Las Vegas charity with $44M in bank courts donors for new mission

Miracle Flights, a Las Vegas-based charity that offers free flights to ailing children requiring distant specialist care, announced Monday that it plans to expand its service to include military veterans.

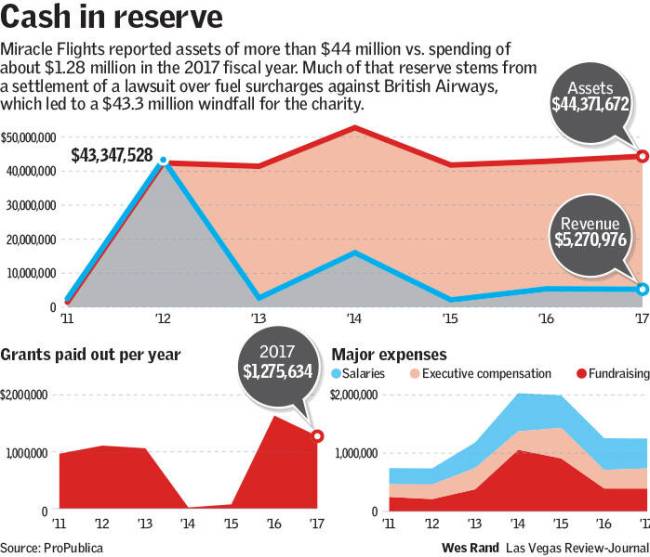

But the announcement of the new mission and corresponding call for donations to support it did not mention that the nonprofit, which has received unwanted publicity in the past for its spending practices and issuing a questionable loan that was never repaid, is sitting on a reserve of more than $44 million — far in excess of the roughly $1.28 million in services it delivered in the 2017-18 fiscal year.

Nor did it mention that the organization is embroiled in a legal battle with its founder, who claims she was forced off the board of directors early this year and denied access to the organization’s financial records after inquiring about “potential financial irregularities.”

Mark Brown, who took over as CEO of Miracle Flights in 2015 after the departure of founder Ann McGee, announced the expansion to help veterans receive treatment at a news conference in Las Vegas. He was joined by, among others, retired U.S. Navy SEAL Robert J. O’Neill, who claims to have fired the shot that killed Osama bin Laden in 2011. (The military has not confirmed or denied his account.)

Brown said it was a conversation with O’Neill four years ago that led him to think of expanding the program to veterans.

“Rob was the one who planted this seed: He was telling me about the difficulty that veterans face coming back from service and trying to get adequate medical care that might extend beyond what the VA does,” he said.

‘A tremendous honor’

In a follow-up interview with the Las Vegas Review-Journal on Thursday, Brown said he considers it a privilege to assist those who have defended our country.

“Helping those who have sacrificed so much for our country is a tremendous honor,” he said.

He also said the organization plans, in most cases, to waive the income requirements for veterans wanting to use their service, adding that “the fact that these people have served our country, to us, is qualification enough.”

Since Miracle Flights’ creation in 1985, when it was known as The Angel Planes, the organization has flown more than 128,000 children and their families in need of medical care that is not available where they live. Those flights are on commercial carriers, some of which make in-kind donations to Miracle Flights by providing free tickets.

The nonprofit currently provides an average of 700 flights per month, about 10 percent going to people who have identified as veterans, and Brown said he hopes to increase the overall number of flights by 20 percent to 30 percent over the next six months as the organization begins ramping up and dedicating transportation for veterans.

Even before announcing the expansion, he said, the charity has paid for veterans to fly for surgeries, rehabilitation programs, service dog training and retrieval, specialized wheelchair fittings, mental health assistance, substance abuse counseling and other medical needs.

Since the announcement Monday, the group has raised $10,000 for the effort, Brown said.

“We’re constantly raising money, and we’re always in fundraising mode,” he said. “We’re prepared to pay for whatever flights are generated by this effort, whether that’s with some new money or through existing fundraising channels.”

Reserve seen as problematic

But Daniel Borochoff, president and founder of CharityWatch, a nonprofit that rates other nonprofits’ business practices, said Miracle Flights shouldn’t be asking for money when it has about 15 years’ worth of reserves in the bank.

The organization gave Miracle Flights an “F” grade in its most recent report, primarily because of its outsized reserve.

“It’s a poor basis to ask for money when they’ve already got so much money,” Borochoff said. “My question would be, ‘You’ve got this balance of $44 million. Couldn’t you spend some of that before you take my hard-earned money?’”

Part of the $44 million reserve includes $2 million in non-interest-bearing cash and about $33 million in securities such as stocks and bonds, according to the nonprofit’s latest financial documents, which cover a fiscal year that ended April 2018.

Brown countered that “any dollars that come in are used for our current operations, and our reserves are meant to ensure that this organization lives on.”

Brown explained that the reserve money came with restrictions, though he did not say who imposed them. The nonprofit has to continue to have a “fairly high reserve” and is reducing dollars not spent on the mission, he said.

CharityWatch’s analysis shows that Miracle Flights reported spending 47 percent of its expenses on services that fiscal year. That compares to what it considers an acceptable ratio of 60 percent.

Brown took issue with the grade handed out, saying CharityWatch raises money from the ratings and doesn’t give a full picture of Miracle Flights because the organization picks and chooses the factors it rates nonprofits on. He said he has been working to improve the fundraising-to-services ratio.

“Our goal is 100 percent of all money raised goes into programming, and we’re working aggressively to get to that and those numbers,” he said.

Brown referred to nearly 500 reviews on Greatnonprofits.org from people who have been flown by Miracle Flights who would not have gotten the medical care they needed had it not been for Miracle Flights.

‘Platinum’ seal from Guidestar

He also noted that Guidestar, another leading monitor of the nonprofit sector, gave Miracle Flights a “Platinum” seal of transparency — the highest rating given by the website. The rating, however, only considers whether the nonprofit is filing truthful information, clearly stating its strategies, listing leadership and board members, and is keeping metrics to track progress. The rating doesn’t evaluate spending practices.

Much of Miracle Flights’ reserve came in a windfall in 2012, after a federal judge ordered British Airways to donate millions of dollars to Miracle Flights as part of a settlement of a lawsuit over fuel surcharges.

That propelled the relatively small charity with annual revenue of around $2.5 million into an operation with $53 million in the bank. That corresponded with several transactions that raised eyebrows in the philanthropic world, including spending $10 million on two Las Vegas Valley office complexes and making a $2.2 million loan to a company known as Med Lien Management, which used what it claimed were medical liens valued at $3 million as collateral.

It later defaulted on the loan, and Miracle Flights in June 2015 filed a lawsuit seeking to recover the outstanding balance. Among the defendants in the case was Michael McDonald, a former board member of Miracle Flights, who allegedly received a $200,000 finder’s fee for the loan and didn’t disclose he owned one-third of the lien business. McDonald now serves at the chairman of the Nevada Republican Party. He did not return a call on Friday seeking comment.

Brown, who became CEO after the episode, called the loan unethical and said the dispute was privately settled and Miracle Flights recovered most of what it was owed.

He also said that he “aggressively went after those responsible” and that the charity no longer makes any loans.

‘A different organization’

“It was a different time, we’re a different organization, and all those people who were here before are gone,” he said.

But new allegations about Miracle Flights emerged in a lawsuit filed by McGee, the charity’s founder, in August, alleging breach of contract and violation of state law.

The lawsuit alleges that board members Chris Khorsandi and Jessica Connell voted to remove her from the board in a March meeting that McGee was unable to attend and denied her access to financial records.

The lawsuit further alleges that “McGee’s care and commitment to transparency and concern regarding financial transactions entered into by the organization were met with scorn and retaliation.” It also claims that at a board meeting in late 2018 or early 2019 when McGee raised a question “regarding potential financial irregularities,” another director challenged her, saying, “Do you want to stay on this board?”

Brown called the lawsuit “unfortunate,” and said he and the current board wanted “a clean break” from the previous administration.

“This is a new day, a new era, and those that are associated with the actions of the organization before don’t have any place with this current charity,” he said.

Questions about the charity’s spending and transparency dogged Miracle Flights during McGee’s tenure as CEO.

The Review-Journal first raised questions in 2007 about the operation’s finances, reporting that less than one-third of the donations received went to fly sick children and that fundraisers kept far more for themselves than what went to the charity.

Generous retirement packages

Salaries after the settlement paid to Ann McGee and her husband, William, who worked for 27 years for the charity, also drew scrutiny, as did a retirement plan reached when the former stepped down as CEO. The package paid her an annual retirement stipend of $344,000, or 75 percent of her final salary of $430,000. William McGee also received an annual payment of $82,000 for 10 years.

Brown, whose background is mostly in the arena of public relations, advertising and lobbying but did some work in the nonprofit sector before joining Miracle Flights, has seen his base pay increase year over year by about $24,000 — from $318,671 to $342,842 — according to the organization’s most recent available financial documents.

In a statement Saturday, Brown said, “I operate a lean organization. We don’t have a CFO, a COO, a senior HR leader or a Chief Administrative Officer to monitor the legal aspects of our fundraising in all 50 states. Those tasks all fall to me.”

He added: “We are fully transparent with our donors about our Board of Directors’ position on compensation. And, as a result, they understand that their donations are well utilized to not only fulfill but grow the mission of the organization.”

But Borochoff of CharityWatch said “a lot of people would love to have that job.”

“Certainly they’re not paying him because he’s brilliant or he’s got the expertise to raise a lot of money because they’ve already got the money,” he said.

Contact Briana Erickson at berickson@reviewjournal.com or 702-387-5244. Follow @ByBrianaE on Twitter.

Why do veterans need free flights?

Chuck Ramey, spokesman for the local VA in North Las Vegas, said that the VA provides travel reimbursement for both VA care and community care appointments under the new MISSION Act on a case-by-case basis.

Eligibility for travel compensation is based on the nature of the service being provided, as well as the veteran's status, such as whether an injury is at least 30 percent attributable to the veteran's military service.

Meanwhile, Miracle Flights CEO Mark Brown said the nonprofit is in talks with the VA to see how Miracle Flights can complement their efforts.

"We had a conversation with the VA today about ways we can work together and maybe supplement some of the things they're doing," Brown said. "And then have them make some of the veterans aware of what they're doing, where they don't coexist."

"With the VA trying to get better with private health care, this relieves that stress on how do I get there. And it's about what we as a community can do to help the veterans because they deserve it."