Revenue from sales tax lagging

All the souvenirs, Subarus and spa treatments in Nevada couldn’t push February’s revenue from taxable sales above earlier budget projections, a Wednesday report said.

The Silver State’s taxable sales — goods and services that consumers and businesses pay taxes on at the time of purchase — were up in February, but they weren’t up enough to erase a growing gap between revenue from sales-and-use taxes and revenue forecasts from the Economic Forum, which provides revenue estimates for budget recommendations.

Gross revenue from sales-and-use taxes was $289.49 million in February, up 3.58 percent from February 2006. Despite the gain, the share of sales and use revenue committed to the state’s general fund is $22.1 million below the Economic Forum’s forecast for fiscal 2007.

The general fund finances things such as education and prisons.

The difference between projections of sales-and-use taxes and actual collection of those levies is up from January, when the revenue shortfall was $13.4 million below the estimates made by state forecasters.

The last time sales-and-use-tax collections surpassed forecasts was in September, when the state’s gross sales-and-use-tax revenue of $323 million was $4.3 million, or 0.44 percent, above Economic Forum projections.

Gov. Jim Gibbons didn’t ask Wednesday for additional reductions in spending requests from Nevada agencies, a call he made in March after the Department of Taxation released its January numbers.

Gibbons noted in March that Nevada was on track to bring in $111.8 million less in sales and business taxes between fiscal 2007 and fiscal 2009 than the Economic Forum predicted in November. Gibbons asked officials of state bureaus to pare $111.8 million from their budget requests in response to the discrepancy between projections and real revenue.

Gibbons said in a statement Wednesday that Nevada still has obstacles to paying for the state’s budget demands.

"The modest gain in February 2007 further highlights the challenge we face in meeting the current fiscal year’s revenue needs," Gibbons said. "I am hopeful that Nevada’s economic prosperity will regain its footing after these past several months of slower growth compared to double-digit increases the past two years."

Brent Boynton, a spokesman for Gibbons, added that Nevada’s growth remains strong, but he said Gibbons wouldn’t be making "a lot of assumptions about our revenue projections" until the Economic Forum meets again Tuesday to discuss future forecasts.

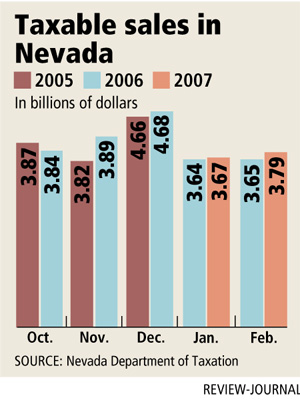

Retailers, car dealers, hotels and other Nevada businesses rang up $3.79 billion in taxable sales in February, a 3.7 percent increase from $3.65 billion in February 2006, the Nevada Department of Taxation said.

Taxable sales in Clark County rose from $2.74 billion to $2.81 billion, a 2.8 percent increase. Taxable sales in Washoe County jumped 4.9 percent, from $528.3 million to $554.4 million.

Taxable sales fell in four of Nevada’s 17 counties, including Carson City, Douglas, Esmeralda and Lyon counties.

Though taxable sales are increasing, the single-digit growth rate of recent months lags the double-digit gains of a year ago. Taxable sales rose 12.9 percent from February 2005 to February 2006, the Department of Taxation said.

Local economists have attributed the slower sales to a downturn in residential construction and less consumer spending, as homeowners with dwindling home equity retreat from fresh outlays on cars, vacations and other big-ticket items.

The Department of Taxation also reported that the state collected $17 million in excise taxes on products such as cigarettes, alcohol and live entertainment in February, up 20.68 percent when compared with February 2006.

Department of Taxation officials didn’t return a phone call by Wednesday afternoon seeking comment on the change in revenue, but February brought key events to Nevada, including the NBA’s All-Star Weekend and the Men’s Apparel Guild in California convention. The month also contained Chinese New Year, a holiday that often results in more spending in hotel-casinos.

Cigarette taxes in the first eight months of fiscal 2007, which began July 1, were $1.9 million, or 1.69 percent, below projections from the Economic Forum. Liquor taxes bested forum projections by $1.5 million, or 3.83 percent.

The tax on live entertainment brought in $1.29 million in February. Revenue from the live-entertainment tax is 6.94 percent above forecasts for fiscal 2007, the department said.