China’s Golden Week a wash for Las Vegas this year

One of the busiest travel months for Chinese tourists is expected to be a wash for Las Vegas in 2020 because of the novel coronavirus.

The weeklong National Day holiday, also known as Golden Week, kicks off Oct. 1 each year and celebrates the founding of the People’s Republic of China.

While millions of Chinese tourists typically use the holiday to travel abroad — including to destinations like Las Vegas — travel restrictions are keeping them closer to home this year.

“October is typically a strong month for Chinese visitation (in Las Vegas),” said Brendan Bussmann, director of government affairs for Las Vegas-based Global Market Advisors. “Unfortunately, we will not be having that this year or in the near term.”

A meaningful holiday

Over 7 million outbound trips were made by Chinese travelers during the holiday last year, according to China’s Ministry of Culture and Tourism.

This year, most travelers are finding domestic destinations, according to Ctrip, China’s largest online travel agency. It estimates roughly 600 million tourists will travel within the country during the holiday, down 25 percent from last year.

Travel to the United States is off the table for most because the country prohibits those who have been in China during the past two weeks to enter.

Lori Nelson-Kraft, spokeswoman for the Las Vegas Convention and Visitors Authority, said it’s safe to assume that there is not any visitation from China in Las Vegas because of travel restrictions.

The LVCVA doesn’t break down international visitation data month-by-month, but October’s Golden Week is usually “a big deal” for Strip casinos that cater to Asian customers, said Josh Swissman, founding partner of The Strategy Organization, a Las Vegas gaming and hospitality consulting firm.

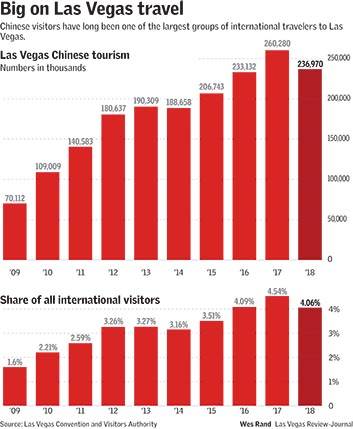

China was the seventh-largest country of origin for international travelers in Las Vegas last year, bringing in 205,400 people, or 3.6 percent of total international visitation.

“It’s not as big as Chinese New Year, but it is meaningful to a subset of properties on the Strip,” he said. “They will be missing that play, that activity this year.”

Chinese tourists spent, on average, roughly $3,127 during their trip to the U.S. in 2018, according to data from the LVCVA. Meanwhile, the average overseas visitor spends $2,039 per trip.

“They come from longer distances, they spend more money, they have a tendency to stay longer, and all of that adds up,” said Jeremy Aguero, principal analyst with research and consulting firm Applied Analysis. “It means more tax revenue for the state and local government, and it means more money for jobs. … These celebrations are extremely important to Las Vegas, and we’ve been feeling the loss of them for the past six months.”

Bussmann said the lack of Chinese visitors this month affects not only gaming revenue, but hotel, food and beverage, retail, entertainment and group spending.

All of those factors are critical to Las Vegas’ recovery, Bussmann said, as UNLV data shows nongaming amenities typically make up roughly two-thirds of Strip casinos’ revenue.

“We are a long ways off from seeing the numbers (we need) from not just Chinese but other international guests,” Bussmann said, adding that borders need to open and conventions will need to return first. “It may be some time before we see that same level of volume.”

The most recent travel forecast from the U.S. Travel Association, published in June, expects only 28.9 million international visitors in the U.S. this year, with spending reaching $622 billion. While numbers are expected to pick up to 47.3 million next year, that’s still far below the 79.3 million who traveled to the U.S. in 2019.

Long-term recovery

Las Vegas casino operators with Macao properties are expected to see some visitors from the holiday — although Bussmann said numbers are still expected to suffer under the pandemic.

Macao, a Chinese territory that permits gaming, is typically a popular spot for many during the holiday. It reinstated tourist visas last month, but it’s still a challenge to enter the region, Bussmann said.

“The Chinese are sticking close to home (for Golden Week), and that includes a less than originally expected volume to Macao,” he said. “Volume should be picking up later on this month, post-Golden Week.”

Las Vegas-based MGM Resorts International, Las Vegas Sands Corp. and Wynn Resorts Ltd. operate casinos in Macao.

As for future travel to the U.S., Bussmann said the country is “not even on the radar” of Chinese travelers at this point.

Aguero said it will take months for international travel to rebound.

If a vaccine is approved in the first quarter of 2021, Aguero expects it will take another 12 months before it’s made widely available to the public. He said international travel will return either when travelers get their hands on the vaccine or when people learn to live with the COVID-19 pandemic.

Overall, he said it will take anywhere between 18 and 36 months for Las Vegas’ tourism industry to recover, and Las Vegas’ international travel recovery will lag behind the broader economy’s return.

The Review-Journal is owned by the family of Las Vegas Sands Corp. Chairman and CEO Sheldon Adelson.

Contact Bailey Schulz at bschulz@reviewjournal.com. Follow @bailey_schulz on Twitter. The Associated Press contributed to this report.