Veteran disputes lawyers’ TV ads

You’ve probably heard their catchy TV slogans: “Enough said. Call Ed.” And “Glen Lerner is the way to go.”

Now two of Southern Nevada’s most visible personal injury attorneys are advertising they can help veterans collect service members’ insurance money.

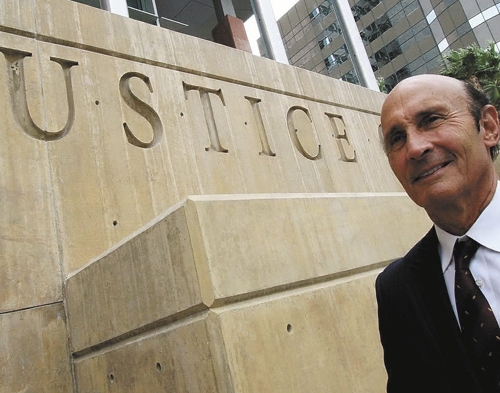

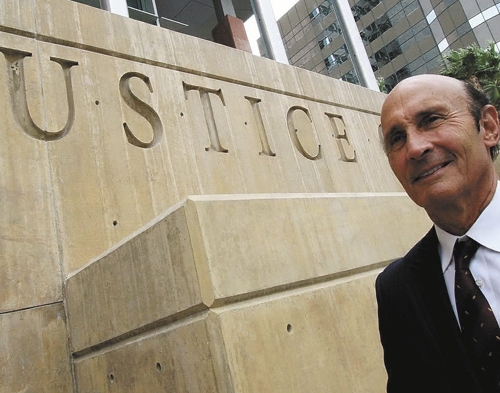

That angers Vietnam War veteran Dave Anson, who says it will cost veterans substantially more than if they sought help from a veterans service representative recognized by the Department of Veterans Affairs for filing paperwork and appeals. In fact, he said, that’s help veterans can get for free even though as one of the lawyers points out on his website: “The VA is slow and the process can be lengthy.”

In the television advertisement by Ed Bernstein & Associates, the Las Vegas lawyer claims his firm can help veterans collect other benefits to which they are entitled.

But Anson, a retired veterans advocate who has helped Las Vegas Valley veterans file claims, said veterans really don’t need to give lawyers a percentage of what they receive for merely filing paperwork.

A service organization sanctioned by Congress will do it at no cost to the veteran, according to the Department of Veterans Affairs website.

“It’s a rip-off,” Anson, who resides in Boulder City, said about the assistance offered in the private attorney commercials.

“When I heard it, it infuriated the heck out of me,” he said, citing a similar TV ad offering help to veterans by Glen J. Lerner and Associates. “It’s certainly morally questionable.”

Veterans who served active duty and qualify for the Traumatic Servicemembers’ Group Life Insurance (TSGLI) program that took effect in late 2001 can seek up to $100,000 in tax-free benefits even for non-combat injuries.

Lerner’s website describes the program: “TSGLI helps traumatically injured service members and their families with financial burdens with a one-time payment. The amount varies depending on the injury, but it could be the difference that allows their family to be with them during recovery, helps them with unforeseen expenses or gives them a financial head start on life after recovery.”

The site says the program covers those who have full-time or part-time Servicemembers’ Group Life Insurance. The TSGLI program “is not meant to serve as an ongoing income replacement, it’s there to help the Soldier through the tough times.”

Anson, however, pointed out that the forms for $100,000 in insurance money can be downloaded for free and sent in by the veterans themselves. If they are denied, the VA can provide attorneys to help them appeal.

Anson said he posed as an injured veteran and contacted Lerner’s office. What he learned disturbed him, he said. While Lerner’s firm doesn’t require an upfront fee, they work on a contingency basis for 30 percent to 45 percent of what the vet receives, he said.

“By the time you get done with court fees — and they’re going to send you to their doctor — you’ll end up with almost nothing,” Anson said.

Jake Glodek, office administrator for Lerner’s office in Mesa, Ariz., said he doesn’t know what fees are charged because contact information about veterans who inquire with the firm are “put in a software system and then dealt out” to an attorney affiliated with the firm who discusses the case and contingency fees with the veteran.

Glodek said the insurance money applies to veterans who served after late 2001 when a mandatory fee was charged for active-duty military personnel to cover insurance. The insurance plan covers veterans who sustained injuries including those that weren’t service-connected.

“We’re not saying you prick your thumb and get $100,000,” Glodek noted.

An employee of Bernstein’s firm discussed differences between the two marketing campaigns, saying Bernstein & Associates only handles combat injury cases, which can take two, three or four years to resolve because the government is involved. She later declined to comment further Thursday and called the Review-Journal back to say an attorney with the firm whom she asked to go on the record wouldn’t comment either.

Its website states that the firm “is proud to help veterans and their spouses receive the benefits they deserve. Unfortunately, veterans are often denied benefits even though they are disabled and injuries are real.”

“You served your country, and now we want to serve you. As you may already know, obtaining veterans’ disability benefits can be a long process filled with paperwork, deadlines and waiting. Thankfully, our law practice focuses on getting compensation or benefits for people who have been injured,” Bernstein’s website states, adding, “The VA is slow and the process can be lengthy.”

A local VA spokesman, David Martinez, said sanctioned veterans service organization officers can’t charge for helping veterans file claims and appeals but it is acceptable for lawyers to charge.

The State Bar of Nevada approves commercials by lawyers.

A spokesman for the organization, Assistant Bar Counsel Phil Pattee, said, however, the advertisements “can’t be false or misleading. As long as they’re not false or misleading, they’re probably not going to violate the rules.”

Jo Cantrell, past president of Women Veterans of Nevada, who is also a veterans services officer for the Nevada Office of Veterans Services, said veterans need all the help they can get, even if they have to pay attorneys, because there are more veterans in need of help than there are service officers to help them.

“In a nutshell, there are so many veterans who are eligible and deserve benefits that anyone who can help them is a plus,” she said, speaking as a disabled veteran and past president of Women Veterans of Nevada.

“At least attorneys who are doing advertising are making the public aware, and I think that’s immeasurable,” she said.

Keith Rogers at krogers@reviewjournal.com or 702-383-0308.