Nevada unemployment falls to 13.6 percent

Nevada’s latest unemployment report provided yet another parade of tough news for the state’s jobs market.

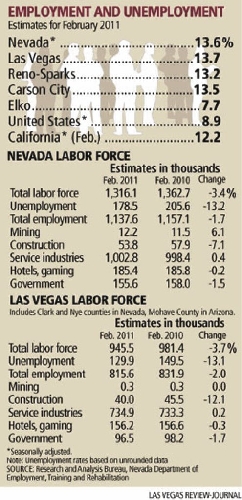

The state’s jobless rate dropped to 13.6 percent in February, down from 14.7 percent a year earlier, while unemployment in Las Vegas came in at 13.7 percent, down from 15.2 percent a year earlier. But the state Department of Employment, Training and Rehabilitation credited the decline to a flood of residents abandoning the work force: A full 45,000 Nevadans, or 3.3 percent of the state’s labor pool, quit looking for jobs in the state year over year in February.

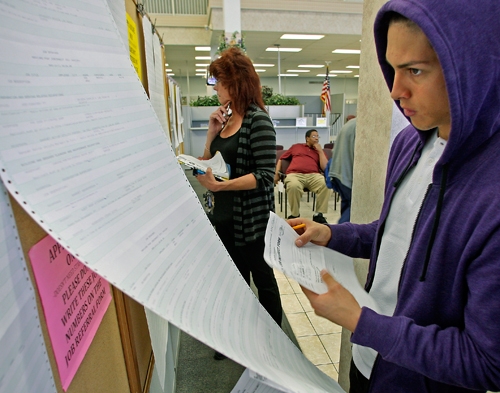

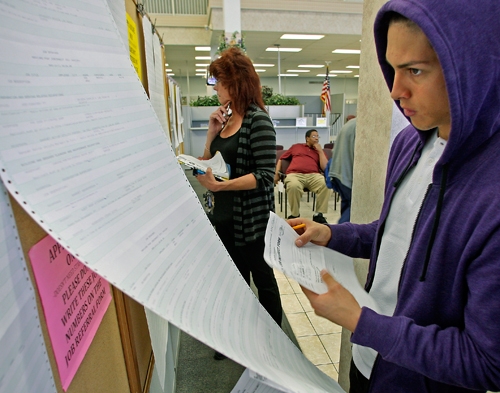

The month also marked the 25th consecutive month of double-digit unemployment in Nevada. And 179,200 people, including 129,900 Las Vegans, were out of work and hunting for jobs in February.

Included in the latest numbers, though, were at least faint glimmers of hope in two key Nevada industries — tourism and construction. The question, observers said, is whether those upticks are sustainable, and whether the positive trends can ultimately restore pre-recession employment levels in the Silver State.

Hospitality operators added 1,500 jobs from January to February, for the largest month-to-month improvement of any industry in the state. Employment in the sector also jumped by 3,800 positions year over year in February.

And construction employment posted its biggest month-to-month gain in nearly a year, with contractors and subcontractors bringing on 1,000 new workers from January to February.

Still, experts cautioned that long-term hurdles to recovery remain in both sectors.

Consider gaming.

Sure, those new jobs provide “a sign that, at least in employment terms, things in the industry may have stabilized,” said Bill Anderson, chief economist of the employment department. The hiring will likely continue as long as the nation’s economic recovery moves forward, Anderson said.

Gaming analyst Bill Lerner of Union Gaming Group in Las Vegas also credited some of those new jobs to the locals market: Lerner pointed in particular to Station Casinos’ plan, announced in January, to hire 1,000 full- and part-time workers.

Strategic operating decisions are driving hotel-casino hiring as well, said Steve Brown, director of the Center for Business and Economic Research at the University of Nevada, Las Vegas.

Statistics from local research firm Applied Analysis show that hotel-casino operators, in search of efficiencies amid plummeting occupancies and visitor spending, slashed their worker base from 1.4 employees per room in 2007 to one employee per room in 2010. Brown said managers in the casino sector now tell him they “realize they had cut things a little too far in the recession.”

“A lot of casinos have advertisements up now for hiring, so there’s potential growth there,” Brown said.

But the leisure and hospitality market remains prone to setbacks. The Sahara, with its 1,050 employees, is scheduled to close for good in May.

“There’s certainly evidence that the road ahead is going to be difficult,” Anderson said. “But just a year or two ago, all the news was negative. Now, at least, we have a mix of positive and negative news. We might have turned the corner, but the road ahead is going to be pretty darn bumpy.”

What’s more, leisure and hospitality lost 30,500 jobs in the recession. So the industry has far to go before it returns to peak form. And with no megaresorts on the drawing boards, it could be several years before Nevada’s gaming employment returns to its apex, Anderson said.

Construction’s outlook is much the same, experts said.

The industry’s 1,000-worker expansion from January to February hinted at some broader economic improvement.

Steve Holloway, executive vice president of the Las Vegas chapter of Associated General Contractors, said the new Las Vegas City Hall, under construction downtown, yielded some of the new jobs. The Clark County School District is renovating buildings, and that’s created positions. Most of the remaining growth came from tenant improvements inside commercial properties, Holloway said.

Those tenant improvements tie into recent reports on heightened business-startup activity in Southern Nevada, Brown said. Nevada Secretary of State Ross Miller said on March 10 that the number of new-business filings in the state rose in the fourth quarter, posting the first startup improvement since mid-2006. And the Ewing Marion Kauffman Foundation, an entrepreneurship think tank in Kansas City, Mo., recently said Nevada owned the nation’s highest rate of new-business formation in 2010.

But as with gaming, construction jobs are well off of their pre-recession peak. The state’s contractors have slashed 74,600 positions since 2006. With a major oversupply of office parks, shopping centers and warehouses, and with no megaresorts planned, Holloway said he doesn’t expect construction employment to bounce back substantially for at least three to four years. The only dynamics that could change that? Construction of a new stadium, plus big investments in infrastructure projects.

Across all industries in Nevada, the pace of job losses eased in February.

Employment fell 0.1 percent when compared with February 2010. That’s a big improvement over the 5.7 percent drop in employment that happened from February 2009 to February 2010.

“I think we have yet to really see the light being turned on,” Brown said. “I think there are favorable signs, but still not enough to say, ‘Wow, this is really strong growth.’ We’re still at the beginning of growth, and I think that’s where we’ve been for the last six to eight months.”

The employment department’s numbers also indicate that recovery is taking hold earlier in Northern Nevada’s major markets than in Las Vegas. Employment in Reno-Sparks was up 400 jobs year over year in February, for its first annual improvement since August 2007. Employment rose by 200 in the same period in Carson City.

Employment in Las Vegas was down by 5,100 jobs year over year in the month.

Anderson said the employment dichotomy between north and south reflects Southern Nevada’s heavier reliance on discretionary spending and construction.

Nevada ranked No. 1 in the nation for joblessness for the 10th straight month in February. California ranked No. 2, at 12.2 percent.

Nationally, unemployment was 8.9 percent in February.

Contact reporter Jennifer Robison at jrobison

@reviewjournal.com or 702-380-4512.