Trust deeds: the unsung hero of alternative real estate investments

Trust deed investing has been around for decades, offering private investors a myriad of opportunities to invest in real estate development and provides benefits such as diversification, capital preservation and historically high-yield returns. And yet, it still receives little merit and remains one of the most underutilized alternative forms of real estate investing in an IRA.

Private lending, such as through trust deeds, is unfortunately marred by dark periods of predatory lending practices, as well as the misconception that they are reserved for borrowers with bad credit and the exceedingly wealthy, who can afford the risk to lend to them.

There are two important factors the general public fails to acknowledge. The first is that, as a consequence of the housing bubble of 2008, the government cracked down hard on the lending industry. To this day, it is one of the most highly regulated industries on both the state and federal level. Second, there are companies, with years of experience, offering opportunities in fractionalized investments like deeds of trust. This essentially breaks down the capital barrier and makes them passive investments for their clients.

The big picture is that trust deeds investments are highly regulated, have shorter hold periods, lower investment minimums, offer capital preservation, are generally passive and delivers a fixed income, making it an ideal investment to deploy for a long-term investment strategy.

You may be wondering, what are the risks because every investment has them? For trust deeds it is liquidity, because you are unable to cash out on your investment before the loan matures. You must wait for the borrower to pay it off, and there is the risk of the borrower defaulting on the loan. If the borrower defaults and the property must be taken back through foreclosure and then sold to recoup investor principle, this process can take time.

Common strategies to mitigate this risk include diversifying your trust deed investments across multiple borrowers, regions and property types (commercial and/or residential). Low investment minimums and shorter turn-over time make it easy to maneuver through the real estate market, which is essential when you are utilizing retirement funds to invest.

In a self-directed IRA account, the interest income from trust deeds will compound tax-deferred or tax-free (depending on the account), and with enough foresight, their ability to generate a fixed income also can be used to help bridge the income gap during your retirement years.

The primary problem that many retirees face is how to replace the income they used to earn from their job. Sources of income from pensions, social security, disability and income properties may still not be enough; and, unfortunately, not a lot of thought is given to creating a strategy on how to effectively use the retirement assets once we reach those latter stages of life.

Imagine if you could take $120,000 from a retirement account and generate $1,000 per month of income in perpetuity without spending a dime of the $120,000. Sounds too good to be true, right?

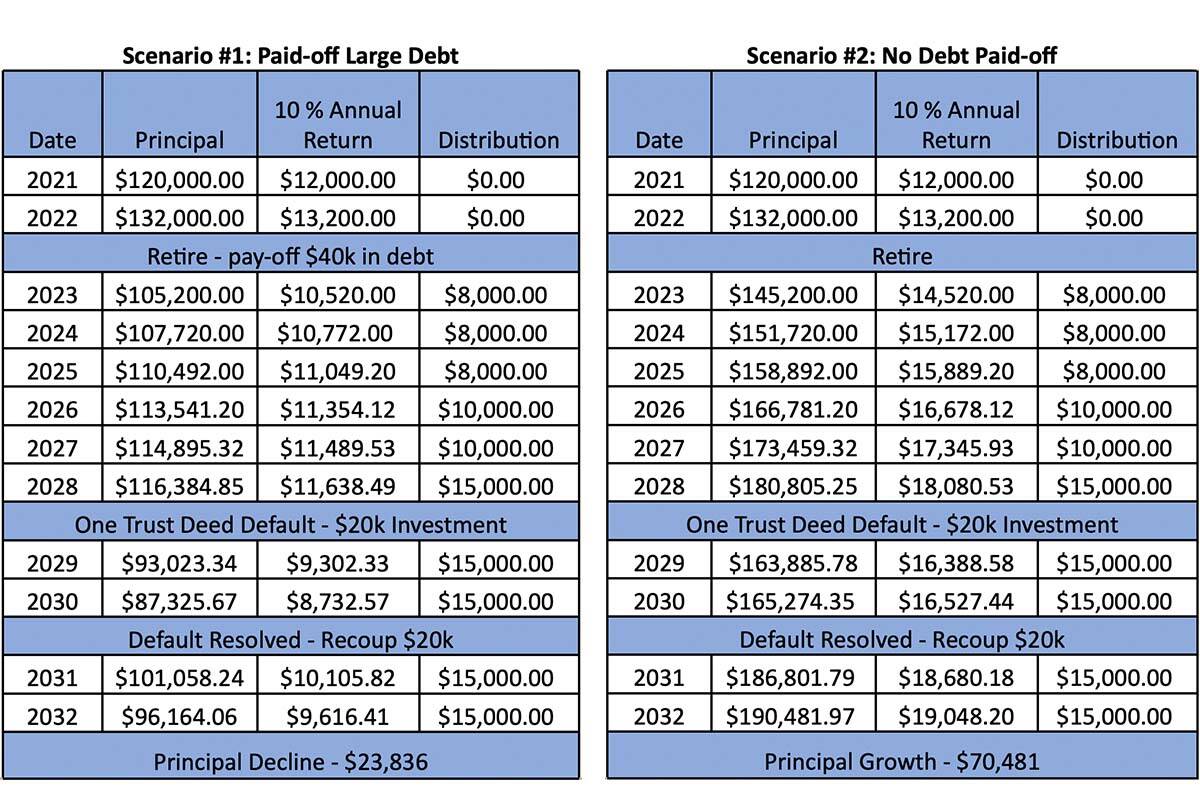

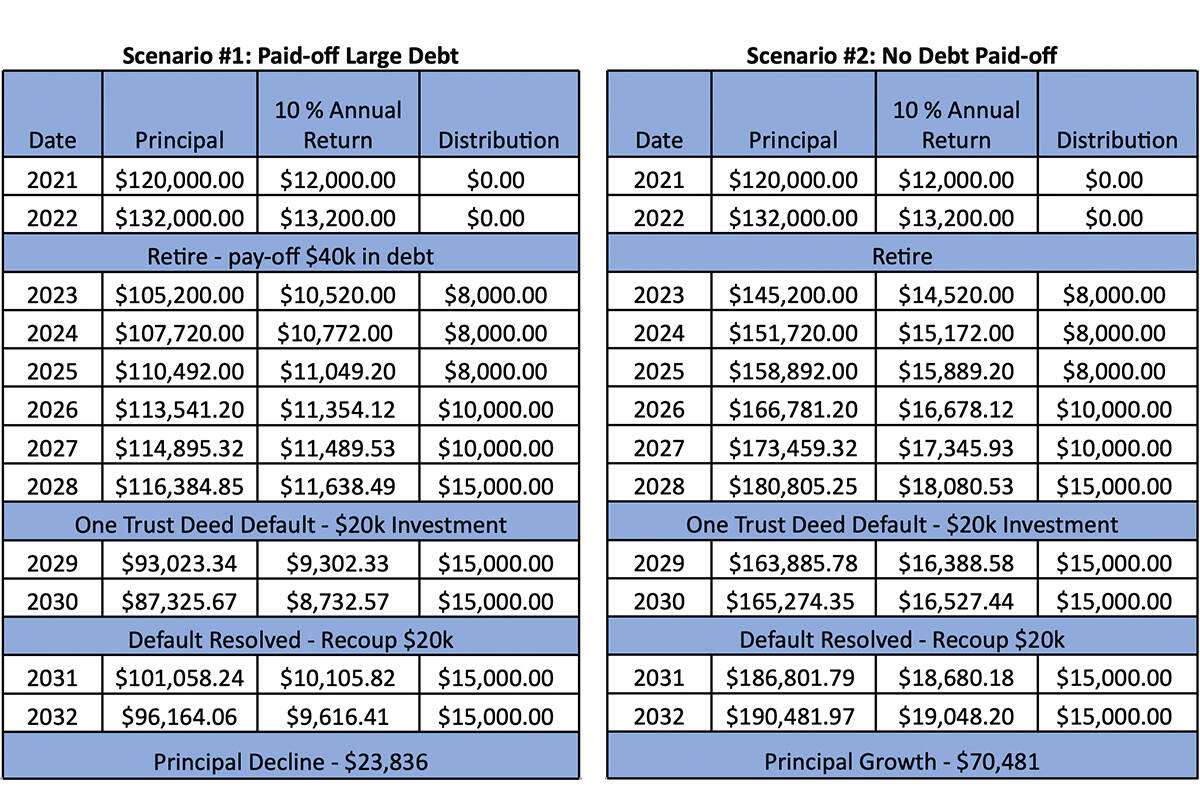

Let’s take a look at two scenarios side-by-side. In Scenario One, a couple years before retirement you roll-over $120,000 into a self-directed IRA from another qualified account to invest in trust deeds; but like many you think it is prudent to pay off a large chunk of debt, i.e., credit card debt or your home loan, which amounts to $40,000.

You find a company that offers annualized returns of 10 percent. You may run into a default or two down the line, but because of the low investment minimum your portfolio is diversified across multiple trust deeds.

While the defaults work themselves out, the others are still performing and providing you an income. As you get older it is no secret that your expenses may increase for things such as health care, which accounts for increased distributions as years pass.

In Scenario Two, all factors remain the same except you opt to not pay off your debts right when you retire so you maintain your full principal amount of $120,000. Now let’s take a look at how the numbers play out in Scenario One and Scenario Two in the charts seen above.

The difference between the build-up in Scenario Two vs. the draw-down happening in Scenario One is rather shocking, isn’t it? You can see the potential that trust deeds present if you have the wherewithal and the ability to maintain (you cannot discount the unexpected) the integrity of your principal amount.

Now, as you get into your latter years and would like to place your retirement savings in something with a smaller risk profile (ergo a smaller return), then you are that much farther away from completely draining your account. This could be a boon if you are planning to leave a legacy.

Finding the right trust deed investment company that will suite your retirement portfolio needs is key. As with any investment, proper due diligence and research is essential before making a commitment with any company.

When you are performing your research and comparing different companies, there are a few questions that you can ask yourself that could help you narrow down your options:

■ How passive do you want this investment to be?

This is important because not all trust deed investment companies will provide the same level of service. If you are comfortable with potentially being more hands-on with the investment, then you could consider companies that will just broker the loan and then leave the servicing of the loan entirely up to you or with the help of a third-party servicer, if you so choose.

If you are retired or at a point in your life where you do not need the chance of an extra commitment, other companies will provide all services needed for life of the loan, leaving the investment very passive to the investor.

■ What is your threshold for risk?

Trust deeds can be offered in first, second, third, etc. positions. If your trust deed investment is not in first position, this means that another loan(s) takes precedence over yours.

If the loan defaults, the loan in first position is not responsible to the preceding loans, which could leave you vulnerable to a loss of your entire principal investment.

■ What real estate markets do you want to invest in?

Trust deed investment companies vary in what regions and what type of real estate developments they will lend on. Some will only lend in their own backyard on fix-and- flip properties and others may lend in a certain region (i.e., West Coast, Southwest, Mideast, etc.) on both residential and commercial developments.

■ How much do you want to commit to each trust deed investment and at what return?

Some trust deed investment companies offer investment minimums as low as $10,000 up to requiring that you be able to cover the entire investment. Returns also can vary between companies, and on each investment they offer.

Preferred Trust Co. will waive the establishment fee and first-year administration fee for all new accounts opened in 2021. For more information, call 888-990-7982.