Las Vegas-based sports betting funds run by ex-felon eyed by SEC

One investor, a retired engineer from Texas, thought of traveling more with his grandchildren as his $50,000 investment in Vegas Basketball Club climbed to more than $700,000 in 15 months.

A New York-based doctor considered cutting his work hours as his $125,000 investment in Einstein Sports Advisory morphed into $900,000 in under two years.

They are among dozens of people across the U.S. who combined have invested more than $1 million in six sports betting funds all run by a Las Vegas resident who claims to have the secret sauce to crushing local books. They also are among a handful of investors who claim they have been unable to collect their winnings or recoup their initial investment from the funds’ manager.

Known to his investors by various names including John Frank, John Marshall and Jonathan West, the 74-year-old sports bettor is actually John F. Thomas III, a felon who served about 10 years for running a Ponzi scheme in the late 1980s, a Review-Journal investigation has discovered. He appears to have been born John F. Rodgers and then changed his name to Thomas in the 1980s.

A person named Thomas J. Becker was jailed with Thomas for selling copy machines that didn’t exist to financial institutions. Nevada secretary of state documents and bank statements show that a Thomas J. Becker is assisting Thomas with the sports betting funds. Now, funds connected to Thomas or Becker or both — Einstein Sports Advisory, Quantum Sports Advisory, Wellington Sports Club, Vegas Basketball Club, Vegas Football Club and Sports Psychometrics — have come under the scrutiny of the U.S. Securities and Exchange Commission.

At least one SEC investigator in its Los Angeles office, Matthew Montgomery, has communicated with investors of Thomas’ group of funds, said David Shapiro, a California-based lawyer for an investor.

Montgomery declined to comment when contacted by the Review-Journal.

Another disgruntled investor on the East Coast, who asked that his name not be used, said he called Montgomery and spoke at length with him regarding Thomas. Montgomery followed up by sending the investor a form regarding procedures for giving testimony to the SEC, the investor said.

Meanwhile, the Nevada attorney general has received at least two complaints about the Einstein fund from investors, but the office declined to say whether it is investigating Thomas and his funds, according to documents seen by the Review-Journal. Monica Moazez, a spokeswoman for the attorney general’s office, declined to provide additional information.

Michael Lawton, a spokesman for the Nevada Gaming Control Board, which oversees sports betting regulation, said it is “familiar with a couple of the funds” but is “not aware they took any investments from Nevada clients. That being said, they were not operating illegally in Nevada.” Lawton declined to say if the agency is investigating.

Thomas did not respond to multiple requests for comment, and Becker could not be reached. Both men are being represented by Crane Pomerantz of Sklar Williams law firm.

“As with every dispute, there are two sides to the story. At the appropriate juncture, my clients look forward to providing their perspective. It would be premature to provide any additional statements right now,” Pomerantz said in a statement to the Review-Journal.

Claims of success

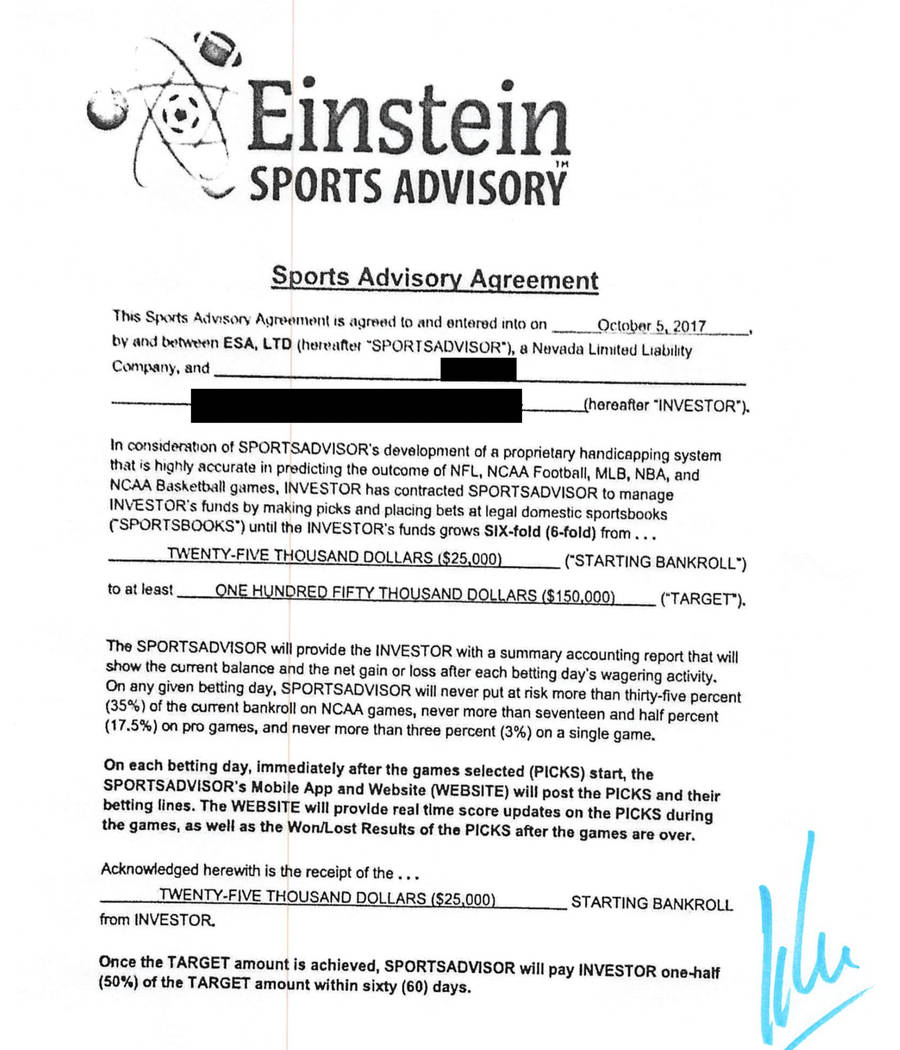

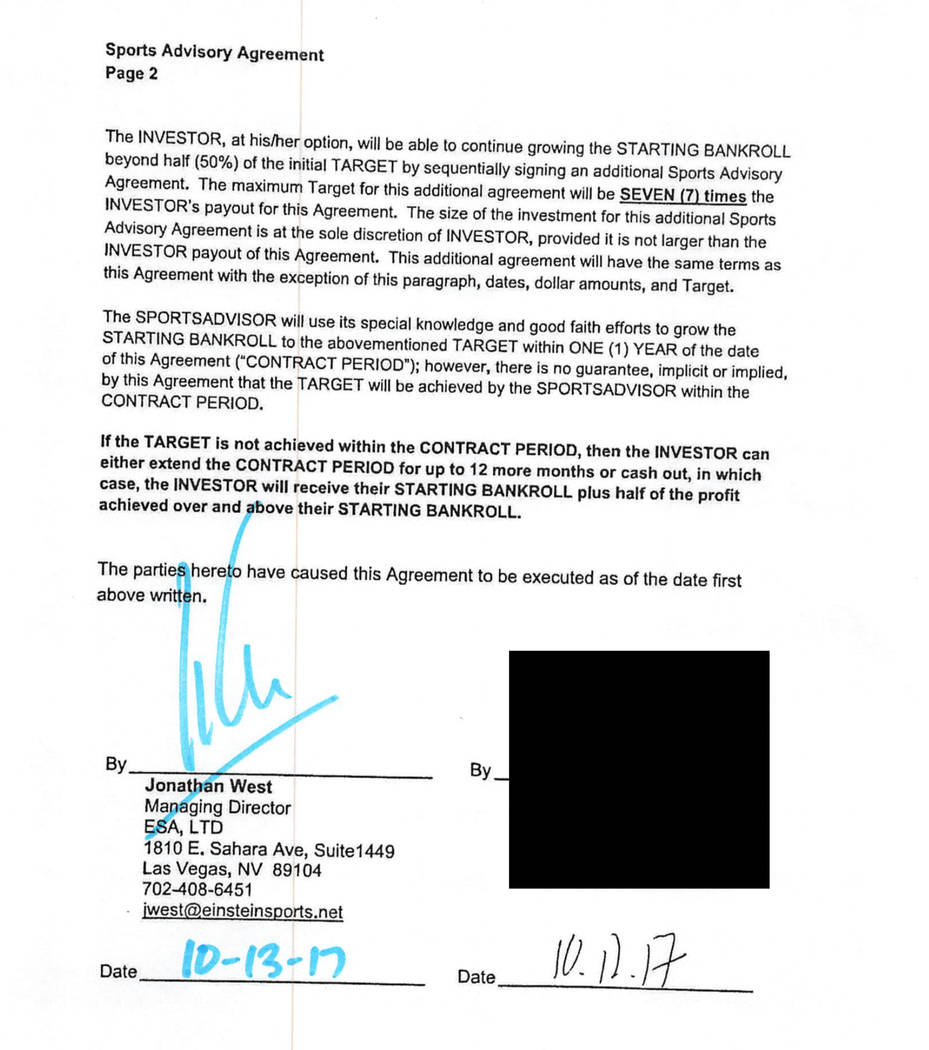

For at least six years, Thomas has been raising tens of thousands of dollars from professionals and retirees in New York, Texas, California, Florida, Chicago and Ohio by convincing them he has a proprietary handicapping system “that is very accurate in predicting the outcome” of games, according to investor contracts provided to the Review-Journal.

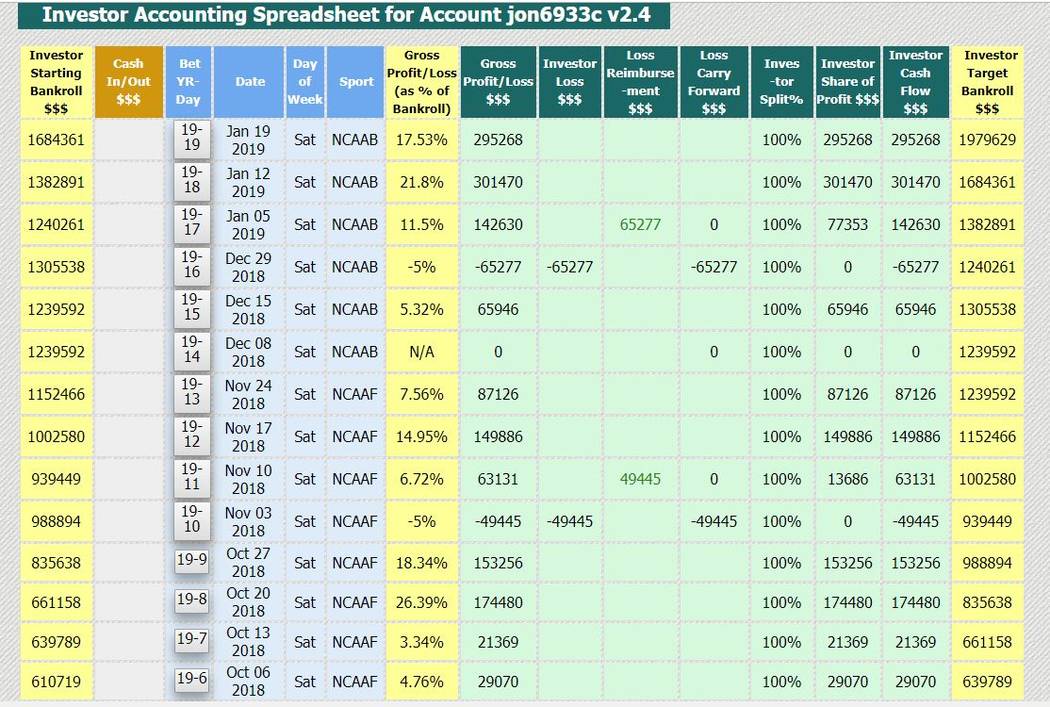

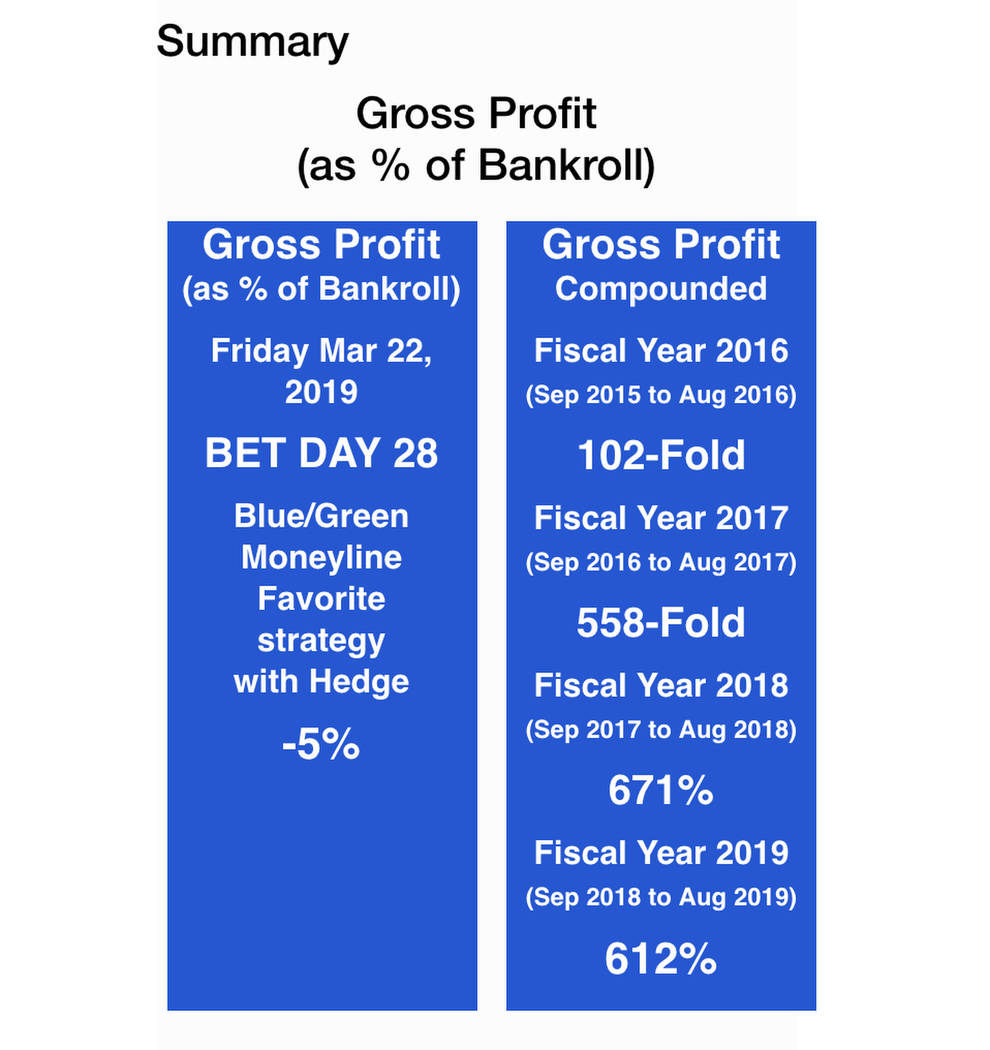

His websites, which require login credentials, say he has consistently won big over the years. His Wellington Sports Club website says he has generated greater than 600 percent compounded gross profit for each of the past two fiscal years.

Thomas advertised that he invested his clients’ money by betting on heavily favored teams using round robin wagers, which are bets consisting of multiple parlays. A parlay is a single wager on two or more teams; parlays only pay if all the single bets win, which makes them among the riskiest wagers.

Nevada casinos’ win percentage on parlays has averaged 28 percent over the past decade compared with about 5 percent for single bets, according to Nevada Gaming Control Board data.

Thomas finds clients with the help of “investment advisers” recruited through ads on Craigslist. Five investment advisers contacted by the Review-Journal were not listed as registered investment advisers with the Financial Industry Regulatory Authority website brokercheck.finra.org.

Now, about 10 investors have told the Review-Journal they have been struggling for months or even years to get their supposed winnings and in many cases their principal as well. The investors are all part of groups of four to 13 that invested with the funds.

The investors spoke on the condition of anonymity because they are embarrassed to have possibly fallen for what they said they think might be a scam. Aside from doctors and engineers, Thomas’ investors include Silicon Valley and financial investment professionals and business owners.

In emails obtained by the Review-Journal, Thomas told several clients that he is so successful at winning — better even than famed stock investor Warren Buffett — that he can’t possibly send so much money through banks without raising money laundering concerns. He also said that banks have shut down his accounts, thus making it difficult for him to send money.

Thomas is now telling his clients — who are clamoring for their winnings — that he will be able to pay them as soon as online betting accounts are available with the passage of a “national sports betting bill,” according to emails he sent to clients and that were obtained by the Review-Journal.

“We grow money a million times faster than Warren Buffett … actually we grow it a quadrillion times faster. Just can’t move it into the banks that fast. Online sports betting solves the bank cash flow problem,” he said in a November email to a disgruntled Florida client. He invested $25,000 with two friends and said he hasn’t received a penny back.

But a national sports betting bill is highly unlikely to pass Congress anytime soon while only six states will probably have mobile betting by the end of the year, said Brian Bussmann, a partner at Global Market Advisors.

In any case, regulation that allows people to move money between online sports betting accounts would take “quite some time — and possibly a change in federal law” before it could become a reality, said Chris Grove, a managing director at Eilers & Krejcik Gaming.

Past complaints

Sports betting funds were prohibited in Nevada before the passage of Senate Bill 443 in 2015, said Tony Cabot, a professor at UNLV and a former gaming attorney.

But Sports Psychometrics and Vegas Football Club were operating before the 2015 bill was passed, according to court records and Nevada secretary of state data.

In 2015, Arizona resident Marc Desabrais sued Thomas and his Vegas Football Club in Nevada District Court for breach of contract, accusing the latter of failing to pay him anything. In a motion to dismiss, Thomas denied the allegations.

Desabrais invested $50,000 in the fund in August 2014, and the sum rose to slightly more than $2 million by April 2015, according to documents in the court file.

But Desabrais told the court that he hadn’t received any money as of June 2016 and said Thomas stopped communicating with him.

Thomas told the court that the employee placing the bets at Las Vegas casinos drowned during a short trip to Nicaragua in May 2015 and winning tickets worth millions of dollars were lost.

The case was settled out of court. Desabrais declined to comment when contacted by the Review-Journal.

In 2017, Oregon issued a cease-and-desist order against Wellington Sports Club and Becker, whose name is on the Nevada secretary of state registration documents, for promoting the fund in the state. Oregon said that the fund was not a registered security and Becker was not a registered salesman. It fined him $35,000.

Oregon sent copies of its findings to the Nevada Gaming Control Board in May 2018 and to the Nevada secretary of state’s office in June, according to Brad Hilliard, a spokesman for the Oregon Division of Financial Regulation.

In August, Minnesota authorities contacted the Nevada secretary of state’s office seeking information about Quantum Sports Advisory after an anonymous complaint about the fund, according to Ross Corson, a spokesman for the Minnesota Department of Commerce. Minnesota could not find proof the investment was being sold to state residents. The Review-Journal was contacted by an investor from Minnesota in April who claimed to be struggling to get back more than $100,000 in principal.

It is unclear when Nevada regulators first learned of Thomas and his funds. The Nevada secretary of state’s offcie declined to comment.

Keeping the faith

At least two investors in Vegas Basketball Club remain hopeful of getting their money from Thomas. In an email exchange with another investor — the retired engineer from Texas — one said Thomas reportedly “was starting a new baseball secured betting program in April called Progressive Betting.”

“He is very confident that he will be making millions by May and will be able to pay us all off entirely around that time,” the investor wrote. “I told him that most of us still have faith in him that he would pay us but we can’t control everyone.”

Contact Todd Prince at 702-383-0386 or tprince@reviewjournal.com. Follow @toddprincetv on Twitter.

Regulators

Sports betting funds were prohibited in Nevada prior to the passage of Senate Bill 443 in 2015, said Tony Cabot, a professor at UNLV and a former gaming attorney.

Under the new law, sportsbooks must approve any sports wagering funds, including its owners and investors. The Securities and Exchange Commission also requires such funds to register with it.

Only CG Technology approved sports betting funds under the new law, but it temporarily stopped accepting bets from funds at the end of last year. CG Technology declined to say whether it approved John Thomas and his funds.

Investigations of such funds could be the domain of the FBI or Nevada Gaming Control Board, depending on what laws are alleged to have been broken, Cabot said. The SEC and secretary of state could also get involved if the funds violate securities laws.