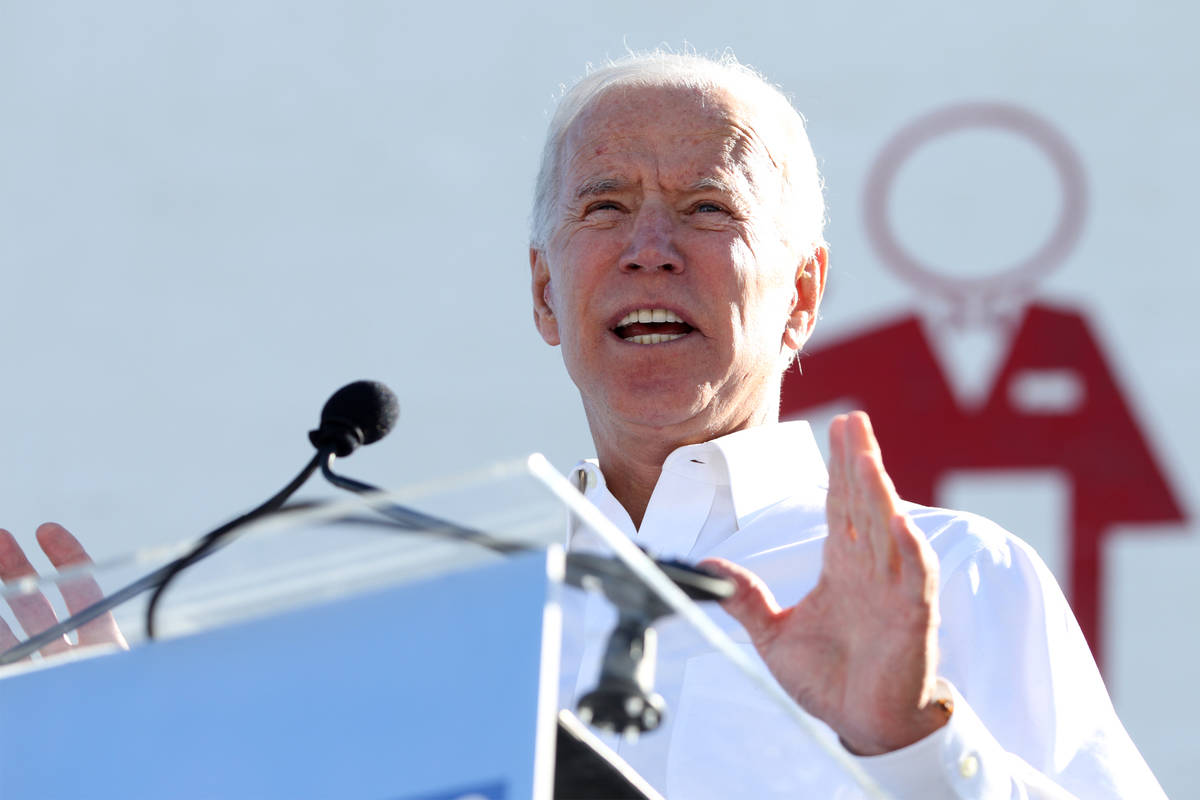

EDITORIAL: Joe Biden takes a big left turn with his tax plan

Tax day has come and gone after a three-month extension intended to help wage earners deal with the coronavirus. Wednesday was the filing deadline this year rather than the traditional April 15.

For many Americans, filing season was greatly simplified by the 2017 passage of the GOP tax reform measure championed by President Donald Trump. Between 2017 and 2018, the number of taxpayers forced to deal with the additional forms necessary to itemize deductions dropped from 46 million to 18 million thanks to an increase in the standard deduction.

But that will all change should Democrat Joe Biden win the election in November.

Mr. Biden has made no secret of his desire to increase taxes on the rich. He has also vowed to reverse most of the 2017 tax bill’s key components. And now Mr. Biden, who has long professed allegiance to policy moderation — is taking cues on tax policy from far-left socialist Bernie Sanders. The ramifications for the U.S. economy — particularly as it emerges from the economic devastation wrought by the coronavirus — are worrisome should he be elevated to the Oval Office.

“In a dramatic change of direction,” Forbes magazine noted this week, “Biden is saddling up to Sanders in an attempt to cocreate policies that appease a wider base of Democratic voters.”

In other words, Mr. Biden is shifting left to appease his party’s vocal and radical progressives. Independent voters should take note.

During the primaries, Forbes reports, Mr. Biden’s tax plan called for raising an additional $4 trillion over the next decade. Sen. Sanders, meanwhile, sought nearly seven times that much, $27 trillion. In addition, Sen. Sanders admitted that his agenda would require massive new levies on the middle class in order to pay for his cornucopia of free stuff, including health care, college, day care and more.

This is the direction Mr. Biden now takes.

It’s worth noting that for all of Mr. Biden’s “tax the rich” rhetoric, one of his first moves as president would be, with the cooperation of a Congress, to restore unlimited tax deductions for state and local income taxes. That provision in his tax plan is, in fact, a large giveaway to wealthy taxpayers and a significant subsidy for politicians in high-tax blue states who use the deduction to camouflage the actual costs of their wealth transfer schemes.

Other portions of Mr. Biden’s plan include heaping more burdens on American corporations and levying huge new payroll taxes on high earners without a concurrent increase in their benefits. All of this would discourage business investment, job creation and entrepreneurship just as the country needs it most.

The coronavirus has been a crushing blow to the U.S. economy. Mr. Biden’s solution is to rush in and deliver a sucker punch.