LV Sands, Wynn survive market slide

Last week’s two-day downturn by the stock markets didn’t leave the gambling sector untouched.

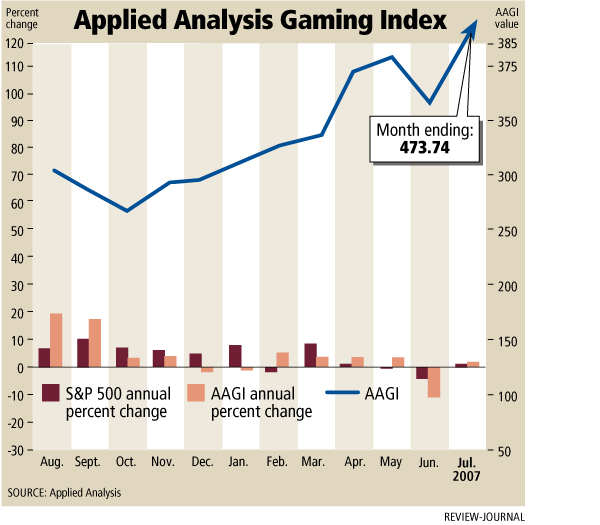

The average daily share prices of six of the nine casino operators and slot makers tracked for an index by Las Vegas-based Applied Analysis fell when comparing their values in July with those in June.

Two companies, Las Vegas Sands Corp. and Wynn Resorts Ltd., however, showed slight increases during the month, mostly due to speculation surrounding their Asian gaming holdings.

One stock market analyst speculated that Japan might legalize gaming, which fueled some of the interest around Las Vegas Sands and Wynn Resorts.

"No such legalization was approved," said Brian Gordon, a partner in Applied Analysis. "Additional speculation and interest in the Chinese gaming market may have investors looking forward to the upcoming earnings season."

Las Vegas Sands and Wynn Resorts are similar companies. Both operate one Strip casino and are building second resorts; Sands expects to open the $1.6 billion Palazzo later this year, while Wynn’s $2.1 billion Encore is scheduled to open in 2008.

Both companies operate casinos in Macau, although Sands is opening its second resort, the $2.4 billion Venetian Macau, at the end of the month.

Shares of Las Vegas Sands traded on the average at $81.46 during July, a little more than 5 percent higher than June. Shares of Wynn finished July with an average daily price of $96.74, almost 4 percent higher than June.

The Applied Analysis index in July finished slightly higher, showing a nearly nine-point jump, the second consecutive monthly increase.

"The upturn continued despite an unraveling of the broader market that occurred late in the month," Gordon said.

The Dow Jones industrial average fell more than 500 points Thursday and Friday, erasing a lot of gains during the month. MGM Mirage, for example, had a more than a 21 percent increase in its average daily stock price in June because of activity by majority shareholder Kirk Kerkorian, who toyed with buying two of the company’s largest assets. In July, shares of MGM Mirage were virtually unchanged.

In a report to investors Tuesday, Jefferies & Co. gaming analyst Larry Klatzkin said the stock values of gaming and lodging companies have only one direction to go — upward.

Klatzkin said last week’s downturn sent large-cap gaming companies down 3 percent, mid-cap stocks down 11 percent and gaming manufacturers down 8 percent.

CIBC World Markets gaming analyst David Katz said investors will get a clearer picture of how casino operators are doing when second-quarter earnings are revealed by the public companies. Las Vegas Sands, Boyd Gaming and Ameristar Casinos will announce earnings today. MGM Mirage is scheduled for Thursday.

"Investors should approach the casino stocks opportunistically, given their capital plans and high valuations," Katz said. "From a fundamental perspective, we believe the second quarter should reflect generally mixed trends, which could affect the stocks. However, concerns over the merger and acquisition market and updates on the significant capital projects across the sector could have a greater effect, given the tightening credit market."

The only major news coming out of the gaming sector during July were the announcements of capital improvement projects, including a renovation of Luxor by MGM Mirage and a $1 billion expansion of Caesars Palace by Harrah’s Entertainment.

Gordon said a Wall Street analyst upgraded his rating of MGM Mirage shares last week, which helped offset losses from the downturn.

"Companies subject to pending buyouts (Harrah’s and Station Casinos) experienced little to no impact as prices creep toward their ultimate buyout price tags," Gordon said.

Bally Technologies was the only other gaming company charted in the index to show a monthly daily price per share increase, climbing 3.4 percent over June.

Katz thought the share of equipment manufacturers, led by Reno-based International Game Technology, were holding their own.

"We maintain our positive view on the traditional slot providers and expect to see signs of improving market trends in their earnings announcements," Katz said.