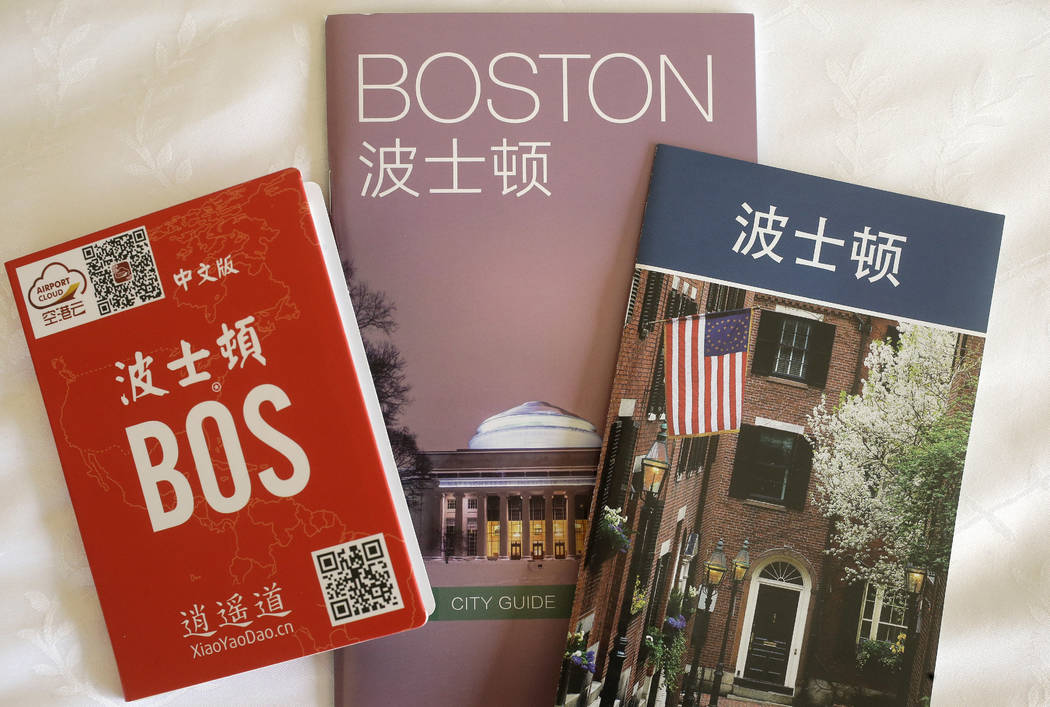

Fewer travelers visiting US from China

After more than a year of escalating trade tensions between the U.S. and China, some tourist destinations are feeling the consequences.

The National Travel and Tourism Office announced travel from China to the U.S. fell 5.7 percent last year to 2.9 million visitors, the first time these numbers have slipped since 2003.

“It’s a big deal,” said Gary Hufbauer, a nonresident senior fellow at the Peterson Institute for International Economics, a Washington, D.C.-based think tank. “My guess is that further declines will be seen next year and beyond.”

Escalating tensions

The trade war kicked off in January of 2018, when the Trump administration imposed tariffs on Chinese solar panels and washing machines. Now, the U.S. has a 25 percent tariff on $200 billion worth of Chinese imports, and China has placed tariffs on $60 billion worth of U.S. imports.

China also placed a travel warning for the U.S. last summer; the country later retaliated with its own warning against Chinese travel.

“The trade and tech wars are creating a new image of China in the American mind: not just a competitor, but definitely an adversary, and probably an enemy,” Hufbauer said via email. “This discourages Chinese tourism – visitors fear hostile encounters, though so far the fear far exceeds the reality.”

But the reasoning behind the fall is more complex than just trade tensions, according to Stephen Miller, director of the Center for Business and Economic Research at UNLV.

“The decline in tourism to the United States is partly because tourists from China are staying closer to home — Hong Kong, Taiwan, and Macau (Macao) — where tourism is up from China,” he said via email.

Visitation in Las Vegas

Tori Barnes, executive vice president for public affairs and policy for Washington, D.C.-based U.S. Travel Association, said the association is concerned that tensions with China might affect business and other travel to the U.S.

“While our commercial and security relationships with China are certainly complicated, it is an undeniable fact that Chinese travel to the U.S. has been a huge win for the U.S. economy and jobs, and there are warning signs that advantage is beginning to erode,” Barnes said in a statement.

According to the travel association, Chinese visitors are extremely valuable; they visit the U.S. in strong numbers and spend an average of $6,700 per trip, 50 percent more than the average international visitor.

However, Miller said Chinese visitors make up such a small percentage of Las Vegas’ overall foreign visitors — 4.5 percent in 2017 — that the decline might “not be a big deal.” China ranked fifth among foreign visitors in Las Vegas in 2017, behind Canada (26 percent), Mexico (20 percent), the United Kingdom (13 percent) and Australia (6 percent), according to the Las Vegas Convention and Visitors Authority.

The LVCVA hasn’t yet posted updated visitation statistics for 2018, according to spokeswoman Heidi Hayes, so she declined to comment on how national visitation numbers could affect Las Vegas. The LVCVA does have data that shows overall foreign visitation went up from 16 percent to 20 percent last year.

The industry as a whole plays a major role in the city’s economy. Visitors spent nearly $36 billion while in Las Vegas in 2018, and the tourism industry accounted for 39 percent of Southern Nevada’s total workforce last year, according to the LVCVA.

What’s next

Miller is optimistic about Chinese tourism to Las Vegas and believes the visitation growth will renew after the trade skirmish ends.

“Chinese tourism will continue to expand as their incomes rise,” he said.

Hufbauer doesn’t expect to see political rhetoric between the countries subside until at least 2021, with a slight chance of an early resolution in the mid-2020s if a new president is elected. Until then, he said travel rates from China to the U.S. won’t improve.

“I’m skeptical that Las Vegas can surmount these geopolitical forces,” he said. “Trade tensions have escalated a lot this year. Rhetoric from both (President Donald) Trump and Xi (Jinping, president of China) is sharp.”

In the meantime, Hufbauer said casino operators can take action to incentivise Chinese visitation.

“If the city and the casinos make a big effort to welcome any and all Chinese tourists, special greetings to individual visitors plus celebrations of Chinese holidays and the like, perhaps word will filter back to China,” he said.

Contact Bailey Schulz at bschulz@reviewjournal.com or 702-383-0233. Follow @bailey_schulz on Twitter.