Jobless Nevadans fearful as extra $600 benefit ends

Hope is dissolving into fear for thousands of unemployed Nevadans as Saturday marks the end of a federal provision that paid an additional $600 a week in unemployment insurance benefits.

Las Vegas resident David Cherkis said he is “absolutely” concerned about how he will be able to pay bills and buy food.

“In my case, all I was doing was getting basics with it,” he said. “It’s (now) a question of where’s the next dollar going to come from (and) where the next TV dinner is going to come from.”

The program, titled Federal Pandemic Unemployment Compensation, was one of three major unemployment insurance provisions passed in March under the $2 trillion federal coronavirus economic relief package. It automatically added $600 to an eligible filer’s weekly traditional state unemployment benefits from the week ending April 4 through the week that ends Saturday.

A contentious debate over how to continue the program is still taking place in the halls of Congress while the program — considered the last source of economic help — ends.

With U.S. coronavirus infections surpassing 4 million and nearly 30 million Americans out of work, the end of FPUC has some economists worrying consumer spending will drop, causing a second national economic blow.

Question mark

Cherkis, a self-employed photographer, said he’s unsure about the future since his primary source of work, photographing conventions and meetings, is on hold until at least next year.

“This is what I’ve done all my life,” Cherkis said. “Speaking to other photographers, it’s going to be years until we get back on track.”

Employment Security Division Administrator Kimberly Gaa said the Department of Employment, Training and Rehabilitation couldn’t offer updates to claimants listening in to its weekly media briefing Friday.

“DETR has been in communication with the Department of Labor, the governor’s office and federal delegates, and we currently have no updated information on any extensions at this time,” she said.

A deal was expected to close by the end of the month, but on Friday, Senate Majority Leader Mitch McConnell said it could be another several weeks.

The delay is over concerns by Republican lawmakers to reduce the $600 weekly benefit amount while Democrats favor extending the extra $600 payments through January.

While some GOP lawmakers want to reduce the FPUC benefit to $200, administration officials floated a plan to reduce the benefit boost to as little as $100.

Dollars and cents

Alix Gould-Werth, director of family economic security policy at the Washington Center for Equitable Growth, said unemployment benefits are designed to push filers back to work by not replacing their full wage.

But with massive job losses spurred by the spread of the coronavirus, Congress implemented the FPUC program.

“It’s designed to give the average worker a full wage replacement, but Congress picked a dollar amount rather than mandating each worker got to 100 percent,” Gould-Werth said.

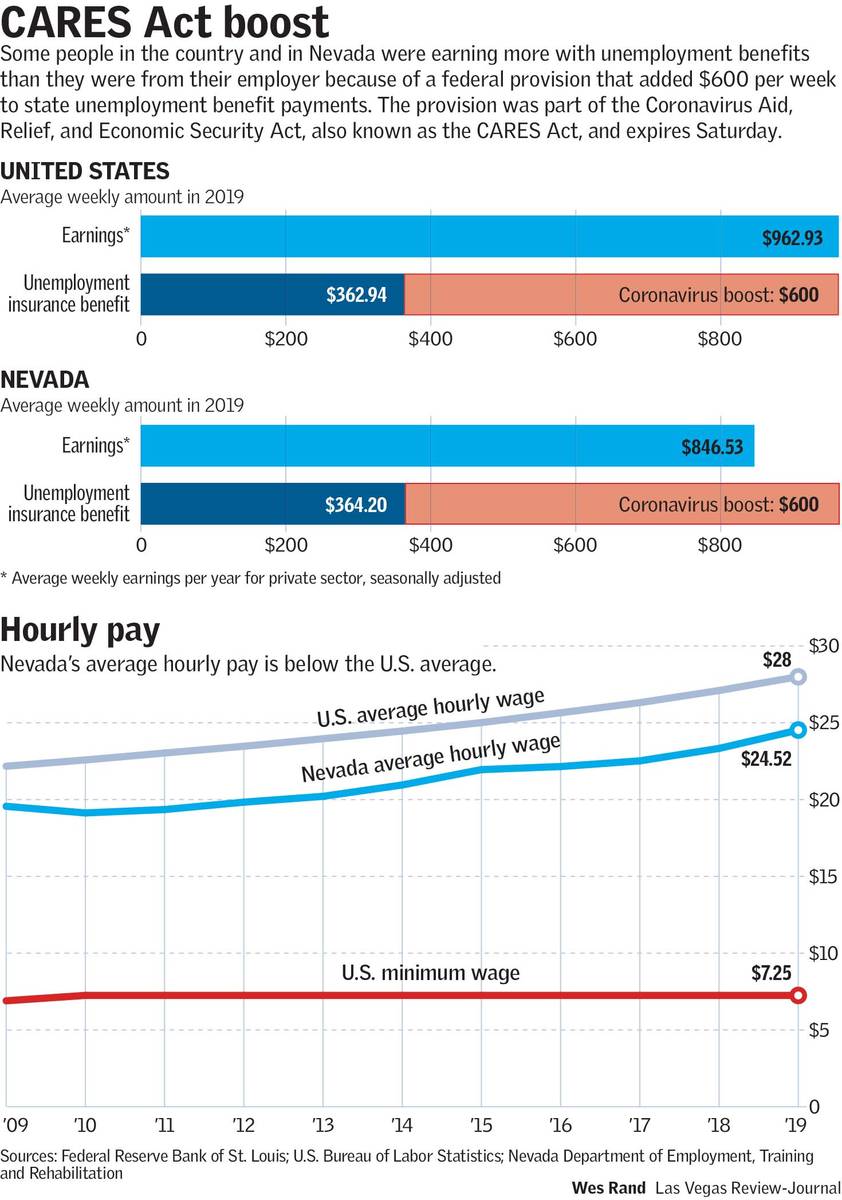

Nationally, the $600 weekly boost means the average person receiving unemployment benefits is bringing in $962.94 per week, a penny more than the average private-sector worker brings in per week, based on 2019 data from the U.S. Department of Labor.

In Nevada, state data shows the boost comes out to $964.20 per week, $117.67 more than the average weekly wage a private-sector employee earned in 2019.

Policymakers are debating whether people receiving more money from jobless benefits than what they earned at their old jobs would be resistant or hesitant to head back to work.

But with states, including Nevada, walking back their business reopening plans, experts say jobs will be scarce for the near future, and many families seem to agree.

Nearly half of Americans whose families experienced a layoff during the coronavirus pandemic now believe those jobs are lost forever, according to the latest poll of 1,057 adults conducted July 16-20 by The Associated Press-NORC Center for Public Affairs Research.

In April, 78 percent of those in households with a job loss thought they would be temporary. Now, 47 percent think that lost job is definitely or probably not coming back.

The poll also showed the pandemic’s disparate impact. About 6 in 10 nonwhite Americans say they’ve lost a source of household income, compared with about half of white Americans. Forty-six percent of those with college degrees say they have lost some form of household income, compared with 56 percent of those without.

Padded paycheck

Unemployment aid accounted for 6 percent of all U.S. income in May, a greater share than even Social Security. Economists say it’s one reason why retail spending rebounded as quickly as it did in May and June. If the full $600 were extended, it would boost consumer spending enough to generate roughly 1 million jobs by the end of this year, Oxford Economics estimates.

Indivar Dutta-Gupta, co-executive director at Georgetown Center for Poverty and Inequality, said it’s estimated the country would need roughly 35 million jobs to economically recover from the pandemic.

It’s why Dutta-Gupta said there’s no question why Congress should implement sustained support.

“The idea that we shouldn’t be doing more is wild,” he said.

Consider the plight of a food server at a restaurant in The Cosmopolitan of Las Vegas. She began working there in December but was laid off in March, two days before her apartment lease was up.

She opted to move back in with her parents, which turned out to be a good source of moral support because her father, a casino worker, weathered the economic downturn of 2008.

Moving in with her parents enabled her to survive without dipping into her savings.

She was able to collect $180 a week for unemployment, plus an additional $600 provided by the CARES Act.

When Gov. Steve Sisolak enabled casino properties to reopen on June 4, the hostess faced a new dilemma.

She was brought back on an on-call basis, but because unemployment benefits are based on an employee receiving less than the $180 a week, she would make more not working than working.

“For me, so far, so good. But I am worried,” she said. “The point of being on call is if someone gets sick, I have to be there to replace them. If I replace them for three days and make $200, that’s more than the limit, and $200 doesn’t pay my bills.”

She and some of her cohorts share news about what they’ve heard about a renewal of the law, but they know there are no assurances.

“You think in your heart, these people want to do the right thing and they want people to have extra income, especially with something like this going on,” she said. “But then, you also know maybe they don’t care as much as we want them to care about it. The people deciding it ultimately aren’t affected by it personally.”

Contact Subrina Hudson at shudson@reviewjournal.com or 702-383-0340. Follow @SubrinaH on Twitter. Review-Journal staff writer Richard N. Velotta and The Associated Press contributed to this report.