Legislators worry about raising vehicle insurance requirements

CARSON CITY — A bill that would boost the state’s minimum vehicle insurance level sparked legislators’ fears Tuesday that the higher premiums it would bring would harm poor and indigent people and force more drivers to go uninsured.

"The poor will be hurt by this bill," Assemblyman Mark Sherwood, R-Henderson, said about the bill that would increase the minimum amount of liability insurance required for people to be allowed to drive in Nevada. "It sucks to be poor, we all know that. A $300 (rate increase) is a lot for some people."

Assemblywoman Dina Neal, D-North Las Vegas, said some friends earn about $36,000 a year and they barely can pay month-to-month costs of auto insurance as it is.

"This has nothing to do with the recession," Neal said. "We are working-class people living on fixed incomes."

Their remarks came during an Assembly Transportation Committee debate on Assembly Bill 120. The bill was proposed by Assemblyman William Horne, who was injured in an accident in which the other driver had only the minimum liability insurance required by law.

It wasn’t clear Tuesday whether the bill would be approved. Its next stop is a Transportation Committee workshop.

Liability insurance protects drivers in accidents in which they injure other drivers and damage vehicles other than their own.

To better cover costs of injuries and damages to themselves and their own vehicles, drivers must purchase additional insurance, including collision and underinsured/uninsured driver coverage. That’s what most motorists who can afford the extra costs do now.

Horne, D-Las Vegas, said the current minimum liability levels do not provide enough money to cover medical and vehicle repair costs suffered by the other motorists injured in an accident.

A score of insurance industry lobbyists testified against the bill. They said more than 40 percent of Nevada drivers now have liability coverage that’s less than the bill’s proposed minimum. They are the ones who would be affected by the proposal.

To meet that higher limit, the drivers would pay 18 percent to 54 percent more in insurance costs, depending on the company, the driver’s age, location and driving record, according to their testimony.

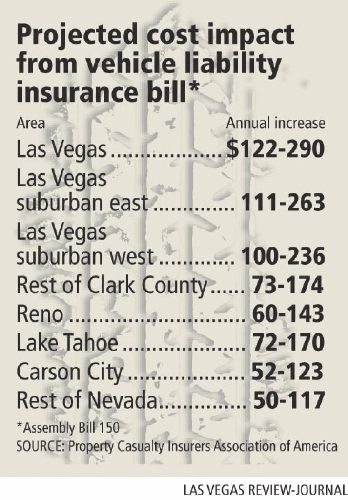

A study by the Property Casualty Insurers Association of America put the increase for those drivers in Las Vegas at $122 to $290 a year.

Insurance lobbyists also testified that if the bill is approved, the number of uninsured motorists, now 15 percent, would increase because poor motorists could not afford the higher premiums.

Drivers now must buy coverage that allows their insurance companies to pay a maximum of $15,000 for the injuries or death suffered by one person, $30,000 for the injuries or deaths of all people in the accident, and $10,000 for property damages just in the other vehicle.

Horne’s bill would raise the minimum liability limits to $50,000 for one person, $100,000 total, and a $25,000 in property damage.

Those limits would tie Nevada with Wisconsin, Maine and Alaska as states with the highest minimum coverages in the country.

Transportation Chairwoman Marilyn Dondero Loop, D-Las Vegas, gave no indication whether she thinks the bill will pass. She said amendments would be considered in a committee workshop.

Neal suggested that the committee consider new limits that are not as high as proposed by Horne.

If the bill passes, she said the state would collect more in insurance premium taxes and that revenue could be used to set up a fund to help indigent people pay for auto insurance.

Horne said he knew his bill would draw a lot of opposition, particularly from people concerned about the poor.

"I know this is going to raise rates of a lot of people," he said. "I know it comes at a time when the economy is struggling. But the purpose of the Legislature is to protect the public."

Horne said the current minimum liability limits were set in Nevada in 1958 — at time when he said "Gunsmoke" was the top TV show, gasoline was 24 cents a gallon and new homes cost $30,000. He said there hasn’t been a legislative hearing to consider higher liability minimums since 1958.

The insurance industry "always will be opposed" to higher minimums, regardless of the state of the economy, he said.

Fighting back tears, Horne gave a personal reason for the bill. Last year he suffered back, neck, wrist, shoulder and other injuries when his car was hit in Las Vegas by a driver carrying the minimum liability coverage.

Horne said the other driver’s $15,000 bodily injury limit won’t come close to covering his medical bills. He said he still might need surgery to reduce pain in a wrist.

"But think of all the people who are less fortunate than me," Horne said, noting that some are left in wheelchairs through accidents with drivers who have only minimum coverage.

Because those drivers purchased minimum liability insurance, they probably don’t have much of an estate or personal assets to go after in a lawsuit, said Horne, a lawyer and chairman of the Assembly Judiciary Committee.

Because he was 48 at the time of his accident and never had been in an accident in his life, Horne admitted he did not purchase underinsured/uninsured driver coverage.

With that coverage, drivers can protect themselves from losses they incur in accidents caused by drivers with minimum liability coverage.

"I didn’t think I needed it," Horne said.

He said he would be willing to accept a lower minimum than he proposed if that concession would lead to passage of his bill.

Contact Capital Bureau Chief Ed Vogel at evogel@reviewjournal.com or 775-687-3901.