Taxpayers on hook for massive court losses over Badlands. How will Las Vegas pay?

With Las Vegas voters about to pick a new mayor, city officials can’t say how they would pay for a string of courtroom losses that could blow a hole in city budgets and leave taxpayers on the hook for the failing Badlands legal fight.

Borrowing money amid high interest rates, selling real estate, raising taxes, cutting staff or services, or spending reserves could all, in theory, help pay for the city’s losing court battles over the never-built housing development on the shuttered Badlands golf course.

The litigation hasn’t ended, and the final amount owed by the city could still change. But the yearslong fight has cost Las Vegas taxpayers nearly $6 million in fees to outside law firms, and courts have imposed more than $230 million in rulings against the city — the equivalent of roughly a quarter of its general-fund spending this year.

Las Vegas also owes hundreds of thousands of dollars in interest payments after the Nevada Supreme Court upheld a victory for developer Yohan Lowie’s firm EHB Cos., according to an attorney for the landowners.

“It’s a difficult spot to be in,” said former North Las Vegas city manager Ryann Juden, adding the judgments could have a “tremendous impact.”

George Stevens, former chief financial officer for Clark County and finance director for Las Vegas, noted who ultimately pays for the courtroom defeats.

“City taxpayers are on the hook for it,” he said.

RELATED: How to pay for costly Badlands rulings? Las Vegas mayoral candidates weigh in

City Hall faced the prospect of more than $200 million worth of Badlands-related rulings by last summer. But after the Las Vegas Review-Journal in February requested copies of any emails, memos or other correspondence on how it would pay for court-ordered judgments in the dispute, the city replied there were “no identifiable records.”

So far, the rulings equate to a burden of nearly $360 per resident within Las Vegas city limits.

‘Trying to plan our funding’

The city has lost multiple times in court to Lowie’s group, who claimed the city effectively took their property when it blocked their redevelopment plans for the closed golf course at Alta Drive and Rampart Boulevard.

Las Vegas’ finances have already taken a hit from one of the cases.

City officials shifted $60 million out of the general fund — a key pot of money for salaries and services — because of the state Supreme Court ruling, according to a budget presentation to the City Council on May 21.

City officials estimated the fund has a shortfall of almost $29 million.

Las Vegas currently has more than $200 million in general-fund reserves, though city leadership did not offer details at the meeting on how they could pay for other judgments in the Badlands fight.

The city has a policy goal — approved by the City Council in spring 2022 — of keeping reserves at a level that amounts to 25 percent of its annual general-fund spending, city spokesman Jace Radke confirmed.

At the budget meeting, Councilwoman Victoria Seaman, whose ward includes the Badlands site and who is running for mayor, asked if any forecasting included future judgments if the city does not succeed on appeals in the land-use dispute.

City Manager Mike Janssen, who took his post last year, replied that the city was still pursuing its options for the other cases and that the fiscal projections did not capture future wins or losses.

“We’re aware of the cases, and we’re trying to plan our funding as best we can to be ready for whatever the end result is,” he said.

The city has already spent around $5.95 million on outside counsel for Badlands-related litigation since 2018, according to figures provided by Radke.

As it stands, Las Vegas officials don’t know if the city’s insurance coverage would pay for the judgments, said City Attorney Jeff Dorocak, who took his post last year.

After the Review-Journal requested copies of insurance policies that cover court-ordered judgments against the city, settlements or other legal-related costs, the city provided one with a list of policy exclusions that included liability or claims related to “inverse condemnation,” which Lowie’s group alleged.

Dorocak also referred to Janssen’s recent comments when the Review-Journal asked what the city’s payment options could be, including whether it can borrow money through a bond sale, sell assets or raise property taxes.

“He laid out the approach that our leadership team’s taking, and we’ll be here to support them to analyze which of those options that are legally permissible,” Dorocak said in an exclusive interview with the newspaper.

Payment plans

Governments often borrow money through bond sales to finance construction projects, though it’s unclear whether Las Vegas is allowed to sell bonds to cover legal judgments.

Stevens and other sources weren’t sure. The state’s Legislative Counsel Bureau did not respond to a request for comment, and the Nevada League of Cities and Municipalities, an association of local governments, had no comment.

Vinson Guthreau, executive director of the Nevada Association of Counties, said he was not familiar with using bond proceeds to satisfy legal judgments.

Higher interest rates have pushed up borrowing costs in the past few years, Stevens noted, meaning a bond sale could result in untold additional amounts of money to pay off. And even if the city’s payments are spread over 20 years, it’s still shelling out money on the Badlands dispute.

“How many parks could be improved or roads improved with that money?” Stevens asked.

As to whether the city can raise property taxes to pay the judgments, Stevens said the city could go to a vote of the people. But taxpayers are unlikely to want to fund the payments this way.

“Good luck,” he quipped.

City poised to own Badlands

The city will take ownership of the Badlands property as it pays the verdicts to EHB, according to Jim Leavitt, an attorney for the developers.

Selling the land may offset some costs of the judgments, though it’s too early to tell how much the property may sell for on the open market.

“Unfortunately, it is hard to imagine a scenario that doesn’t affect city services and the budget moving forward,” Councilwoman Seaman said.

She noted the city has reserve funds, as officials discussed at the recent budget meeting.

The city expects to have $193 million in general-fund reserves next fiscal year, down from its current $215 million and last fiscal year’s $244 million, according to the presentation.

In the latest defeat for City Hall, the state Supreme Court in April upheld a $48 million award to Lowie’s team, affirming a District Court ruling that the city had improperly taken a 35-acre section of the course from the developers.

“When a governmental agency acts in a manner that removes all the economic value from privately owned land, just compensation must be paid,” Supreme Court Justice Douglas Herndon wrote in the high court’s unanimous ruling, released April 18.

The city later defended its stance in a post on social media, saying it had tried to settle the dispute “from the onset” but the developers sought “hundreds of millions of dollars for a settlement” on land they acquired for far less along with a much-higher density of homes than was ever envisioned for the area.

Statement on Badlands pic.twitter.com/j1cx3BqiL9

— City of Las Vegas (@CityOfLasVegas) May 8, 2024

“That is why the city has been compelled to find a solution in the courts,” the statement said. “Nevertheless, the city remains open to finding a settlement that is agreeable to the developer and to the tax-paying residents of Las Vegas.”

EHB partner Vickie DeHart responded that the city’s statements were “demonstrably false.”

“Despite our genuine attempts to cooperate, we have been met with continual delays and aggressive legal tactics,” she said.

Leavitt, EHB’s lawyer, said that his clients hadn’t received any money from the city yet and that interest costs are piling up.

He estimated the city owes an additional $20,000 per day, or around $600,000 total, stemming from the unpaid Supreme Court judgment a month earlier.

“You’d think they just come pay it,” he told the Review-Journal.

Radke, the city spokesman, said that the interest payments cited by Leavitt seemed high and that the judgment would be paid when the case returns to the lower courts.

‘Waste of time and resources’

Las Vegas has a long list of mayoral candidates who are angling to replace termed-out Mayor Carolyn Goodman ahead of the June 11 primary election. Many of them have been critical of the city’s lengthy legal battle over the Badlands.

“This is taxpayer dollars that we’re gambling with,” Seaman said.

She said the city could pay for the judgments out of its general fund but noted this would significantly deplete that pot of money.

Las Vegas shouldn’t be in this position, she said, adding that multiple judges found the city effectively took the developer’s land and that she has advocated for an end to the dispute.

In the summer of 2022, Seaman brought a proposed $64 million settlement with Lowie’s group to the City Council. But the deal collapsed shortly before it was set for public discussion at City Hall.

At the time, Lowie said the city tried to make last-minute changes to the agreement.

Mayoral candidate Shelley Berkley, a former congresswoman, who lives in the upscale Queensridge area that surrounds the long-shuttered golf course, said it’s too soon to determine how the city should pay for the judgments.

But the courts have determined the city was wrong and the developer was right, she said, adding it’s time to negotiate.

“I just don’t understand why the City Council keeps voting for funding to pay outside counsel to continue this fight,” Berkley said.

Councilman Cedric Crear, meanwhile, has said he’s been a “staunch supporter” of neighbors’ rights in the dispute and echoed the city’s contention that it has made good faith attempts to resolve the fight.

“I’ve been standing up for you and the city hasn’t done anything wrong,” he said at a recent mayoral candidate forum.

Crear, an elected official running to lead Nevada’s largest city, did not comment for this story, as his mayoral campaign referred questions to the city’s public information office.

Eric Medlin, one of several other candidates for mayor, said that for the average person, the Badlands saga looks like “a bunch of rich people buying political influence to prevent something from being built in their backyard.”

“What a waste of time and resources,” he told the Review-Journal. “I hope the owner builds a rocket engine testing plant there out of spite.”

Court losses pile up

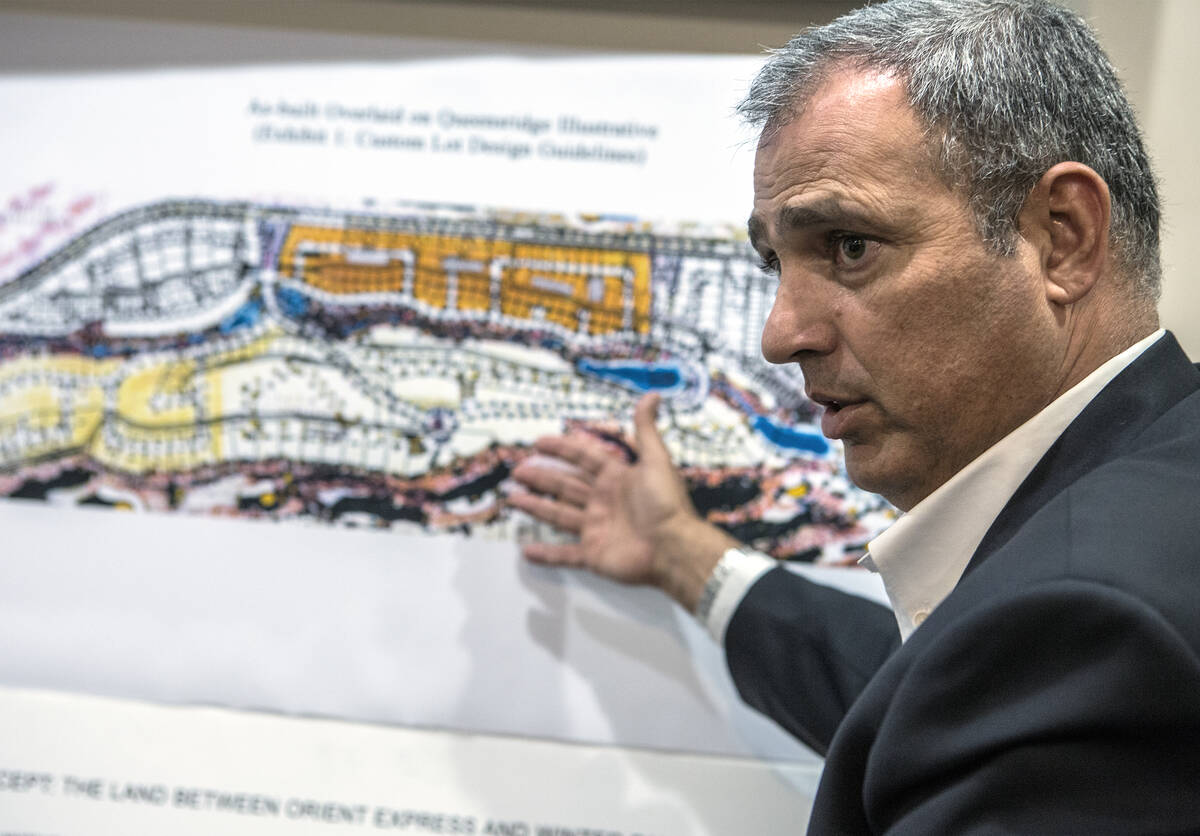

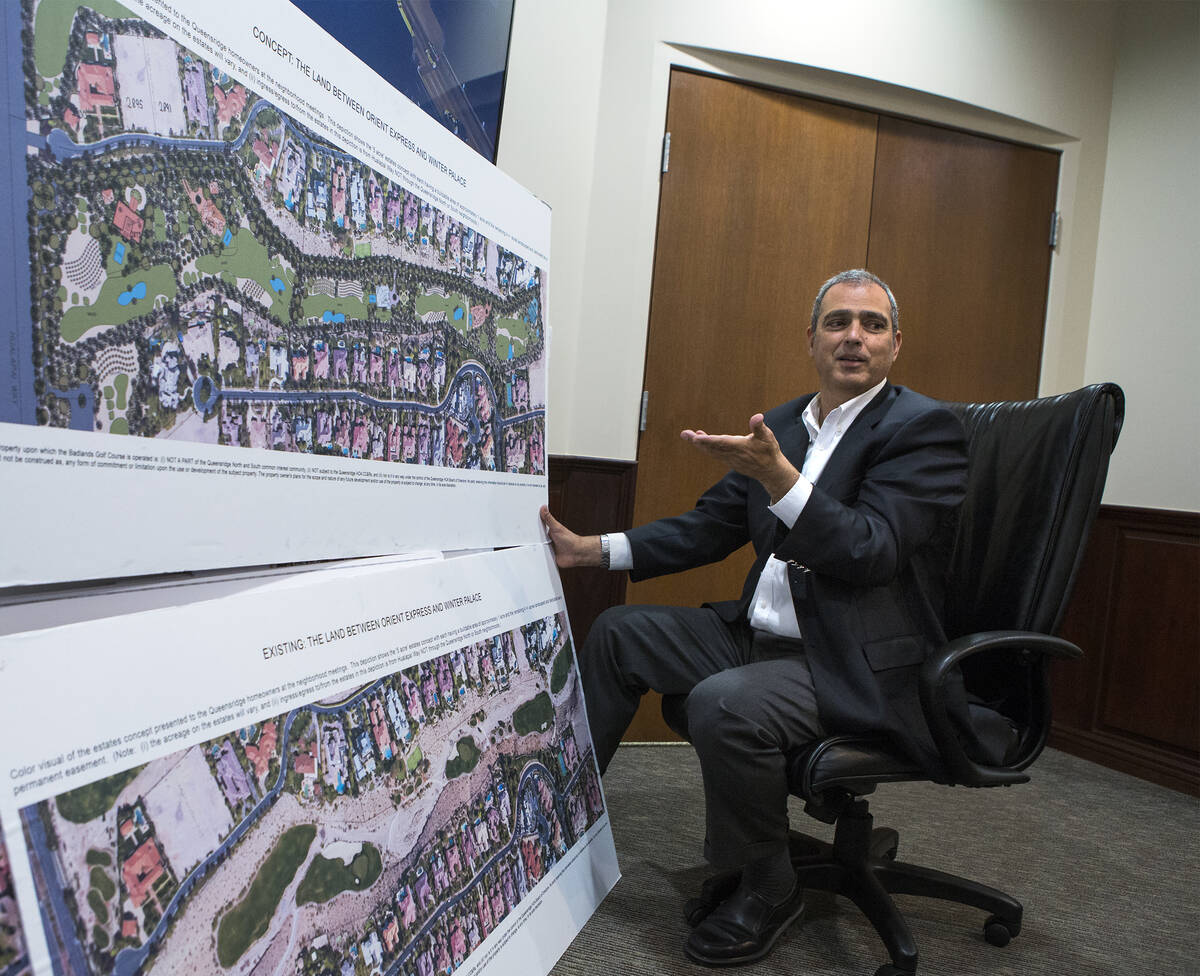

Lowie’s group acquired the 250-acre Badlands property in 2015, years after his firm partnered to develop two big neighboring projects: retail-and-office complex Tivoli Village and luxury condo towers One Queensridge Place.

The golf course closed in 2016, and according to a marketing brochure, EHB drew up plans for up to 60 large homesites, thousands of multifamily units and open space.

But the project faced strong opposition, especially from Queensridge-area residents, and Lowie’s group took the city to court, in cases involving different sections of the property.

The developers were awarded almost $48 million in one case, around $48 million in another, and $141 million in yet another, court records show.

There has not been a verdict in an additional case.

After years of litigation and mounting courtroom defeats, the city has not given up.

On May 20, it filed a petition for rehearing in the Nevada Supreme Court case it lost, saying the court had “overlooked, misapprehended, and disregarded” material facts.

Absent a mutually agreeable settlement with the developer, Radke said, Las Vegas’ attorneys will continue to defend the city in court.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Segall is a reporter on the Review-Journal’s investigative team, focusing on reporting that holds leaders, businesses and agencies accountable and exposes wrongdoing.