The FBI arrived at the only house on this stretch of Ruffian Road at 1:25 p.m., parking out front of the $1.6 million property, hedged by empty lots of scrub and dust. The three agents approached the camera-equipped doorbell at the home’s perimeter, pressing it once. Then they pushed past an unlocked gate, cut through the courtyard and rapped against the glass French doors of Matthew Beasley’s home.

Produced in partnership with

Las Vegas Review-Journal investigative reporter Jeff German was slain outside his home on Sept. 2. To continue German’s work, The Washington Post teamed up with the Review-Journal to complete one of the stories he’d planned to pursue before his murder. A folder on German’s desk contained court documents he’d started to gather about an alleged Ponzi scheme that left hundreds of victims — many of them Mormon — in its wake. Post reporter Lizzie Johnson began investigating, working with Review-Journal photographer Rachel Aston.

The Las Vegas attorney, then 49, had been anticipating this visit for months, he would tell an FBI hostage negotiator. He’d already drafted letters to his wife and four children, explaining what he could and describing how much he loved them.

On this Thursday in March, Beasley knew his time was up. He placed the letters — along with a note addressed to the FBI and a zip drive of computer files — upstairs on the desk in his office. Then, alone in the house, he went to the front door. He paused, the left side of his body obscured by the door frame.

One of the agents — identified only as “J.M.” in a detailed criminal complaint filed March 4 in the U.S. District Court of Nevada — opened his suit jacket and flashed his badge.

Beasley stepped fully into the doorway. He held a loaded pistol against his head.

“Easy, easy,” yelled J.M.

“Drop the gun,” shouted a second agent.

Authorities had long suspected Beasley of running a massive Ponzi scheme with his business partner, Jeffrey Judd, that mainly targeted Mormons, as members of the Church of Jesus Christ of Latter-day Saints are often called. The investment was pitched as a nearly risk-free opportunity to earn annual returns of 50 percent by lending money to slip-and-fall victims awaiting checks after the settlement of their lawsuits.

There was just one problem, the Securities and Exchange Commission charged in a civil complaint. None of it was real.

For five years, the SEC said, Beasley and Judd paid existing investors with money from new clients — a classic Ponzi scheme. The most notorious fraud of this kind, run by Wall Street financial guru Bernie Madoff, cost investors billions of dollars. By comparison, one expert said, the alleged Vegas scam was distinguished less by its size and more by its victims: It came to be known as the “Mormon Ponzi scheme.”

More than 900 people invested their savings — an estimated $500 million — between 2017 and 2022. They included surgeons, real estate developers, Mormon bishops, retirees and stay-at-home mothers. Money poured in from as far away as Singapore, Taiwan and Australia, according to a class-action lawsuit filed in July against Wells Fargo, where Beasley had an attorney trust account to hold and disburse client money. (The bank has moved to dismiss the lawsuit, denying any wrongdoing.)

Some people emptied their retirement accounts, according to more than two dozen interviews with investors by The Washington Post, while others took out a second mortgage on their house.

“They’ve destroyed a lot of people’s entire lives,” said Greg Hart, 81, a retired entrepreneur who lives in Buckeye, Ariz., and fears he may be forced to sell his home. “About $2.2 million — 95 percent of our money — was tied up in it. … This has been completely and totally devastating.”

Meanwhile, Beasley, who repeatedly acknowledged that he was running a Ponzi scheme during his confrontation with the FBI, and Judd, who has denied knowingly defrauding anyone, amassed a fortune. They bought luxury vehicles, a private jet, cryptocurrency, and multimillion-dollar properties in California, Nevada and Utah, according to reports by the court-appointed receiver, who has recovered about $90 million in investor funds by selling those assets.

Before the FBI arrived at Beasley’s door that day, they’d raided Judd’s $6.6 million mountainside mansion, which overlooked the Las Vegas Strip. There, according to a new court filing, agents confiscated Judd’s cellphones and computers, more than a half-dozen high-end watches, thousands of silver and gold coins, and nearly $400,000 in cash, just a day before the nuptials of his 21-year-old daughter.

“The sad thing is he has all of his family in town for that big wedding,” a colleague texted Beasley at 12:07 p.m.

“Really surprised they have [not] come to me,” Beasley replied three minutes later.

But his house was next.

As the FBI agents shouted at him, Beasley said later in an interview with The Post, he pointed the pistol toward the ground.

He was doing what the three agents had asked of him, Beasley said, adding that “I never pointed my gun anywhere except for my head.” The FBI maintains in its criminal complaint, though, that he aimed the weapon at the agents. At least one opened fire, striking Beasley in the chest and shoulder.

He retreated into his home, refusing to come out as the FBI assembled a SWAT team and began recording its calls with him. The hostage negotiator tried to persuade him to seek medical care, but Beasley repeatedly threatened to kill himself, saying that he didn’t want to go to prison.

“I f—-ed this all up …” Beasley told the FBI, which entered transcripts of the conversations into the court record. “And I’m not even talking about today. This was not even close to my worst decision today. My worst decisions happened many years ago.”

Soon after, the line went quiet. Crouched on the floor with the pistol resting on his chest, Beasley had dropped his cellphone, slick with his own blood.

‘Really lucky to be involved’

Ann Mabeus was at a Starbucks on March 3 when her cellphone began blinking with notifications. Then a call rang through.

“Ann,” her friend told the single mother, then 42. “Do you realize that the Humphries’ house is getting raided right now?”

The FBI was also executing a search warrant at the home of Chris Humphries.

Mabeus blanched. Humphries — who has maintained his innocence and sought dismissal of the SEC complaint against him — had been a marketer of the same investment that she’d put most of her money into.

Though they socialized and were members of the same Mormon church, Mabeus and her husband wound up investing through another marketer, Shane Jager, the 47-year-old owner of a pest control company.

Jager had four children about the same age as the Mabeus kids. Like more than a dozen other investment marketers, he earned commissions by bringing people in, though he denies in an SEC filing that he knowingly defrauded anyone and accuses Beasley of deceiving him.

Everyone called the operation J&J, referencing two LLCs created by Jeff Judd: J&J Consulting Services and J&J Purchasing.

“Because we were friends and belonged to the same church, the red flags were heart-shaped. I was like, ‘Wow. We are really lucky to be involved in this investment.’”

Jager had told Mabeus about the opportunity to make money in August 2019, during a couples trip to Mexico, she said. She felt flattered to be included.

“We were a little nervous, but we trusted him,” Mabeus said. “Because we were friends and belonged to the same church, the red flags were heart-shaped. I was like, ‘Wow. We are really lucky to be involved in this investment.’”

The next month, she and her husband wired over $140,000. Ninety days later, the first interest payment of $18,000 arrived, right on time. The couple continued adding money until they reached a total of $680,000, she said.

“There was never a hiccup,” Mabeus said. “My bishop was involved and invested, and so were my closest friends. A lot of people were told to keep it quiet.”

When she and her husband, a former Major League Baseball pitcher who worked for a medical device company, divorced in June 2021, Mabeus agreed to take the investment as alimony. She planned to rely on the dividends, along with child support payments, to remain at home with her daughter and three sons. A former elementary school teacher, she hadn’t worked for 13 years.

Now, Mabeus hung up the phone, horrified.

She tried to call Jager. No answer.

“Word is spreading like wildfire,” Mabeus remembered. “People are texting left and right. No one is getting responses.”

Maybe it was all a big misunderstanding, she thought. She told herself that she’d know for sure the next day, when the quarterly interest payment was scheduled to hit her bank account.

But when Friday arrived, the money didn’t. All her savings, Mabeus realized, were gone.

‘Gentleman’s investment club’

Matt Beasley’s gambling debts were mounting.

He was big into sports betting, he told the FBI, and by late 2016, he’d paid his bookie the last $40,000 he had. He was being pressured to come up with more, he said, so he decided to get lunch with Judd, a friend and former law client.

Beasley’s path to becoming a Las Vegas lawyer had been a halting one.

He grew up in the Kansas City area, the younger of two children. After his parents’ divorce, he rarely saw his father, a union electrician who went on to remarry four times, according to a psychological evaluation requested by his attorney and entered into the court record. Unmoored, it took Beasley a decade to finish his undergraduate degree, eventually obtaining a finance and management degree from Park University in Missouri.

He moved to Las Vegas in 2004 after graduating from the University of Missouri School of Law. He chose it, he told The Post during three short phone conversations and a series of written messages, because he hadn’t really visited anywhere else.

Unlike Judd, Beasley was not Mormon. The two men met through their sons, who played soccer together.

“We became friends,” Beasley told The Post, “and then I represented him on a couple pharmacy cases.”

“I realized there’s no going back. … Jeff had more people that were interested in getting in, so I made up more attorney’s deals and I just kept growing it.”

Judd was a native of Las Vegas who’d dabbled in real estate and pharmaceutical sales while his wife, Jennifer, stayed home with their two sons and two daughters.

At lunch, Beasley told Judd that he had an investment opportunity to share: bridge loans for slip-and-fall victims awaiting their settlements.

“I just explained it as this type of deal related to lawsuits,” Beasley told the FBI.

In an Oct. 6, 2016, email obtained by The Post, Beasley wrote to Judd that he had a client who “wants a $50k loan which will pay back $60k within 45 days.”

Judd “thought it was a legitimate investment,” said someone familiar with Judd’s involvement, who spoke on the condition of anonymity.

“Man, this is a great idea,” Beasley recalled Judd saying. “Do you know any other attorneys [so] we could continue to grow this?”

As cash flowed into Beasley’s attorney trust account, he told the FBI, he used it to pay his gambling debts. In all, SEC forensic accounting would show that Beasley sent more than $6.7 million to his bookie.

After a while, Beasley told the FBI, “I realized there’s no going back. … Jeff had more people that were interested in getting in, so I made up more attorney’s deals and I just kept growing it.” Beasley said he never actually talked to other attorneys.

He maintained to the FBI that Judd didn’t know it was a Ponzi scheme.

But in an April SEC complaint against Judd — who received at least $315 million from the alleged scam — the regulatory agency said that he either “knew or was reckless in not knowing … the business was a fraud.”

When asked to submit evidence clarifying his status as a “victim,” SEC lawyers said in a July court filing, Judd refused, “asserting his ‘Fifth Amendment privilege against self-incrimination.’”

In an email, Judd’s criminal defense attorney, Nick Oberheiden, blamed Beasley for the alleged fraud and took issue with the SEC’s characterization of Judd, saying that “legal terms like ‘knowledge’ and ‘intent’ are complex, technical, and sausage-like: “few know what’s really inside.”

As the operation got bigger, so did the men’s lifestyles. Beasley bought a $3.8 million house in South Lake Tahoe, Calif. He bought a $750,000 RV, a $250,000 boat, a $240,000 Bentley Continental and two $25,000 Jet Skis, according to a list of relinquished and seized assets filed in court.

Judd, now 50, purchased a 6,330-square-foot home in the gated community of Ascaya, which claimed Las Vegas Raiders owner Mark Davis and Kiss rocker Gene Simmons as residents. He drove a $650,000 Rolls-Royce Black Badge Cullinan and a $400,000 Rolls-Royce Dawn convertible.

“I have the illness,” Judd texted a friend in April 2021, referencing the new Porsche he planned to add to his fleet of cars.

The SEC noted that in one text message from October 2020, Judd referenced the investment as “an illegal business.” He also assured potential investors that he’d had discussions with the lawyers Beasley was working with — even though Beasley said he’d never contacted any — and had seen the personal injury settlements and bank statements, the SEC said.

The source familiar with Judd’s involvement called that assertion “an overstatement” unsupported by any real evidence. He also denied Judd was the initiator of nondisclosure agreements intended, the SEC said, to deter clients from contacting the personal injury lawyers listed on their investment contracts, as well as a clause prohibiting them from contacting any parties “without the written consent of Jeffrey Judd.”

“Beasley created excuses for the need to have these,” and Judd had no reason to question it, the person familiar with Judd’s involvement said.

Despite the red flags, hundreds of investors were receiving their dividends on time — paid from the funds of new investors — and word was spreading.

Marshall Gibbs, a 37-year-old dentist in Cheney, Wash., said it was described to him by marketer Jason Jongeward as a “gentleman’s investment club.” Jongeward has maintained he did not intentionally defraud anyone in SEC filings.

“We started chatting, and he said, ‘We have this investment. My wife and I are going to be able to retire early because of it. We just feel so blessed,’” Gibbs said. “I did have my suspicions, but he said his family was in it. That just kept fueling me to add more.”

Gibbs wound up investing $940,000, he said.

The SEC had been investigating J&J since at least December 2020, according to court documents, after a Salt Lake City attorney became alarmed by a friend’s investment paperwork and reported it.

Then those same contracts started hitting the desk of an accountant in Washington state.

“I started panicking because I realized there were five clients already involved in this stuff, probably blowing their money,” said the accountant, who spoke on the condition of anonymity because of the investigation.

He decided to send an email to a New York City-based investment firm that specializes in exposing fraud.

“So many of the details seem incredibly off,” he wrote in the Jan. 11, 2022, email to Hindenburg Research that he shared with The Post. “I don’t mean to waste your time but I am very concerned there are all kinds of people, small businesses, individuals, etc. that stand to lose tens of millions.”

If anyone could help, the accountant thought, it would be this group. In some circles, the people at Hindenburg had come to be known as Ponzi hunters.

‘Outrageous claims’

They were going to need a private plane.

In the month since Hindenburg Research founder Nate Anderson had first heard of J&J, his firm had secretly recorded phone conversations with Jongeward, who would later tell the SEC that he was “only trying to help my family and friends.”

“We really, really struggled to see the risk,” Jongeward had said during one call with Hindenburg Research. “I think that’s probably why the performance has been — I’ll call it immaculate.”

Anderson, 38, who’d once worked with the whistleblower who tried to warn the SEC about Bernie Madoff, said he had immediately spotted the telltale signs of a Ponzi scheme. An online search showed neither Judd nor Beasley had liens listed under their names, which, in a legitimate endeavor, would have ensured legal recourse if the slip-and-fall victims didn’t pay back their loans, Anderson said.

The investment also had no website. Spread via word of mouth, it was reliant on the trust that came from a shared religious affiliation, known as an affinity scam.

“The explanation was that it was such a brilliant strategy that they needed to keep it as secretive as possible,” Anderson said. “Litigation finance is a competitive and specialized field. Yet they were claiming to be able to generate five times the returns of everyone else in the industry, with virtually no risk and no defaults. It took very little time to realize this was highly likely to be a complete Ponzi scheme. The challenge was in proving it.”

“The explanation was that it was such a brilliant strategy that they needed to keep it as secretive as possible.”

Any evidence that Hindenburg gathered would be turned over to authorities, ensuring it would be in line for a government-funded whistleblower award. Under the SEC’s program, the group could stand to receive up to 30 percent of any fines collected, potentially amounting to millions of dollars.

The firm wanted to record Judd giving the same pitch as lower-level marketers. To lure him in, it would need something flashy.

One of Anderson’s colleagues knew of just the right bait: Mark Holt, a Salt Lake City entrepreneur who owned a private aviation business — and had an unlikely connection to Judd.

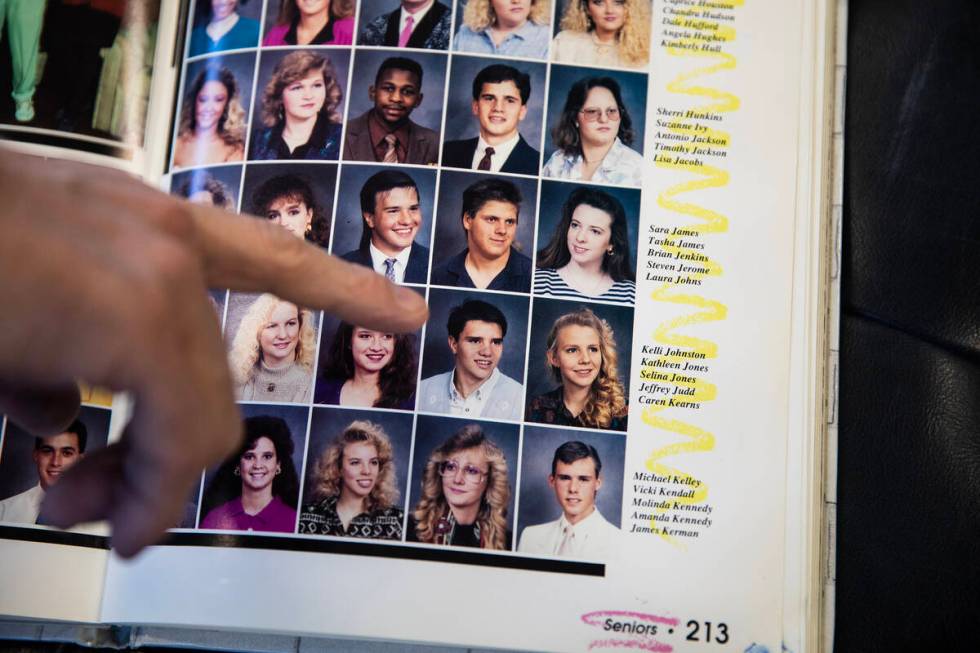

Holt, a Mormon, had attended Bonanza High School in Las Vegas with Judd. On Facebook, the two men shared more than 40 friends. Holt’s ex-fiancee was a woman Judd had once dated, too.

Holt agreed to help out by posing as a “whale” — a wealthy businessman looking for places to invest large sums of money — in his case, $50 million.

Holt had been defrauded himself a decade earlier, giving money to a man who promised a 25 percent interest payment if the price of Canadian oil stayed above $30 a barrel. When his returns arrived, Holt decided to bring his mother in. Not long after she’d invested a good chunk of her savings, he said, the man disappeared.

Now one of Holt’s private planes would serve as the site of a pitch meeting designed to expose J&J as a Ponzi scheme.

On Feb. 17, Holt arrived with a Hindenburg Research whistleblower — identified only as “Mike” in recordings given to the FBI and SEC — at Henderson Executive Airport in Nevada, where a parked jet had been rigged with surveillance equipment. Cameras were tucked in a water bottle, a tissue box and a bowl of mints. Audio equipment was inserted into the plane’s overhead lights.

They invited marketers Jongeward and Jager on board. Judd didn’t usually do introductory pitches like this, though Holt hoped that their shared history, combined with the plane, would be enough to guarantee a later phone call.

Over chicken salads and sandwiches, the men chatted with Holt about being Mormon and tried to sell him on the investment. A former improv comedian, Holt played the part — “mostly excited,” he said, “a little bit cautious, credulous enough.”

“I’ve heard some pretty outrageous claims as far as returns go,” Holt, then 48, told the marketers. “So it seems … too good to be true. So maybe you guys can help me understand, wrap my head around it.”

“When I first heard about it,” Jager replied, “I thought it was too good to be true, and it took me … about six months to get off the fence and put some money into it. Fast forward today, almost five years later, it’s never missed a beat. … It’s more or less a friends and family deal.”

Holt said he still wasn’t sure. He wanted to talk with Judd first.

A week later, on Feb. 24, they got on the phone.

“Jeff lives high up on the mountain,” Jager explained, his voice tinny as he merged the conference call. “And sometimes cell service isn’t great.”

“All right,” Holt said. “Awesome. Okay. This is the Jeff Judd, huh?”

“Jeff Judd from a long time ago,” Judd replied, laughing.

They spent a few minutes catching up on all that had transpired since their graduation from Bonanza High — how Judd had gone to Chile for his mission trip, while Holt had been sent to Portugal. How Judd’s 23-year-old son was a professional soccer player for the LA Galaxy, while Holt had a 1-year-old at home, with a second child on the way. Then they turned to business.

Judd explained that he had “$475 million under management.”

“It’s changed a lot of people’s lives,” Judd said, because the returns are so good. “I wasn’t greedy when I did that. I mean, we pay a high percentage. So my thought process was, ‘It’s not my money. I’m going to make my money on each deal. Then why wouldn’t I pay out a high percentage?’ So that’s the way we set it up.”

Judd hit the same points as Jongeward and Jager — little risk, high reward. Holt pretended to mull it over. He said he was considering investing $2 million, to start.

That’d be no problem, Judd agreed.

Within a week, the FBI was at Judd’s door. And then they were at Beasley’s.

‘Hey, Dad’

The FBI negotiator couldn’t persuade Beasley to surrender.

Beasley’s 22-year-old son joined the effort to end the standoff, now in its fourth hour. He’d recorded a message for his father, but Beasley refused to listen to it.

Slouched in the entryway, the floor scattered with broken glass from the front door, he fingered the loaded gun. He’d bought the pistol just before his son’s birth, he told the FBI, so he could protect him, no matter what.

Now, Beasley wasn’t sure he could stand up. He’d lost a lot of blood and was in shock. He told the negotiator that he couldn’t face his family.

“Your son is still here,” the negotiator said. “He refuses to leave. … Do you want to hear his message?”

Finally, Beasley agreed. Over the phone, he heard a recording of his son’s voice: Hey, Dad, it’s me. … [We] are waiting for you outside. I love you and need you to come out. … Everything is going to be okay.

Outside, darkness had fallen. Floodlights were aimed at the house, and the SWAT team was finally ordered to enter and bring Beasley out in handcuffs.

He was taken to a hospital before being charged with assault on a federal officer.

Since then, he’s been held at Nevada Southern Detention Center in Pahrump, a windblown swath of high desert about 70 miles west of Las Vegas.

“He was willing to take his own life rather than answer for his actions.”

No criminal charges have been filed against anyone else, including Judd, Humphries, Jager and Jongeward.

“We do not comment on potential charges,” said Trisha Young, a spokeswoman for the U.S. attorney’s office in Las Vegas.

In an interview with The Post, Beasley said he figures more charges were probably coming.

“Almost everything about the shooting has been misrepresented,” Beasley said. “Considering the only charges I have are related to the shooting, I guess I don’t have a problem with being the only one incarcerated. I assume that once charges on the alleged financial crimes come down that I won’t be alone. It is simply illogical to think otherwise.”

At Beasley’s initial court appearance, on March 8, his attorney argued that his standoff with the FBI had been a result of a “one-time extreme emotional crisis” and asked that he be released.

But Tony Lopez, chief of the white-collar crime section at the U.S. attorney’s office in Las Vegas, objected.

“This nine-figure Ponzi scheme is what made the defendant hole up in his house for four hours until the FBI had to literally drag him out,” Lopez told the judge. “He was willing to take his own life rather than answer for his actions.”

The consequences of those actions were wreaking havoc on the lives of hundreds of people across the country, including Beasley’s own loved ones.

Less than three weeks after the FBI raid, Beasley’s wife divorced him. She moved out of the house on Ruffian Road, which was seized along with millions of dollars in other assets to help repay investors.

To support their two younger sons, Beasley’s attorney said in court, his wife had gotten a job working 5 a.m. to 1:30 p.m., Sunday through Thursday. And his oldest son — who had once described his father as his greatest hero on his biography for his university soccer team — had left college to help out at home.

‘Survival mode’

The mansion had a towering entryway with a chandelier that cast rainbows against the walls on sunny days. It had a soccer field and a basketball court and more garages than most families would ever need.

Ann Mabeus hoped this house would save her.

It was mid-November, and she was still reeling from the collapse of J&J.

She’d been renting a house across town for herself and her kids, but she’d fallen behind on the $3,890 monthly payments. The $3,600 she received in child support each month wasn’t enough to pay her bills.

Her church had helped, paying two months of rent and providing donated groceries, which she picked up at the Bishops’ Storehouse, a 24-mile drive away. But Mabeus didn’t have health insurance. She couldn’t afford birthday parties for the kids. She needed to start earning an income again.

“I don’t have time to be angry,” Mabeus said. “I’m in survival mode. Everything in my life has to change. I have to learn how to make money.”

She’d decided to become a real estate agent. If she sold this mansion — owned by someone whose children she’d home-schooled during the pandemic and who had since moved to Florida — she’d make enough on commission to pay her debts and float her family for a few more months, until she could list more houses.

On a dark-skied afternoon just before Thanksgiving, she drove toward a real estate firm, where she’d enrolled in a home-selling course. Outside, the palm trees whipped in the wind, winter rain splashing against the arid ground.

Ann Mabeus speaks with a client intake advocate at the Legal Aid Center of Southern Nevada in Las Vegas hoping to secure financial assistance for her family after falling victim to a Ponzi scheme. (Rachel Aston/Las Vegas Review-Journal) @rookie__rae

Ann Mabeus speaks with a client intake advocate at the Legal Aid Center of Southern Nevada in Las Vegas hoping to secure financial assistance for her family after falling victim to a Ponzi scheme. (Rachel Aston/Las Vegas Review-Journal) @rookie__rae  Ann Mabeus loads her car with groceries from the Bishop’s Storehouse, a food pantry run by The Church of Jesus Christ of Latter-day Saints. (Rachel Aston/Las Vegas Review-Journal) @rookie__rae

Ann Mabeus loads her car with groceries from the Bishop’s Storehouse, a food pantry run by The Church of Jesus Christ of Latter-day Saints. (Rachel Aston/Las Vegas Review-Journal) @rookie__rae Mabeus felt like she was foundering. She often woke up in the middle of the night, panicked and anxious.

In class, a presenter promised the aspiring real estate agents that prospecting karma — making connections to sell houses — was a thing.

Mabeus rested her chin in her hand, her mind wandering. She had a lot left to do to get the mansion listed and sold. She needed to get landscapers in and a dumpster out. She needed to get an exterior light fixed and the dust and debris swept out of the hallways.

After the class ended, she drove back to the huge house. In the driveway, she checked her cellphone. A friend had texted, asking how she was doing. She set her phone down without replying.

Fearing eviction

In mid-January, Mabeus arrived home to a pink notice on the garage door of her rental.

She’d fallen behind on all her bills, she said. Her bank account was overdrawn. She’d racked up nearly $10,000 in credit card debt. The internet had been shut off, and the electricity was next. She was considering filing for bankruptcy. Her 17-year-old son — with $201.12 in his checking account — had more to his name than she did.

Now, this notice was threatening eviction.

Ann Mabeus laughs with her daughter Bree-Ann Mabeus, 11, as she reads from her schoolwork. (Rachel Aston/Las Vegas Review-Journal) @rookie__rae

Ann Mabeus laughs with her daughter Bree-Ann Mabeus, 11, as she reads from her schoolwork. (Rachel Aston/Las Vegas Review-Journal) @rookie__rae  Ann Mabeus helps her son Broch Mabeus, 13, with his homework at their Henderson home. (Rachel Aston/Las Vegas Review-Journal) @rookie__rae

Ann Mabeus helps her son Broch Mabeus, 13, with his homework at their Henderson home. (Rachel Aston/Las Vegas Review-Journal) @rookie__rae Mabeus had a week to pay the two months of rent she’d missed or risk being booted from her home. She couldn’t afford to pay the $7,780, but she also couldn’t afford to move. A new place meant another deposit and first month’s rent.

The mansion with the chandelier was still a week or so away from being listed.

She counted the cash in her wallet: $54.

Online, she applied for teaching jobs, food stamps, housing assistance. She had a master’s degree, but couldn’t get a call back about work.

Mabeus’s bishop held an emergency meeting. The church would pay her back rent and take care of the utilities, he told her, but he wanted the family in something cheaper, like a two-bedroom apartment, before her lease ran out on March 1. She had six weeks to figure it out, and she was determined to do so.

On New Year’s Eve, Mabeus had jotted down a list of goals for 2023 in a note on her cellphone. She scrolled through the list again. The final one was the most important. It read: “Stand on my own two feet.”