Clark County commissioners seek authority to raise fuel taxes

Clark County motorists could end up paying nearly 10 cents more for each gallon of gas in a few years if the Legislature gives the County Commission power to boost its fuel taxes.

Commissioners last week unanimously backed a resolution supporting Assembly Bill 413, a proposal tailored for Clark County that would allow county commissioners to increase fuel tax revenue based on the level of inflation-based increases in the costs for highway projects, also called the inflation index.

The legislation, which was introduced to an Assembly committee March 20, wouldn’t guarantee an increase in fuel taxes but would give county commissioners the option to raise fuel taxes . Under the existing system, the county already collects 9 cents a gallon in fuel taxes for road projects.

The potential increase would be about

3 cents a gallon annually, based on current estimates of inflation trends. Within three years, the cumulative increase could be as much as 9.6 cents a gallon, according to Regional Transportation Commission estimates. If inflationary increases dropped, so would the potential increases.

Backers of the bill, including Regional Transportation Commission officials, say the legislation is needed as existing motor fuel tax revenues have stagnated and declined. Clark County is the only county in Nevada without the ability to increase fuel taxes based on the inflation index.

“We really just feel like this is putting us on equal footing and creating equity between Clark County and the rest of the state,” said Tina Quigley, general manager of the transportation commission.

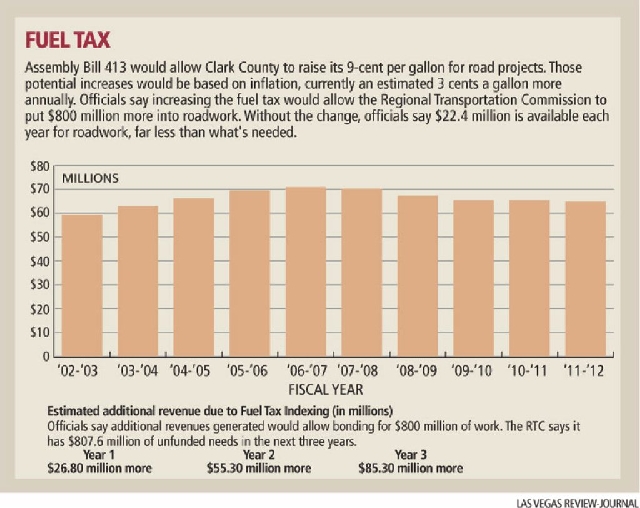

Under the existing system, the county’s flat rate of 9 cents a gallon has yielded less revenue in recent years as gasoline usage has dropped. It generated $64.86 million in fiscal year 2011-12, down from a high this decade of

$70.9 million in fiscal year 2006-07.

If fuel tax increases are enacted, the county could get $26.8 million more in revenue in the first year, with that reaching $85.3 million in the third year.

That’s just part of the picture, though. The potential change would enable the transportation commission to add

$800 million to its bonding ability within three years, making more money available sooner for projects.

Without any changes to the fuel tax, the commission will have $22.4 million available on average each year for projects for the next decade. That figure accounts for existing motor fuel tax and sales tax revenue, while also factoring in administrative expenses and payments on prior debts.

That $22.4 million a year is enough for one interchange, or a mile of new roadway.

“Right now we have enough money at RTC to only do one interchange,” County Commissioner Chris Giunchigliani said. “This is really necessary for our infrastructure, the maintenance part, and I believe, putting people to work.”

In comparison, the transportation commission reports it has $807.6 million of unfunded projects throughout the region that are needed in the next several years.

Options will remain, even if the legislation passes. Commissioners could decide not to raise the fuel tax or raise it less than the maximum allowed by inflation.

Commission Chairman Steve Sisolak said he is open to the possibility of putting an increase in place, but only if voters have a role in making the decision.

“If they want to try to put it on the ballot, I could possibly go along with that, but I can’t support implementing it without a vote of the people,” he said.

The county’s existing 9-cent tax is just part of the fuel taxes motorists fork over. Each gallon pumped has 52.2 cents of total taxes and fees in it, which includes the county’s tax and federal and state taxes.

Not everyone is quick to embrace higher fuel taxes.

Fuel tax increases translate into higher costs for other products, including fuel, said Ray Johnson, operations manager of Speedee Mart, a convenience store business with 20 locations in the valley. That in turn affects everyone, regardless of whether they fuel up, he said.

“Whenever fuel prices go up, I get charged gasoline surcharges, and I have to increase the price of the food,” he said.

The bill faces an uncertain fate, even if it passes the Legislature.

Gov. Brian Sandoval has said he would veto any legislation raising taxes. It’s unclear whether he would apply that stance to this legislation, which doesn’t mandate higher taxes but would allow Clark County to increase its own gasoline tax.

Mary-Sarah Kinner, a spokeswoman for the governor, declined to take a position on the legislation, saying bills can be amended before passage.

That is not the only bill in the Legislature that would raise fuel taxes. Senate Bill 377 would increase the state’s fuel tax next year from 17.65 cents a gallon to 19.65 cents a gallon, with 2-cent increases each year until 2023.

Contact reporter Ben Botkin at bbotkin@reviewjournal.com or 702-455-4519.