Clark County commissioner proposes cutting sales tax in half

A sales tax authorized by the Nevada Legislature that could raise $108 million annually to fund education and social service programs might be cut in half if the Clark County Commission votes to enact it.

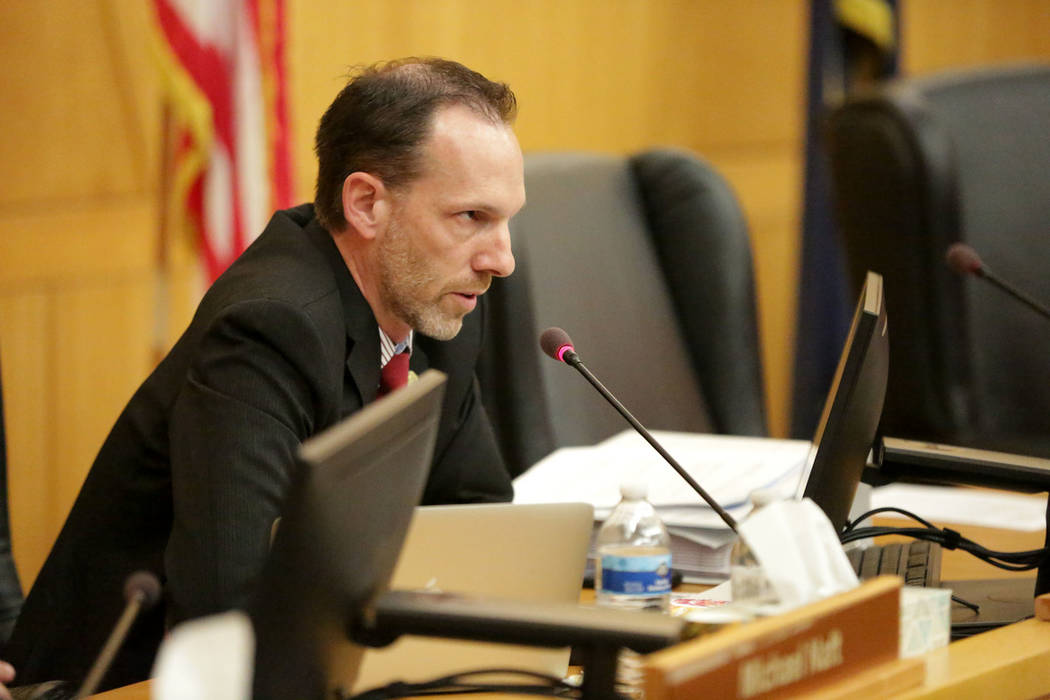

Under an ordinance to be introduced Tuesday, Commissioner Justin Jones is proposing a one-eighth percent sales tax instead of the maximum quarter-cent sales tax allowed under Assembly Bill 309, which authorized county commissions in Nevada to vote to implement the tax.

A one-eighth percent sales tax will raise an estimated $54 million annually for things such as early childhood education, teacher recruitment, fighting truancy, combating homelessness and building affordable housing. But it also means there will be roughly $54 million less in the funding pool than if the full quarter-cent tax was imposed.

There will be no decision Tuesday on the tax, which must be approved by two-thirds vote from the commission, or five of the seven members. A public hearing on the ordinance is scheduled for Sept. 3.

Jones said Thursday that the idea is to push forward the smaller tax in time to hopefully begin collecting funds in January and then to revisit it in the future as programs expand.

“I think we were very clearly able to identify programs that made sense for fifty-something million dollars,” Jones said, citing conversations held with the Clark County School District. “But it wasn’t clear yet whether we had programs that could be implemented in short order for 100-plus million dollars for next year.”

The two sides met last month as the commission sought assurances that the district would be accountable for any tax proceeds it would receive.

Boys Town has shown interest in assisting with truancy issues, Jones said. However, realistically, it would take two to three years for a program to be incorporated into all district schools.

Pre-kindergarten plans, he added, were in a similar state and will require time to get up and running, he said.

Half of all funding, or approximately $27 million, would be earmarked to the school district for early childhood, adult education and teacher recruitment in high-vacancy schools, according to the ordinance to be introduced. But the district would receive an additional $27 million or so if a quarter-cent sales tax is imposed.

The district “is eager to collaborate with the Clark County Commission to support our students as we work as a community to ensure our students receive a rich and rigorous education,” a district spokesperson said, adding that any potential funding would enable officials to focus on the aforementioned programs.

The other half of funding would be distributed to the county for truancy, homelessness, affordable housing and workforce training in the hospitality industry.

Jones said he believed the additional dollars will make a “tremendous impact” not only for the school district but on county efforts to reverse chronic absenteeism while building on anti-homelessness initiatives it has been funding through marijuana business licensee fees.

Contact Shea Johnson at sjohnson@reviewjournal.com or 702-383-0272. Follow @Shea_LVRJ on Twitter.

AB309 Ordinance by Las Vegas Review-Journal on Scribd