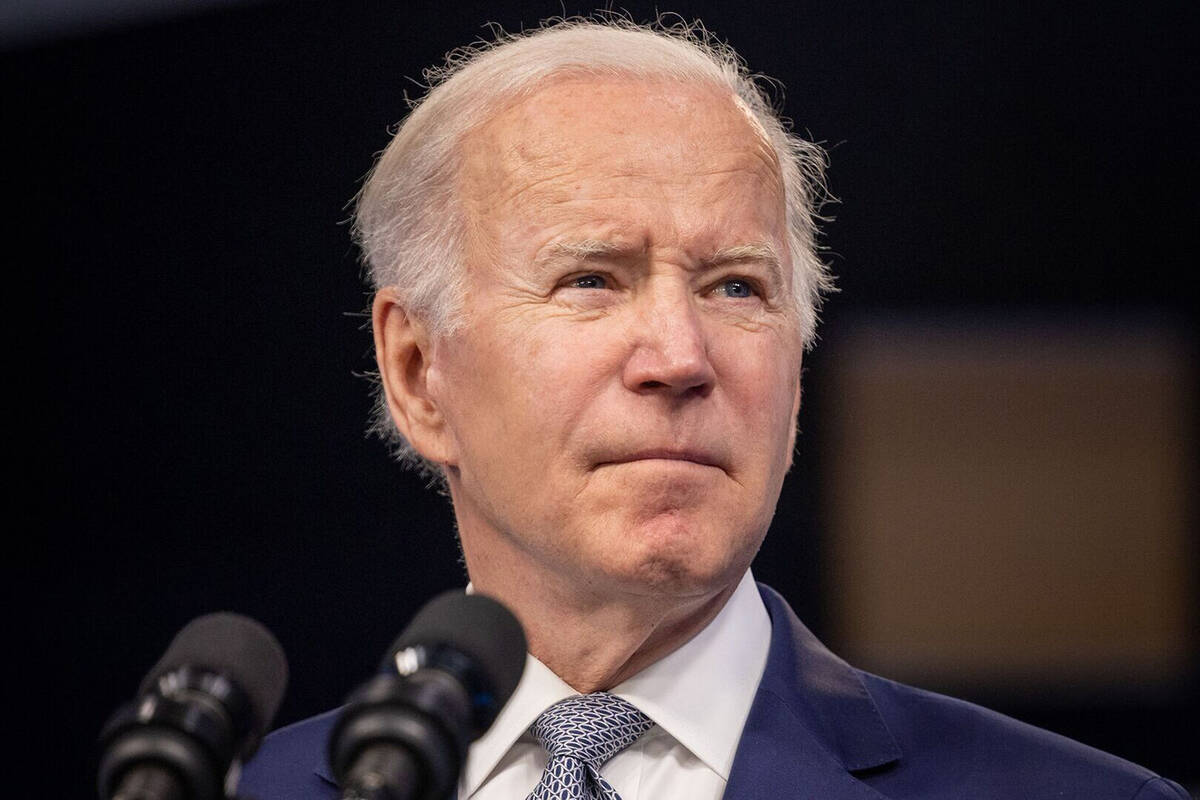

How Joe Biden is impacting Social Security

President Joe Biden inherited an underfunded, overextended Social Security program that was already crowded with aging baby boomers as dwindling funds dried up before the pandemic stressed the system even further.

Read More: States Whose Economies Are Failing vs. States Whose Economies Are Thriving

State Side: 10 States That Receive the Most Social Security

The Social Security Administration (SSA), the agency tasked with running the program, was anemic after a decade of budgetary neglect when the virus shuttered its offices, thinned its staff, gobbled up its budget and swelled its rolls. Then, the rising inflation that followed the pandemic forced Social Security recipients to stretch their benefits until they couldn’t stretch them anymore.

Naturally, Biden had to act. His actions have by no means been universally applauded, but the president has certainly left his mark on the program that represents the bedrock of America’s social safety net — and 2022 is shaping up to be the most consequential year of all.

Some of Last Year’s Changes Have Already Taken Effect

Social Security recipients started 2022 with the biggest boost to their benefits since 1982. To help retirees cope with the highest inflation rate in 40 years, Biden oversaw a cost of living adjustment (COLA) of 5.9%, which boosted the average recipient’s check by $92 from $1,565 per month to $1,657 per month.

But the biggest raise that beneficiaries have received in four decades isn’t the only change to Social Security that the Biden administration made in 2021 that took effect in 2022.

Social Security recipients who haven’t yet reached full retirement age can collect their full benefits while still earning income up to a certain threshold — and this year, that income threshold went up.

In 2021, recipients could earn $18,960 before the SSA began temporarily withholding $1 for every $2 in earned income. In 2022, that threshold went up to $19,560. If you reach full retirement age in 2022, you can earn as much as $51,960 before the SSA starts pulling $1 from your check from every $3 you earn, compared to $50,520 last year.

It’s known as the income test, and it never applies to beneficiaries who have already reached full retirement age.

A Big Boost for SSA in 2023?

Biden’s proposed 2023 budget includes an added $1.8 billion in discretionary funding for the SSA, which administers benefits to 70 million Americans. That would be a 14% increase over the funding levels enacted in 2021 to bring the total to $14.8 billion.

Nearly all of the new funding — $1.6 billion out of $1.8 billion, which also happens to be an increase of 14% over 2021 — would go to improving services for the more than 6 million retirement, survivor and Medicare claims the SSA processes each year, as well as 2 million disability and SSI claims.

The money would be spread around to field offices, teleservice centers for retirees and state disability determination services, while funding investments in things like:

- Decreasing customer wait times

- Better outreach to people who are hard to locate

- A simplified application processes

- Modernized information technology systems

- Improved 800-number access

- Improvements to online services

The remaining $224 million goes to program integrity, responsible spending initiatives and the investigation and prosecution of fraud.

POLL: Do You Think You Will Be Able To Retire at Age 65?

Neither Side Was Fully Satisfied

According to CNBC, some groups thought that Biden’s proposed increases to FFA funding didn’t go far enough. The National Committee to Preserve Social Security and Medicare, for example, expressed disappointment that the 2023 budget proposals didn’t increase benefits and adjust the payroll wage cap so that the wealthy would pay more into the system. Currently, wages over $147,000 are not taxed for Social Security purposes.

The Committee for a Responsible Federal Budget, on the other hand, took issue with the fact that Biden’s budget proposals didn’t address the program’s trust funds, which will be depleted in 2034 and able to pay only 78% of promised benefits.

The Challenges of an Underfunded SSA

While it does not address Social Security’s long-term solvency problem, Biden’s proposed budget would provide a sorely needed financial shot in the arm to an agency bordering on dysfunction.

Funding to the SSA has been steadily declining since 2010, according to CNBC, just as aging baby boomers have swelled its rolls with an ever-increasing number of beneficiaries to serve. The SSA’s budget dropped by 14% since 2010, it lost 13% of its employees and closed 67 of its field offices. At the same time, the number of beneficiaries participating in the program increased by 21%, from 54 million to 65 million.

Already stretched thin, the pandemic pushed the SSA’s budget to the breaking point with predictable results. The agency closed its 1,200 remaining field offices during the pandemic, and when it reopened 98% of them in April, they were manned with only 50%-60% of the required staff.

In May, Congressional leaders met to discuss the breakdown of the agency’s services. In 2010, the average wait time to get an answer on the SSA’s toll-free number was three minutes. By 2019, it had increased to 20 minutes.

Lawmakers who attended the meeting said that their offices had become de facto SSA hotlines. After waiting on extended holds after multiple tries, their elderly constituents were simply calling the offices of their Congressional representatives for answers to their Social Security questions instead. Between 2008-2019, 109,000 applicants for disability benefits died while waiting for appeals.

More From GOBankingRates

- Social Security: You Could Lose Your Benefits If You Didn’t Report Your Marriage to the SSA

- Quiz Yourself on Travel & Learn How To Travel Rich on Any Budget

- Looking To Diversify in a Bear Market? Consider These Alternative Investments

- 12 Expenses Successful People Don’t Waste Time or Money On

This article originally appeared on GOBankingRates.com: How Biden Is Impacting Social Security in 2022