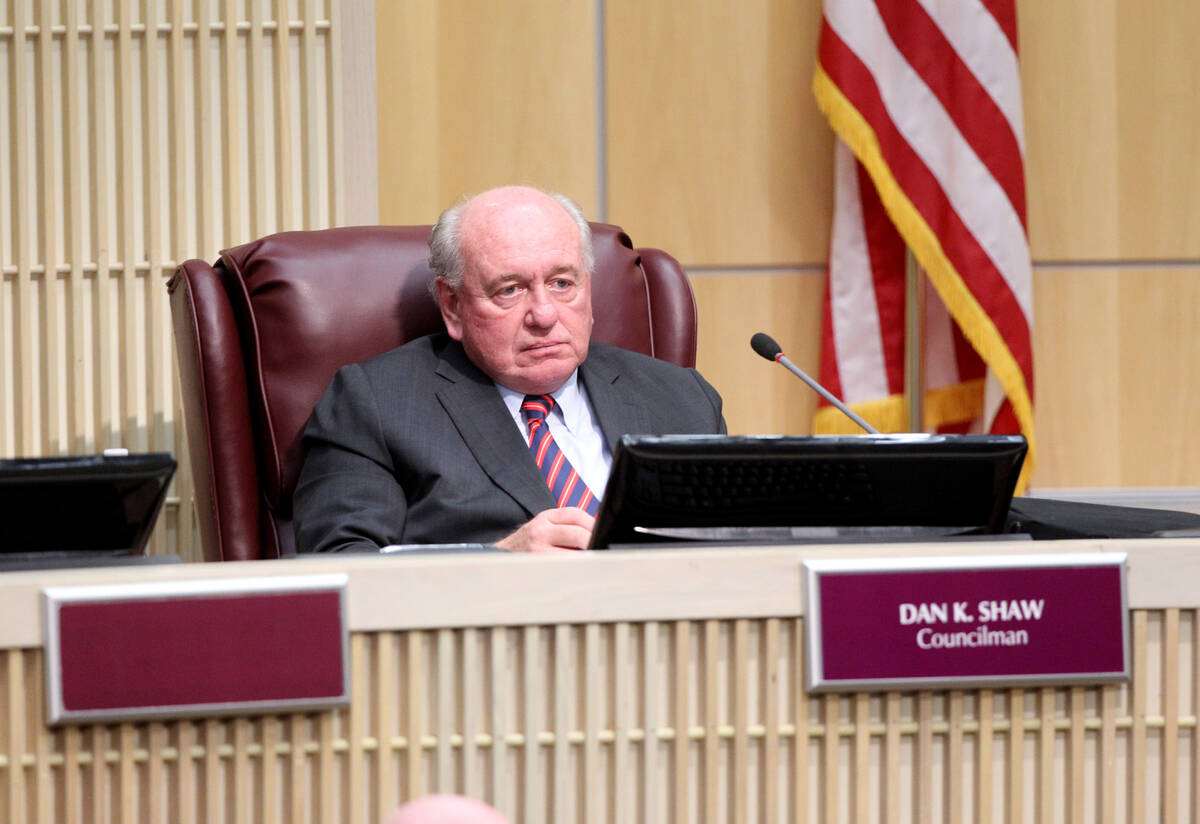

Lawsuit accuses Henderson councilman of predatory loans, presenting company as tribal entity

Henderson City Councilman Dan Shaw is accused of giving predatory loans with interest rates over 700 percent while allegedly representing his firm as a tribal lender to avoid liability.

A class-action lawsuit was filed in Wisconsin on June 26. Another lawsuit was filed in Illinois on May 30 with the District Court for the Northern District of Illinois.

Defendants have not yet filed responses to either lawsuit.

In the Illinois complaint, plaintiffs are seeking relief for damages under the Illinois Predatory Loan Prevention Act, Illinois Consumer Fraud Act and the RICO Act.

Plaintiffs also want the court to declare loans void and issue an injunction so that defendants cannot collect on loans given out. The annual interest rate on one of the plaintiff’s loans was over 700 percent, when Illinois law limits interest rates to 36 percent, the lawsuit claims.

Defendants named in the Illinois lawsuit are Shaw; his business partner Greg Jones; Green Arrow Solutions; Integra Financial Services, LLC; and Nevada Impact Management, LLC. Shaw and Jones are managers for Nevada Impact, and they created Integra and Green Arrow Solutions, according to the allegations.

The complaint alleges that Shaw and Jones, under Green Arrow Solutions, schemed to make illegal high-interest loans on the internet while presenting Green Arrow Solutions as a tribal entity, the Big Valley Band of Pomo Indians, to avoid state and federal laws limiting high interest rates.

The complaint details that lending businesses frequently “rent-a-tribe,” where they claim their businesses are owned and operated by Native American tribes. Loans are made in the name of a Native American tribe, which shields the business from state and federal laws against charging unreasonably high interest rates.

Suit claims $787.28 in interest charged on $350 loan

One of the plaintiffs took out a loan with Green Arrow Solutions for $350 last year, according to the complaint.

The complaint claims Green Arrow Solutions charged an additional $787.28 in interest, which would be an annual percentage interest rate of 852.42 percent. Illinois law prohibits annual interest rates over 36 percent.

Shaw has previously been sued four times in Massachusetts, Illinois and Indiana. All of those cases were settled out of court.

In the Wisconsin lawsuit, which does not mention Shaw or Jones, the plaintiff claims that Green Arrow Solutions, among eight other defendants, obtained the plaintiff’s personal identifying and financial information.

Accusations of misuse of credit report information

The complaint alleges that Green Arrow accessed the plaintiff’s consumer credit report, which included the plaintiff’s name, address, Social Security number, credit score and transaction history.

Green Arrow and other defendants are accused of selling, bartering or sharing the plaintiff’s consumer credit report, violating state and federal law.

Efforts by the Las Vegas Review-Journal to directly reach Shaw, who is running for re-election, have been unsuccessful.

Elizabeth Trosper, campaign communications director for Shaw’s re-election campaign, said she anticipates that Shaw’s name will be dropped from the lawsuit for lack of standing.

“Shaw owns the financial institution that services the loans of other companies. He doesn’t set the terms, payouts, collections, or interest rates… (Green Arrow) services the loans but they don’t make the loans.”

Trosper adds that she is not sure whether one of the companies that use Green Arrow Solutions as a service provider in Illinois is a tribal entity.

Monica Larson, who is running against Shaw for the council seat, criticized the Henderson councilman over his legal run-ins. “He’s been sued repeatedly over violations of statutory laws and the RICO act … I’m amazed that he’s even allowed on the ballot,” she said.

Larson alleges that Shaw is preying on the most vulnerable, notably young, adults who don’t know any better, by giving out loans on the internet.

On Wednesday, Henderson public information officer Justin Emerson said, “We don’t comment on our council members’ private or personal business.”

Attorneys for the Wisconsin lawsuit did not comment on the lawsuit, other than to say that the complaint speaks for itself. Attorneys for plaintiffs in the Illinois lawsuit have yet to respond to a request for comment.

Contact Annie Vong at @avong@reviewjournal.com.