow” about 8,000 community banks with assets of up to $10 billion to make loans to small businesses, though it’s not clear what was preventing them from making those loans to qualified borrowers in the first place.

The bill has been dubbed a smaller version of the earlier bank bailout known as the “Troubled Asset and Relief Program” (TARP), whose go-along Republican backers are being purged in primary after primary this summer. (Paging Delaware’s Mike Castle.)

“TARP was a disaster,” Mitch Jacobs, founder of On Deck Capital, tells USA Today. “It did very little to help Main Street.” Unless the whole lending system is re-evaluated, “Putting more gas in a broken system gets you nowhere,” Mr. Jacobs warns.

The biggest question, though, is why small businessmen would want to increase their debt loads by borrowing in this uncertain economic climate, at all. “Nobody I know will borrow money for the sole purpose of creating payroll,” entrepreneur Jason Jacobs told the newspaper.

TARP handed the bigger banks billions in federal tax dollars. For the most part, as employers struggle to pay down existing debt, the banks are still sitting on that cash. And how is the estimated $15 billion overall cost of this latest “mini” bailout to be “offset”? By “closing tax loopholes” and “imposing new tax penalties” — tax hikes on everyone, no matter what the administration chooses to call them.

Watch your mailbox. Those 16,000 new IRS men have to keep busy doing something.