EDITORIAL: Why Biden can’t convince voters he’s beat inflation

Economic happy talk doesn’t lower mortgage payments. It’s one reason Bidenomics remains deeply unpopular.

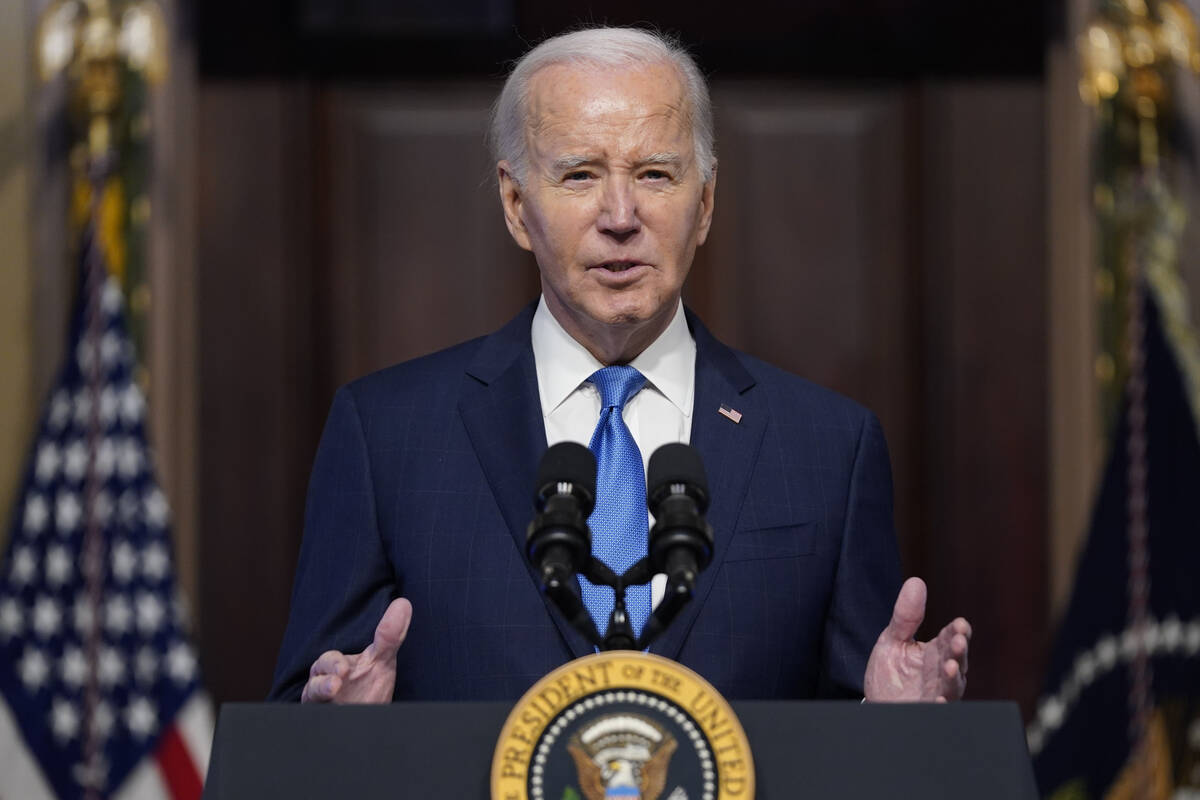

President Joe Biden wants the public to believe that the economy is doing great. At a recent campaign event, Mr. Biden bragged that he had overseen “record job creation, historic economic growth, (and) among the lowest inflation rates of any major economy in the world.” The White House frequently touts Bidenomics. His administration even claims, “Bidenomics is working.”

His allies in the media are pushing this narrative, too. “Biden goes into 2024 with the economy getting stronger, but voters feel horrible about it,” The Associated Press wrote recently.

New York Times writer Nate Cohn suggested the problem was vibes, not economic. “It’s harder to argue that voters should believe the economy is outright terrible, even after accounting for inflation,” he wrote.

The subtext is clear: Mr. Biden has worked wonders on the economy — if only those dumb voters would realize it.

At least they have one thing right. The public strongly disapproves of Mr. Biden’s handling of the economy. A recent Wall Street Journal poll found just 30 percent of those surveyed had a favorable view of “Bidenomics,” with more than half viewing it unfavorably. A majority also said Mr. Biden’s policies have hurt them personally. Two-thirds of voters said the economy is poor or not good. Two-thirds also said the economy has declined over the past two years.

Those numbers reflect a brutal reality, even if insulated progressive elites are blind to it. Mr. Biden’s problem is runaway inflation. Real disposable income has fallen 7.5 percent since Mr. Biden took office, according to the Heritage Foundation. Prices for many food items are up 20 to 30 percent. Vehicle costs — such as gasoline, insurance and repairs — are up more than 35 percent.

While inflation has slowed, prices for almost everything remain elevated from pre-pandemic levels. To fight the rising costs triggered by Mr. Biden’s unprecedented spending spree, the Fed has jacked up interest rates.

This hits hardest in housing costs. As the Journal reported, “It is now less affordable than any time in recent history to buy a home.” Increased interest rates dramatically increase mortgage payments. New buyers can’t afford a starter home. Current mortgage holders can’t afford to lose their 3 percent interest rate and move to a bigger home. Many are abandoning their dreams of home ownership entirely.

Simply put: The president seems oblivious to the reality on the ground. Ultimately, that could cost him dearly.