Health reform already helps grad’s family

As college graduation approached, Brett Kincaid sent out résumés and wondered if he’d land a good job offer.

The last thing on his mind was health insurance.

"I had always been on my parents’ insurance," said the 2005 graduate of Centennial High School in Las Vegas. "I just hadn’t thought about it."

Then Craig and Robin Kincaid heard from their insurance company: Their 23-year-old son would be dropped from the health plan shortly after his December 2009 graduation from the University of Nevada, Reno.

"It was a reality check," Brett Kincaid said. "You always think when you graduate from college you’ll have a job where you’ll get insurance. But in this economy it’s not so easy."

It appears that Brett Kincaid will be among the first to benefit from the new health reform package.

One provision of the package signed into law in March by President Barack Obama is designed to ensure that young people up to age 26 can have access to affordable health care by remaining on their parents’ insurance plan.

Unlike the majority of provisions in the new law, which go into effect between 2011 and 2014, the extension of dependent coverage up to age 26 goes into effect this year.

A 2009 report by the consumer group Families USA revealed that the percentage of uninsured was highest — 49.5 percent — among Americans age 19 to 24.

Part of this undoubtedly is because of personal choice, yet insurance coverage restrictions also have placed many young adults in a state of limbo.

Before passage of the legislation, children over 18 continued to qualify for coverage under a parent’s plan only as long as they remained full-time students and had not reached age 23.

This meant many high school and college graduates were left uncovered as they searched for the jobs that became increasingly hard to find as the recession took hold.

The Kincaids’ experience with this facet of The Patient Protection and Affordable Care Act shows how the new law is already affecting some families in Southern Nevada and across the nation.

Not surprisingly, the Kincaid family is all for such a plan — particularly since Brett, after his graduation, has been able to find only part-time work that doesn’t offer health insurance.

A finance major, the former Centennial High School varsity baseball player is doing marketing for the Reno Aces minor league baseball team.

Despite the fact that their son has long been the picture of health, the news that Brett might be without health insurance after graduation unsettled Craig Kincaid, a building inspector for the city of North Las Vegas, and his wife, Robin, who works part-time helping families with special-needs children.

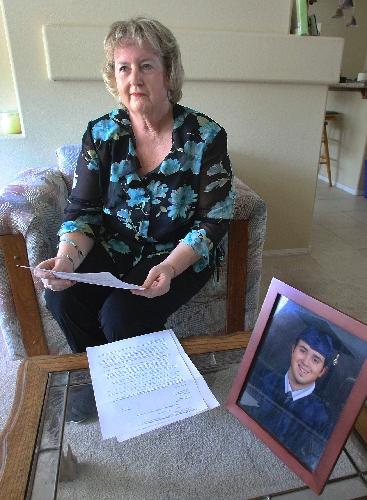

"We had gotten him through college without debt, and we didn’t want to see him incur some medical expenses that could put him into debt forever before his life even got started," Robin Kincaid said recently in the living room of the family’s northwest Las Vegas home.

Yet the Kincaids’ dilemma isn’t entirely solved by the new law.

The extension of dependent coverage doesn’t go into effect until late September, and Brett Kincaid was taken off his parents’ insurance in March.

Under current federal law, the Kincaids have a window of 60 days to sign up for what is known as COBRA, a temporary continuation of health coverage at group rates. That would cost the Kincaids another couple hundred dollars a month, Robin Kincaid said.

Another way to go, she said, is to buy what is known as a catastrophic or high deductible insurance plan. It would cost much less a month — some plans come in at around $50 a month — but the amount of money that would have to be paid in case Brett had an accident or needed surgery could be substantial.

In 2009 the government defined high deductible plans as having a deductible of $1,180 to $5,800 for individuals.

They are plans that make sense if an individual doesn’t have a lot of routine medical costs, such as frequent doctor visits or prescriptions.

"At Brett’s age, he doesn’t really need to go to the doctor much," said Robin Kincaid, who said she and her husband are leaning toward buying their son a catastrophic plan until he can get back on their insurance.

While she realizes that $200 more a month for COBRA may not seem like much of a jump, she said that when a family is on a budget that extra expense can be significant.

Unlike with some insurance plans, when Brett goes back on his father’s Teamsters health plan in September there won’t be an increase in the cost of the family’s coverage, Robin Kincaid said. The Kincaids also have a teenage daughter.

The Department of Health and Human Services expects about 1.2 million young adults to sign up under the new law.

The new benefit means premiums will rise by 0.7 percent in 2011 for employer plans, according to the department’s midrange estimate.

A survey by the National Business Group on Health and benefits consultant Towers Watson said the premium increase will come on top of 7 percent increases that employers already expect for next year.

Counting the shares paid by both the employer and employee, family coverage through the workplace now averages about $13,400 a year.

The Kincaids wish the Teamsters insurance plan would have done what UnitedHealthcare, one of the largest insurers in Nevada, recently did: Offer extension of existing coverage for graduating students ahead of the Sept. 23 effective date.

In mid-April, Gail Boudreaux, the insurance company’s president, announced: "We want students to graduate into a secure future, not the ranks of the uninsured, so we are working with employers to make sure these young adults have health coverage available to them ahead of the new requirements."

If Brett Kincaid has his way, he won’t be utilizing his parents’ insurance for very long.

"I’m glad this new provision in the law is there, but this is strictly a bridge for me," he said. "I expect to have my own job with affordable insurance before very long."

Contact reporter Paul Harasim at pharasim@reviewjournal.com or 702-387-2908.