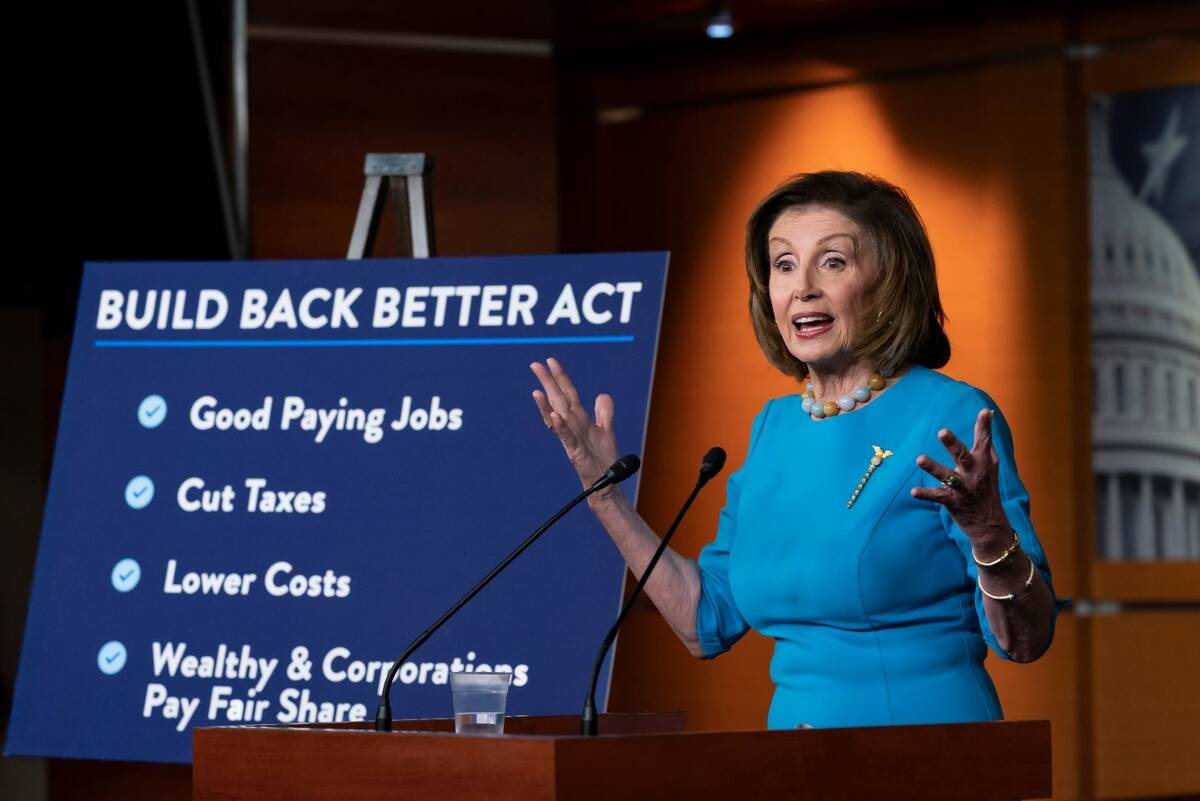

House passes $1.85T Build Back Better spending package

WASHINGTON — House Democrats patched up differences and beat back Republican opposition Friday to pass a massive social spending package that would be largely paid for with tax hikes on corporations and wealthy wage earners.

The House voted 220-213, mostly along party lines, to send the roughly $1.85 trillion Build Back Better Act to the Senate, where it faces major revision.

The spending bill approved by the House would expand of pre-kindergarten programs for thousands of Nevada children, extend Medicare eligibility to more Silver State residents and renew child tax credits for working families.

“At long last — with Democrats in the majority — Congress is delivering the change that our constituents deserve,” Rep. Steven Horsford, D-Nev., said during the floor debate on the bill.

Democratic division between liberals and centrists was smoothed over by an independent congressional analysis released Thursday that found the bill would cost $1.68 trillion, less than $1.85 trillion that Democrats had projected, although the initial analysis could change.

Analysts with the nonpartisan Congressional Budget Office also projected the bill would increase deficits by $367 billion over the next 10 years. But the estimate did not include revenue raising measures that include a crack down on tax cheats.

Treasury Secretary Janet Yellen released a statement after the analysis that said the bill “is fully paid for.”

Applause and chants greet vote

With the vote secured, Democrats on the House floor broke into applause and chants when the bill passed early Friday.

It was hailed as a legislative victory for President Joe Biden and a boost for Democrats who face stiff headwinds in the upcoming 2022 midterm elections

Biden said the bill’s passage in the House is “another giant step forward in carrying out my economic plan to create jobs, reduce costs, make our country more competitive, and give working people and the middle class a fighting chance.”

The bill includes programs for Medicare, Medicaid, public education, wage increases for home and senior care, as well as billions in incentives to combat climate change and develop clean energy.

Republicans were united in their opposition. They called the spending “reckless.”

The lone Democrat to oppose the bill was Rep. Jared Golden of Maine.

In a long-winded, theatrical critique of the president, House Minority Leader Kevin McCarthy, R-Calif., delayed the vote when he took the floor Thursday evening and then spoke more than eight hours into the early hours of Friday.

McCarthy is under pressure from Republican lawmakers who favor a more-aggressive strategy and tactics against Democrats. The GOP needs to flip just five seats in midterm elections to win back control of the House.

During his stem winder on the House floor, McCarthy derided Biden’s economic plan as “Build Back Broke.”

The legislation includes a rollback of some of the 2017 GOP tax cuts, as well as new taxes on corporations and taxpayers earning income over $400,000 annually.

Nevada lawmakers split on party lines

Nevada’s congressional delegation voted along party lines. Democratic Reps. Dina Titus, Horsford and Susie Lee supported the bill. Republican Rep. Mark Amodei opposed it.

Amodei explained earlier his opposition to the “left-wing” funding priorities of the package, tax increases, debt and higher prices for families.

The GOP has called the bill a giveaway to special interest groups and Democratic donors and maintained that the spending will be funded by tax hikes. They also argue that climate programs in the bill will kill jobs and raise energy costs on families.

Republican Rep. Kevin Brady of Texas, the ranking member of the House Ways and Means Committee, said the bill contains crippling tax hikes that would worsen the labor shortage, hurt small businesses and “drive inflation even higher.”

A minimum 15-percent corporate tax, and lifting the $10,000 cap on state and local tax deduction for federal income filings would penalize middle-income earners, while giving the wealthy a break, he said.

“Two out of three millionaires will get a tax cut while the middle class get a tax hike,” Brady said.

But Biden has pledged to fund the bill through taxes on corporations that have paid little or none, and on wealthy Americans with income over $400,000 per year.

The revenue would pay for programs to help working-class families, seniors and fund Pell grants for students in underserved communities.

The president said the tax hikes in the bill would force corporations and the wealthy to pay their fair share.

It also would provide pre-kindergarten education for an additional 65,895 children in the state and expand Medicare coverage for 71,000 additional residents, according to White House projections.

Health care provisions would reduce prescription drug prices through Medicare and cap out-of-pocket costs of medicines for seniors.

‘Historic legislation’

Horsford, a member of the House Ways and Means Committee, helped write the legislation that he said would provide those benefits, nursing home and child care programs and clean energy proposals that would create an additional 1.5 million jobs, nationally, over the next decade.

Titus called the Build Back Better Act “historic legislation that makes once-in-a-generation progress.”

She said the plan “helps Nevada families by lowering the cost of everyday expenses, delivering clean drinking water and high-speed internet, and making overdue investments in education, child care, home care and health care.”

Lee, a member of the bipartisan Problem Solvers Caucus, also pushed for passage of the spending package and its proposals for education, health care and caps on prescription drug prices.

“Nevadans sent me to Congress to deliver lower costs for prescription drugs, affordable health care and child care, tax breaks for the middle class, and policies that will fight this climate crisis with the urgency that it demands,” Lee said in a statement.

She said House passage of the bill is “another step forward in delivering on our promise.”

Lee and Horsford are considered front-line Democrats in the upcoming midterm elections, which have historically favored the party that does not control the White House.

Even with more favorable congressional lines drawn by the Nevada Legislature, the two Nevada Democrats are in districts that are considered competitive. They are not alone.

Republican gains in state elections this month spurred House Democrats to pass a $1.2 trillion bipartisan infrastructure. Nevada will see about $4 billion in spending for roads, bridges, water projects and high-speed internet access.

Democrats hope the bill, signed into law by Biden this week, will give them a winning message of job creation and public works improvements sought by every city and state.

They also are banking that it will help offset the president’s plummeting public approval ratings, driven by rising inflation and higher costs for gas and home heating fuels.

Battle shifts to Senate

Meanwhile, the bill may face heavy revision in the evenly divided Senate.

Democrats are using budget reconciliation rules to pass the legislation with simple majorities, and to avoid a legislative filibuster in the Senate.

Sen. Joe Manchin, D-W.V., forced the Biden administration to lower the original $3.5 trillion price tag on the bill, which was done by reducing the time span of benefits, like child tax credits and scaling back the expansion of some Medicare programs.

Manchin, who represents a coal producing state, also has voiced concerns about clean energy proposals in the legislation that could take years to develop while current energy prices increase.

Senate liberals, meanwhile, want more social spending for health care, and elimination of the state and local tax deduction that would increase to $80,000 from the current $10,000 cap.

Sens. Bernie Sanders, I-Vt., Elizabeth Warren, D-Mass., and others, have vowed to strip the state and local tax deduction provision out of the Senate version of the bill because it benefits wealthy property owners.

The tax deduction relief is sought by Democratic and Republican lawmakers in high-tax states on the East and West coasts. The $10,000 cap on deductions was part of the 2017 GOP tax cut bill and criticized by opponents as punitive to largely blue states.

Nevada, which does not have a state income tax, would receive little benefit from lifting the cap, which is set to expire in 2025. Only the wealthiest property owners in the state would benefit from a larger deduction amount, according to the Tax Foundation, a right-leaning think tank.

Contact Gary Martin at gmartin@reviewjournal.com. Follow @garymartindc on Twitter.