Las Vegas unemployment falls to 13.7 percent

A smaller labor pool in Nevada might make for a lower unemployment rate, but it won’t pave the way for long-term economic health, experts said Thursday.

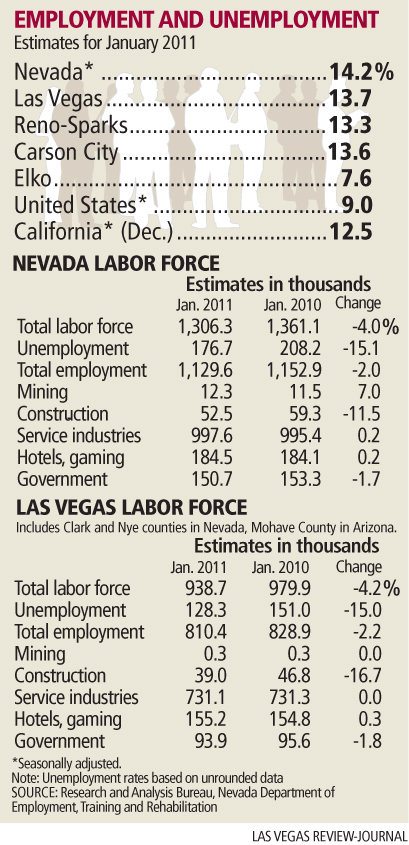

The state Department of Employment, Training and Rehabilitation reported that joblessness in the Silver State eased off of its record levels from December to January, dropping from 15.1 percent to 13.7 percent in Las Vegas — the first time since March 2010 that local unemployment fell below 14 percent — and from 14.9 percent to 14.2 percent statewide.

Joblessness dropped year over year too: Unemployment in January 2010 was 15.4 percent in Las Vegas and 14.6 percent across the state.

But the improvements came not from job growth but from steep drops in the number of workers seeking positions in Nevada. The Silver State lost 54,800 workers year over year in January, with 41,200 of those lost workers coming from Las Vegas. That is a 4 percent contraction in the state’s labor pool and a 4.2 percent decline in the local work force.

Observers said it’s tough to determine whether those workers have left the state for jobs elsewhere or whether they are sticking around and surviving on unemployment benefits.

What’s more clear is the detrimental effect those disappearing workers will have on the state’s economic recovery.

For starters, fewer employed workers will translate into fewer potential homebuyers, and that could bring fresh pain to a struggling housing sector, said Brian Gordon, a principal in local research and consulting firm Applied Analysis.

What’s more, each jobless Nevadan — and there were 176,700 of them in January — costs the state $16,000 a year in unemployment insurance benefits alone. A drop in the state’s employee base means fewer workers to help cover the cost of the public services that discouraged workers receive.

More importantly, though, the smaller labor pool has bigger long-term implications, said Bill Anderson, chief economist for the Employment Department. A smaller employee pool will pack less of a punch in driving the sales and economic activity that could reverse Nevada’s downturn.

"The shrinking labor force is one of the earliest indicators that once we do work our way through this recession, we’re not going to emerge like the Nevada that we were used to a half a decade ago," Anderson said. "We’re not going to grow, in employment terms, at 6 percent year over year, like we used to, and we’re not going to be the fastest-growing state in the nation for essentially two decades. We just won’t see the kind of job generation that attracted people to Nevada in the past."

So when might the state’s worker pool stop its free fall?

Not until businesses start boosting consumer confidence with new jobs.

"A lot of it is psychological. You see your neighbor without a job, and you’re without a job," Anderson said. "As the economy stabilizes and activity picks up, we should see the labor force stabilize."

That steadying process could take a while longer.

Recent months have brought improving economic indicators, with visitor volumes, gaming win and taxable sales beating expectations. Employment losses have mostly stopped falling .

But rising gasoline prices could stymie the recovery in Nevada’s tourism industry, and continued cuts in government payrolls could cancel out small job gains in the private sector, Anderson said.

Plus, hiring managers are usually cautious during recovery. Replacing the 177,000 jobs Nevada has lost since 2007 probably will prove slow-going, and that could keep confidence flagging among discouraged workers.

"Employers will have to be convinced that any recovery is going to have legs. They’re not going to put out ‘help wanted’ signs at the first indication of stability and improvement," Anderson said. "They’re not going to change on a dime overnight. It will be a gradual shift."

Nevadans could see the beginnings of that shift by 2011’s end, Anderson said.

Consider that the decline in jobs in Nevada between January 2009 and January 2010 was 6.5 percent. That job-erosion rate had fallen to 0.5 percent in the same period a year later. If that trend continues, Anderson said, then increases in job levels statewide could start to emerge at the year’s tail end, but they will be minor gains only.

Gordon agreed that improvements in the job market might barely register on the radar in coming months.

Business owners must see stabilized or improved economic conditions for three to four quarters before they decide their businesses enjoy near-term growth potential, and until that happens, Gordon doesn’t expect to see "a tremendous amount of uptick" in the local jobs base.

When the job market does revive, unemployment could rise in some periods, Gordon said. That is because even if the employment base ramps up, job seekers who have been sitting out the recession could flood the market in hopes of finding work. Any noticeable jump in the work force’s size could push up unemployment rates if there aren’t enough jobs for the re-emerging workers.

The upshot: Nevada’s unemployment rate could show some volatility in the year, as people enter and exit the labor force, Gordon said.

Nevada has led the nation in joblessness since May, as its construction and hospitality sectors bore the brunt of a nationwide downturn in housing and consumer spending. Not all states have reported their January unemployment rates, so it’s too early to tell whether the Silver State will keep its top ranking for the month.

Nationally, joblessness was 9 percent in January but fell to 8.9 percent in February. Nevada is scheduled to report its February jobless rate on March 25.