Sales dip extends into July

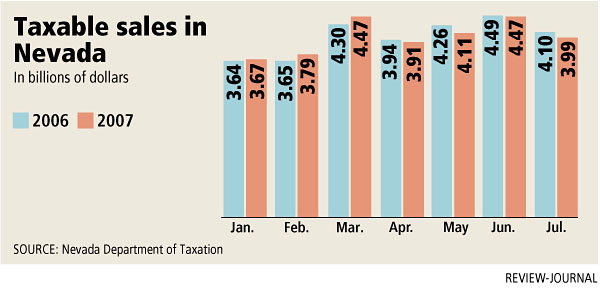

CARSON CITY — Nevada’s economy slumped again in July, with the value of taxable goods and services purchased by consumers down 2.6 percent over the same month a year ago.

Several major taxable sales categories, including auto sales, home furnishings, and bars and restaurants, reported lower taxable sales than in July 2006, according to a report released Monday by the Department of Taxation.

The July report continues a trend of declines that began in April.

Taxable sales were just under $4 billion in July, lower than the $4.1 billion reported in July 2006. In Clark County, taxable sales were $2.9 billion, or 1.3 percent lower than the nearly $3 billion reported for the same month last year.

“Nevada continues to feel the effects of the slow housing market and decline in automobile sales, a trend exhibited over the past several months,” Gov. Jim Gibbons said in comments accompanying the report. “This is partially offset by growth in the wholesale and general merchandise business categories and strong sales in the clothing category. We will be cognizant of future economic tendencies and their effect on our state.”

The largest increases in statewide taxable sales were from hotels and motels, up 25.8 percent; clothing and accessory stores, up 9.5 percent; miscellaneous retail stores, up 17.4 percent; and specialty trade contractors, up 7.8 percent. Also up were durable goods, 1.4 percent, and general merchandise stores, 2.5 percent.

But declines were seen in motor vehicle and parts dealers, off 12.8 percent; food and beverage stores, down 2.6 percent; home furniture and furnishings, down 13 percent; and food and drinking places, down 7.9 percent.

Eleven of 17 Nevada counties showed a decrease in taxable sales for July 2007 compared to July 2006: Carson City, Churchill, Clark, Douglas, Esmeralda, Humboldt, Lander, Lincoln, Nye, Pershing and Washoe.

As a result of sluggish sales, taxes collected by the state are also down, by 2.3 percent over July 2006, and total $295 million. Compared to a forecast set by the Economic Forum in May, the state general fund portion of the tax collections is off by $10 million.

The current trend of actual declines in taxable sales is the first since October 2006, when the economic indicator dropped by 0.6 percent compared to October 2005. Before that, there had not been a decline in taxable sales in Nevada since June 2002.

While taxable sales declined, excise taxes increased in July by 8.7 percent over July 2006, the Tax Department reported.