EDITORIAL: ‘Unicorns, magic wands’ needed to fund Harris’ Medicare-for-all plan

The Bernie Sanders campaign is now the voice of fiscal reality in the Democratic presidential primary. That’s not a good sign.

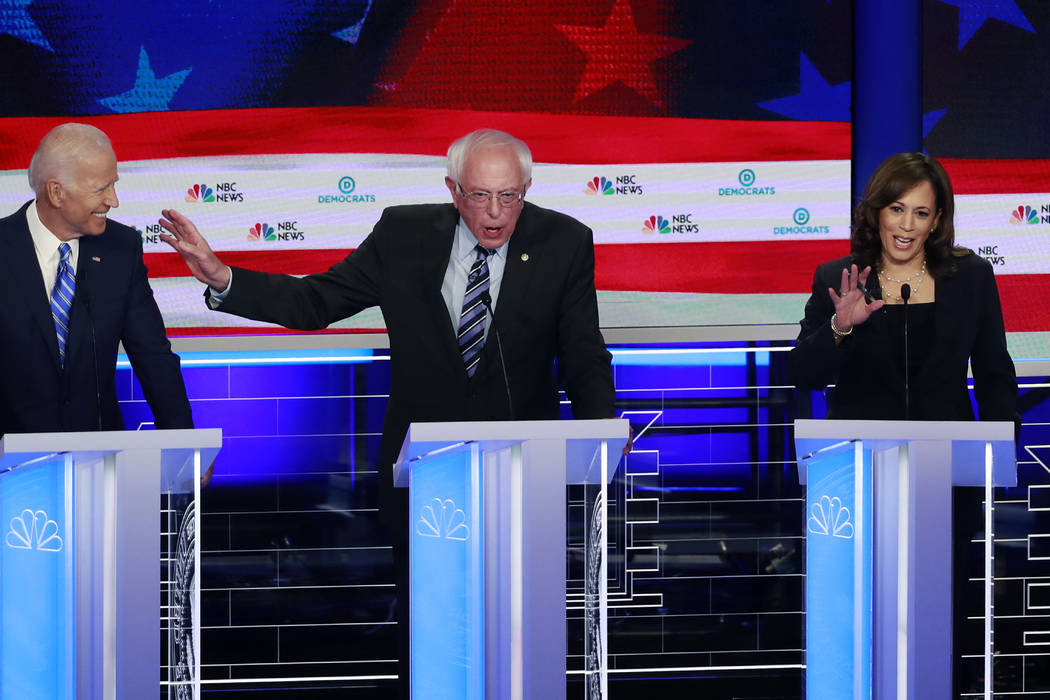

The Vermont senator’s signature proposal is “Medicare for All.” Absent favoritism from the Democratic National Committee, he might have ridden that plan to a presidential nomination in 2016. He has succeeded in making single-payer health care a mainstream idea among Democrats. Four other Democratic senators running for president, including Sen. Kamala Harris, D-Calif., are co-sponsors of Sen. Sanders’ Medicare for All bill.

That’s left his fellow presidential candidates looking for a way to distinguish themselves.

“I’m not in support of middle-class families paying more taxes for it,” Sen. Harris said on CNN when asked how her Medicare for All plan differed from Sen. Sanders’ proposal.

Asked how she was going to pay for it, Sen. Harris dodged.

“Part of it is going to have to be about Wall Street paying more,” she said. “It’s going to have to be about looking at what we tax in terms of financial services. That’s part of it. But the other part of it is understanding that this is an investment, which will reap a great return on the investment.”

Jeff Weaver, an adviser to Sen. Sanders, struck back about the finances of the Harris plan being about “unicorns” and “magic wands,” pointing out that you can’t afford Medicare for All without much higher taxes on all Americans. “Health care is not free.” he said. “There’s doctors, nurses that have to be paid. There’s hospitals. You have to pay for it.”

Not free is an understatement. Outside groups have estimated that it will cost around $32 trillion over the next 10 years. Sen. Sanders thinks that estimate could be low. At a Washington Post forum, he said the plan could cost up to $40 trillion over the decade. For context, total federal spending in fiscal 2018 was $4.1 trillion, which included an almost $800 billion deficit.

Medicare for All would nearly double the current unsustainable level of federal spending.

Sen. Sanders proposes numerous tax increases to fund this plan. Several would affect only high-income earners. These include raising the top tax rate to 52 percent, expanding the estate tax and imposing a constitutionally dubious wealth tax. Sen. Sanders projects that these tax hikes will raise $3.6 trillion over the next 10 years, which is about 10 percent of the projected cost.

He also suggests broad-based tax hikes. These include a 4 percent income tax, labeled a “premium,” paid by individuals and a 7.5 percent payroll tax paid by employers. Those tax hikes would raise $7.4 trillion over 10 years, he claims. Additional taxes on corporations and eliminating health care-based tax breaks would generate another $5.2 trillion.

Those capable of doing second-grade math will notice that adds up to only $16.2 trillion. That’s not even close to $40 trillion — which is why Sen. Sanders’ proposal would also include a significant tax hike on the poor and middle class. But even that would be unlikely to raise the required revenue for “free” health care for all.

Little wonder his camp is upset at Ms. Harris breezily asserting that Medicare for All is possible without a middle-class tax hike. His own numbers show that it’s not financially feasible even with a middle-class tax increase.

High taxes on the middle class are exactly what funds expansive government health care programs in places such as Scandinavia. Sen. Sanders has commented favorably on the generous social services provided by countries such as Norway, Sweden and Denmark. What’s not mentioned is how much the middle-class there must pay in taxes.

Including payroll taxes, the top marginal income tax rate in Denmark is 60 percent. It’s not just paid by the rich. It’s applied to every dollar earned over 1.2 times the average Danish income. In America, the average income is around $50,000. That means every dollar earned above $60,000 would be taxed at 60 percent. Sweden’s top rate is 56 percent applied at 1.5 times the country’s average income. In America, that would be a 56 percent tax on all earnings of more than $75,000. In contrast, the top U.S. tax rate of 37 percent doesn’t kick in until a wage earner brings home $500,000.

Those three countries also have value-added taxes of 25 percent. A value-added tax is a super-charged sales tax that’s assessed at every level of production. Expect that to eventually be assessed in the United States if progressives are able to impose their will regarding health care.

But it still wouldn’t be enough. Even with unicorns, magic wands and Sen. Sanders’ proposed tax hikes, the United States can’t afford Medicare for All.