Estate planning can save your family plenty of money and heartache later

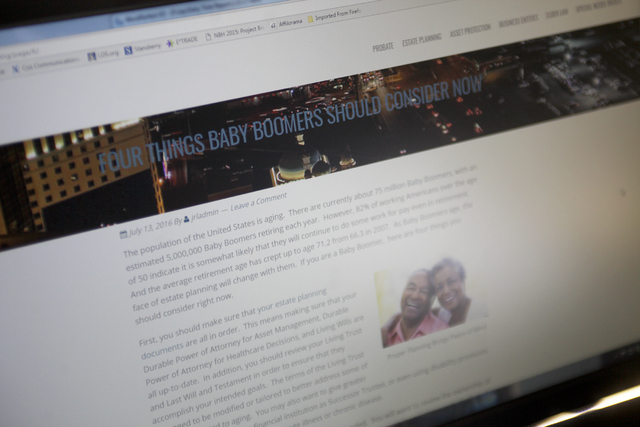

Let’s be clear: There are not many of us in the baby boomer cohort who enjoy thinking about our own deaths.

The uneasiness that accompanies that thinking is only exacerbated as we start contemplating how best to deal with our heirs.

So we put it off.

Studies show that only 50 percent of the 70 million baby boomers have engaged in estate planning, which generally means using a will or living trust to transfer property.

Horror stories abound of deaths without wills or living trusts opening the door to ugly family fights and time-consuming and costly court battles. Much of what people thought would immediately go to loved ones after death ends up in the hands of attorneys.

A brush with my own mortality recently — a mini-stroke — prompted a survey of devices that can be used to provide for the distribution of an estate upon death.

An Internet marketing piece on estate planning by attorney Jay Larsen — “FOUR THINGS BABY BOOMERS SHOULD CONSIDER NOW” — quickly got my attention. With the Henderson-Las Vegas firm of Gerrard Cox Larsen, which specializes in estate planning, Larsen provided me an overview of what boomers should do.

What can be problematic, Larsen said, about not having a will or trust is that state law controls and generally distributes your property through the probate court to your spouse and/or your closest heirs.

How that is done may not be what you intended. And by failing to appoint someone to carry out your wishes, the state can appoint someone to be the administrator of your property, and the administrator may have to pay thousands of dollars at the expense of your estate, before he or she can begin to distribute your assets.

Larsen said an accountant friend had a client, a married small businessman with a net worth of about $10 million, whom he urged to do estate planning. He died of a heart attack in his early 60s before that was done. Almost the entire estate was in the husband’s name so the probate court had to handle it. To complicate things, there were minority business owners without a proper buy-sell agreement in place.

“His surviving spouse not only dealt with losing her husband, but had to deal with the probate process,” Larsen said. “Over a year later and more than $100,000 of attorney fees, the probate was finally finished. So much of the financial and emotional cost could have been avoided with proper estate planning.”

Larsen generally advises people with estates of more than $200,000 to do a living trust rather than a will.

Unlike a will, he noted that it does not have to go through probate court, which can be time consuming and expensive.

“On the short end, going through probate court here in Nevada with a will takes five or six months and costs $5,000 to $6,000 and it can be more if it’s contested,” he said. “Properly prepared, a living trust can avoid the public, costly and time consuming court processes at death. Basically, all you’re doing is transferring your assets from you to your trust.”

If you want assets to be distributed quickly to help family members, the living trust makes sense.

Larsen said those with smaller estates also have to engage in planning.

He said he helps make sure that people have beneficiaries listed on checking accounts. Transfer on death deeds are recorded for a house to go to a named heir.

“Those people should still make out a will though in case they’ve forgotten something,” Larsen said.

What is most important, Larsen said, is to go through estate planning. “It can save your loved ones a lot of heartache and grief later.”

Paul Harasim’s column runs Sunday and Tuesday in the Nevada section and Monday in the Health section. Contact him at pharasim@reviewjournal.com or 702-387-5273. Follow @paulharasim on Twitter.