Las Vegas office market still recovering from recession

If you want to track the wild swings of Las Vegas’ office market, just look at Red Rock Business Center.

The two-building office complex in the southwest valley got started during the mid-2000s bubble. But after the marked crashed, the mothballed project was seized through foreclosure, and the developer filed for bankruptcy.

It was one of many zombie projects blighting Southern Nevada during the recession. But investors bought it, finished it and sold it, and by last December, when another landlord picked it up for $17 million, the suburban complex was around 90 percent occupied.

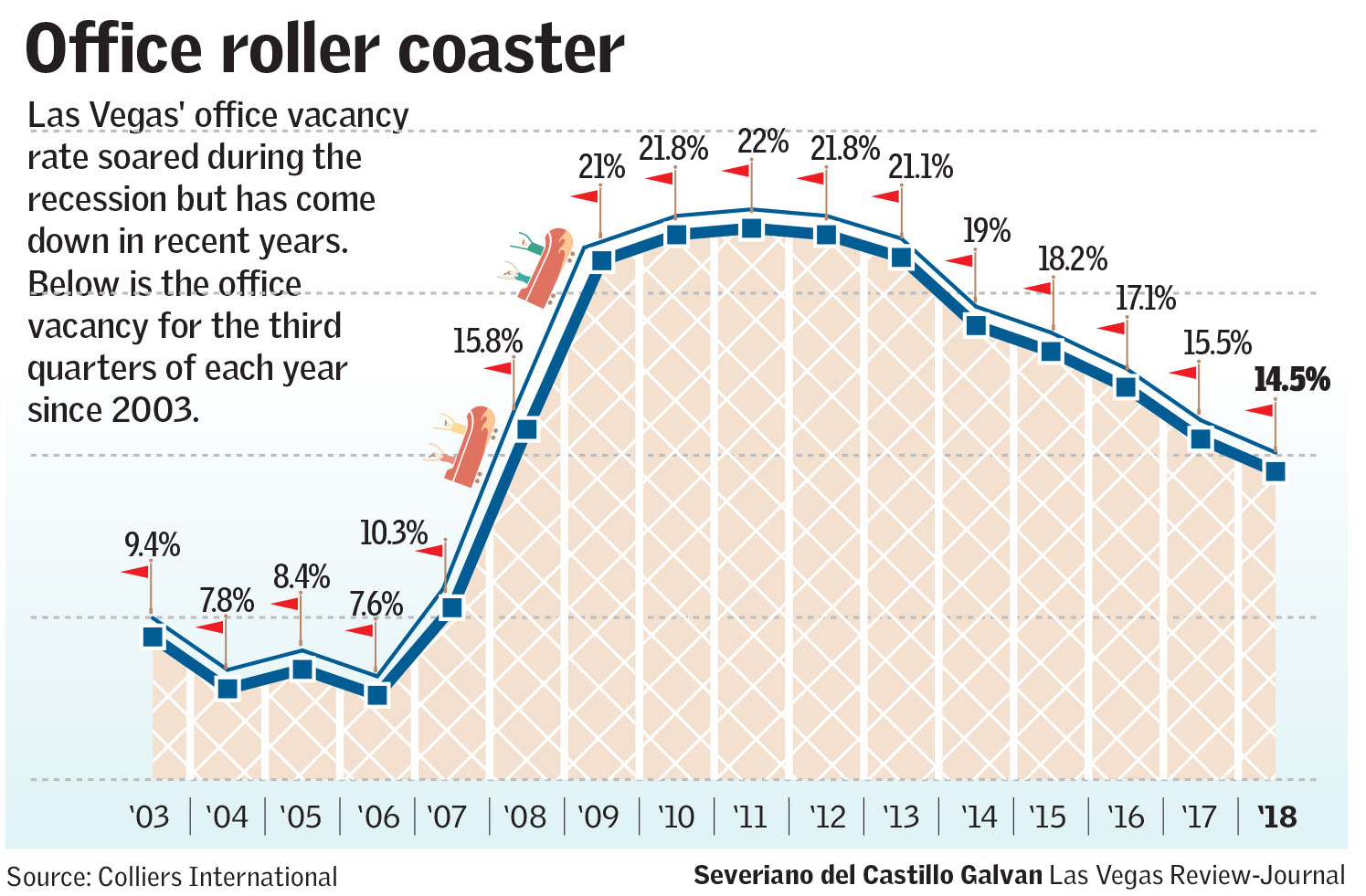

Compared with other types of commercial real estate in town, Las Vegas’ office market has been slowest to recover from the recession after rapid overbuilding during the bubble years and a reliance on tenants whose industry, real estate, was all but wiped out.

The office market still has weak spots but overall is on stronger footing than it used to be. Vacancy rates have shrunk amid a rebounding job market, and investors have loaded up on buildings.

Brokerage firm Sun Commercial Real Estate is a tenant in Red Rock Business Center and has sold the complex three times, Sun owner Cathy Jones said. She and Roy Fritz, senior vice president of Sun’s investment services group, sat down with the Las Vegas Review-Journal to discuss the office market.

The interview was edited for length and clarity.

Las Vegas saw the most office building sales in years in 2017. What accounted for the burst of deals?

JONES: Investors became far more comfortable with Las Vegas. The Raiders are coming to town, and there has been a good diversity of new businesses and expansion of existing businesses. For the longest time, buyers who want stabilized buildings were only focused on major markets, and they looked at Vegas as a tertiary market that had too much risk because we had a total reliance on gaming.

Were they waiting for the vacancy rate, unemployment levels or other economic gauges to hit certain levels before they could say, OK, Vegas finally looks like it’s on its feet?

JONES: The vacancy rate definitely helped. Our recovery, which I think has been steady, also caused people to feel more confident because there wasn’t this craziness again.

FRITZ: Another big piece is investors are comparing Las Vegas to Denver, Phoenix, Dallas or some of the noncoastal California markets, and every single one of those markets are past their pre-recession peaks in terms of rental rates. If you come to Las Vegas, that’s not the case. In very specific cases we have crossed over, but the market as a whole, we have not.

Some office submarkets in Las Vegas are still doing badly, and some are doing pretty well. Why do you think there’s such a big disparity between, say, Class A space in the southwest and anything on the east side?

JONES: I would say it’s the employee base. Businesses are moving closer to where their employees are and specifically where their executives are based. There has a very significant trend toward the suburbs.

Office construction has picked up, especially for corporate headquarters in the southwest valley, but speculative development still seems slow for the most part. Why do you think that is?

JONES: We’ve talked to a lot of developers, and they’re saying they can’t get the economics to work. The rents have not gotten to the point where they can justify the cost of the construction.

FRITZ: It’s a function of land costs. You’ve got sellers who have owned land through the bubble, they got some crazy offers for condo towers back then, and they say they’d sell it for that price or somewhere close to that. But it’s going to be 10, 20, 30 years until you get there. The outside perception is we’re in the middle of the desert so we should have land everywhere. The reality is, when you look at the restrictions from the Bureau of Land Management, the restrictions from zoning, good pieces of land are rare to come by, and it’s even rarer to find a price that will work.

JONES: When I talk to leasing brokers and developers, one comment I get all the time is you can’t get preleasing done in Vegas for office projects. I don’t know why that is. For whatever reason, it’s difficult here.

Why do you think that’s the case?

JONES: Confidence in the longevity of our market, the stability of our market maybe. I don’t know what else it would be.

I’ve heard from many people that office overdevelopment was off the charts during the mid-2000s. Looking back, what did you think when you saw all those projects popping up?

JONES: It was just amazing to me that certain projects were getting approved. It was insane. The financing should have been the biggest red flag for everyone: Lenders were basically giving money away.

FRITZ: There was a point where the fundamentals absolutely flipped, and a vacant building was selling for more than an occupied building. The reason was: The building that’s occupied is locked into its rents. People said, ‘Look at the vacant building. When our rents go up 30 percent next year, it’s going to be worth even more.’ And they were selling.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.