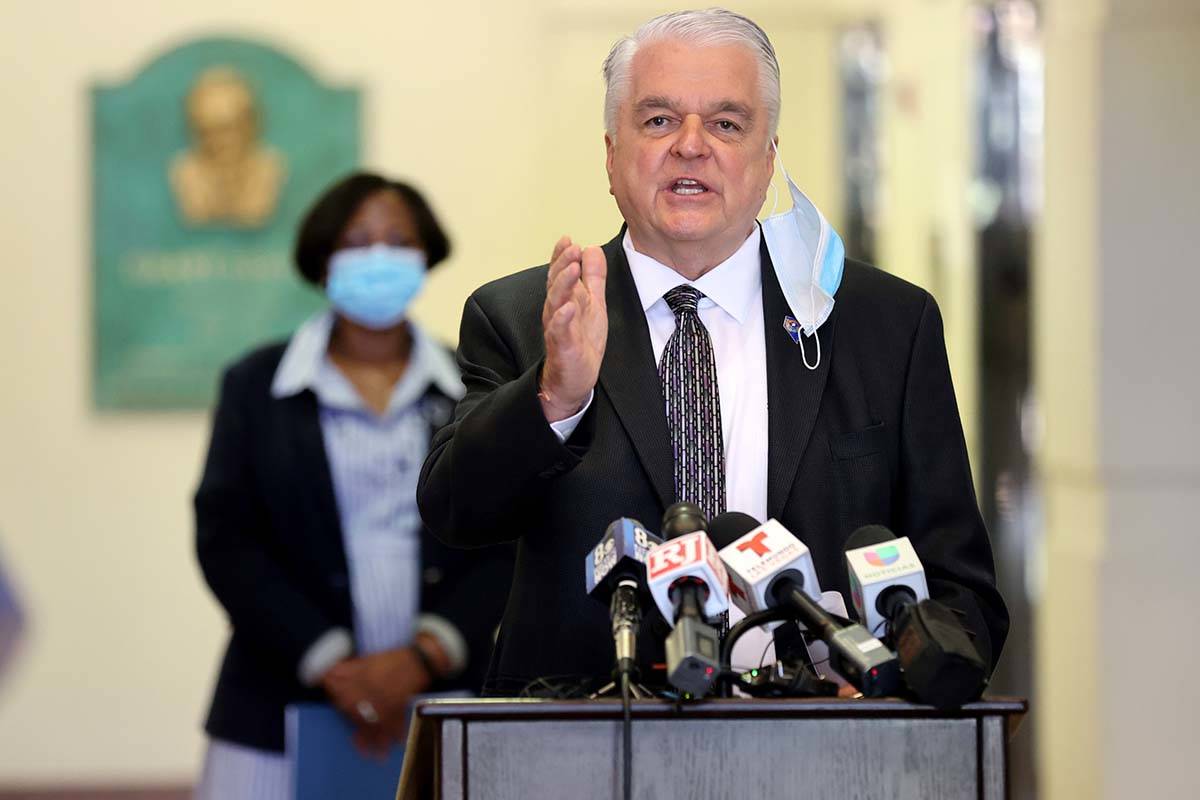

Deep cuts, possible tax increases on tap for special session

CARSON CITY — Gov. Steve Sisolak is not ruling out possible tax increases during the upcoming special legislative session as a way to address the current year’s budget hole, which is projected to exceed $1.2 billion.

But such moves, if enacted, would be “short-term, stopgap measures” that would sustain critical public services amid the current financial emergency,” according to a report released by Sisolak’s office Monday that details the dire financial straits the state is facing as well as Sisolak’s proposed moves to balance the budget.

The governor also ruled out any consideration for new taxes or revenue sources for the special session, which is scheduled to begin in Carson City on Wednesday.

Sisolak’s plan includes massively steep cuts to state agencies that total upward of $549 million, cuts of nearly $170 million to the state’s K-12 budget, furloughs for all state and higher education employees and elimination or reduction of one-time infusions of money to several state programs.

“None of us could have predicted a pandemic of this magnitude and the global economic crisis that has followed. The world looks incredibly different since I first approved our state’s biennial budget back in June 2019,” Sisolak said in a statement included in the announcement. “The difficult fiscal decisions for fiscal year 2021 now lay ahead of us. My proposal preserves as much funding as possible for our most essential priorities — health, education and the state workforce — so they are able to continue providing the vital services on which Nevadans rely.”

The plan reiterates some things Sisolak has previously proposed, such as the furloughs for state employees. But it also adds clarity on those state-level cuts, including specific dollar amounts to be cut from some agencies and a mention that Nevada would keep vacant nearly 700 open positions in state government as a way to save money.

Some of those proposed cuts include:

■ $233 million from the Department of Health and Human Services, which would affect services of the divisions of aging and disabilities services, public and behavioral health, and Medicaid.

■ $190.6 million from the Nevada System of Higher Education.

The governor’s plan would cut $156 million from K-12 funding as well as $10 million from the Department of Education’s budget. But the plan would keep whole the state’s Distributive Schools Account, which directly funds school districts and charter schools for public education. That means that the budget cuts would not affect Nevada’s basic per-pupil funding of $6,288.

Republican state Sen. Ben Kieckhefer of Reno said Monday that Sisolak had “presented a plan that on the surface works.”

But Kieckhefer said lawmakers need to sit down during the special session and analyze how the cuts would affect the agencies and their ability to provide services, especially in the public health sector, and to hear from those agencies and the people they serve before making any final decisions.

“I think we need to figure out what it means on the street,” he said.

The report states that while the governor’s proposal balances the budget without any additional revenue, “the necessary reductions are deep and significant and will negatively impact the State and those it serves in this fiscal year, especially in the areas of healthcare and education.”

Sisolak determined that because of time constraints involved with the setup of new taxes, they would not be viable, according to the report. But it states that any increases in existing taxes passed during the special session would be a temporary bandage to keep important services afloat until lawmakers convene for their regular session in February.

“Without confirmation that federal assistance will be provided to states to help address budget shortfalls, the Governor explored and evaluated revenue options that could reduce the need for cuts, understanding that any options during an unplanned special session would be short term, stop-gap measures to help sustain critical public services until the legislature reconvenes in a regular session in 2021,” the report states.

In Nevada, any tax increase requires a two-thirds vote by both houses of the Legislature. Democrats hold a supermajority in the Assembly and could pass tax increases without a single Republican vote. The Senate, however, would be a different question, as Democrats would need at least one Republican vote in order to pass any tax increases.

On potential tax increases, Kieckhefer said it’s too early to discuss because it’s not clear what that extra money would go toward.

“It’s hard to talk about the concept of raising additional revenue until you know what you’re buying,” Kieckhefer said.

Contact Capital Bureau Chief Colton Lochhead at clochhead @reviewjournal.com. Follow @ColtonLochhead on Twitter.