Some homeowners sue, seek senator’s aid to get mortgages altered

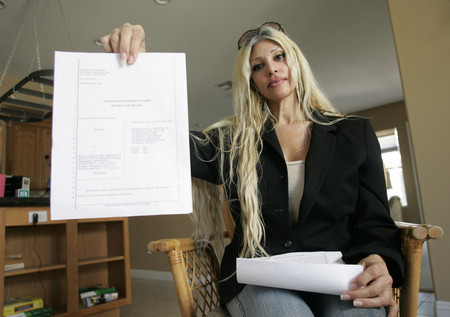

Getting nowhere with the bank on modifying her home mortgage, Denise Fuleihan resorted to a tried-and-true American strategy: Sue.

The Las Vegas real estate broker filed a lawsuit in Clark County District Court against Wells Fargo and Fremont Investment and Loan for violations of the Real Estate Settlement and Procedures Act and the Truth in Lending Act.

The lawsuit accuses Wells Fargo of engaging in predatory lending practices, knowing there existed an “unreasonable probability” that Fuleihan could not perform loan obligations for residential property at 209 Royal Aberdeen Way in Las Vegas.

Fuleihan, delinquent on mortgage payments and facing foreclosure, wants the government to step in and mandate a reduction in principal balance for subprime borrowers with negative home-equity value.

“Why don’t they bring it down? They bring the interest down, but they won’t touch the principal,” the owner of Royal Pacific Properties in Las Vegas said. “It should be 50-50. They should stabilize the interest rate and negotiate the principal to market value. Principal recovery is going to take five years or more. The market is flooded with foreclosures and it’s driving the markets down, which is going to (make it) impossible for people to ever recoup any equity at all.”

Natalie Brown, spokeswoman for Wells Fargo in Reno, said company attorneys have filed a motion to dismiss the case.

“We have asked the court to dismiss Ms. Fuleihan’s lawsuit, as we believe it to be completely without merit,” Brown said. “The suit, which raises issues about the origination of her loan, was filed well past the deadline she was legally allowed to make those claims. Furthermore, as the loan servicer, Wells Fargo had no role in the origination of her loan.”

A statement from Des Moines, Iowa-based Wells Fargo Home Mortgage said the company has worked out 62,989 loan modifications under President Barack Obama’s $75 billion Home Affordable Mortgage Program, in addition to 292,005 modifications using its own programs. It has also refinanced about 987,000 mortgage loans, assisting more than 1.3 million households this year with mortgage payment relief.

Sen. Harry Reid, D-Nev., said his office received more than 650 calls from homeowners complaining about lenders’ unwillingness to work with them. They gripe about the difficulty of reaching lenders.

“One of the biggest complaints I get from people fighting to stay in their homes is that they can’t get anyone on the phone to talk to them,” Reid said from Washington. “They won’t return phone calls. People just want a little attention. They want to know where they stand. These people are just looking to get someone on the phone who can help navigate these troubled waters.”

Reid said he knew he wouldn’t be able to help everyone, but started taking casework to do what he could. He sent letters to lenders urging them to be more responsive and received about 180 responses. The senator’s efforts resulted in 19 Nevada homeowners getting a loan modification or workout plan from the bank; another 40 or so have been assigned to a workout negotiator.

“It may not sound like much, but for those 59 people, they’re pretty happy,” Reid said.

The U.S. Treasury Department reported a milestone 500,000th loan modification in October under the Home Affordable Modification Program.

It took the senator’s action to get a loan modification for Gloria Lucas of Las Vegas. She had been calling offices of Wells Fargo and Wachovia almost weekly since March seeking help in lowering her $1,322 mortgage payment.

After seeing an announcement on television, Lucas called Reid’s Las Vegas office. Within three weeks she was receiving phone calls and documents from the bank. Lucas submitted a hardship letter explaining that she and her husband, Filipino, are living on a small retirement pension and raising two teenage grandchildren.

Their payment was reduced to less than $800 a month with 18 percent, or a little less than $30,000, forgiven on the mortgage balance.

“I wrote him (Reid) a thank-you letter,” Lucas said. “I first thanked God because I’ve been praying and praying that we wouldn’t lose our home. It was really hard to keep up with the payment.”

Reid said his goal is to ensure struggling homeowners have access to as much information as possible to prevent foreclosure whenever possible.

Government intervention to date has been extremely helpful in preventing an even more dramatic decline in the housing market, California-based real estate consultant John Burns said.

How far would home sales and prices have fallen without historically low mortgage rates, support for Freddie Mac, Fannie Mae and the Federal Housing Administration, and an $8,000 tax credit? Perhaps further.

“We have been projecting a W-shaped recovery for some time and we are becoming even more convinced that we are right,” Burns said. “The shape of the second leg down is almost completely dependent on the level of government intervention that will take place.”

Although some analysts believe that housing may be reaching its bottom, they’re not accounting for the massive supply of homes that are already in foreclosure and will depress home prices further when they’re sold, Burns said.

For a number of reasons, banks have not been aggressively taking title to homes and selling them, which has resulted in very few distressed sales compared with the level of distress in the market. This delay in bank-owned home sales, along with low mortgage rates and the tax credit, has helped to stabilize the housing market temporarily, Burns said.

James Lockhart, former director of the Federal Housing Finance Authority, recently said that mortgage giants Fannie Mae and Freddie Mac have more than 100,000 real estate-owned properties on their books and that number is rising.

Fuleihan, plaintiff against Wells Fargo in her Aug. 26 lawsuit, said banks are getting tougher and tougher to deal with every day.

“Banks are not reducing principal balances on these mortgages whatsoever,” she said. “They are not doing this willingly or modifying interest rates as easily, especially if they don’t fall under the Obama plan. Banks are also suing borrowers after they make a full recovery financially for the negative balance of these mortgages. Then they came up with mediation. This is also not working at all. Basically the banks go through mediation and are asking for the borrowers to surrender their keys.”

In her lawsuit, Fuleihan claims the defendants are not the holders of the original promissory note and therefore lack the right to demand payment on it. They failed to provide proof that they have rights under the note and did not properly sign the note or related documents, thereby rendering them void.

Mark Connot, an attorney with law firm Hutchison & Steffen, said the “produce the note” claim may delay things for a while, but it won’t result in a victory for the homeowner.

Specific facts might support Real Estate Settlement and Procedures Act and Truth in Lending Act violations, particularly on stated income loans. However, the homeowners are not usually blameless either, Connot said, as they knew the incomes the mortgage brokers put on the loan applications were fictitious.

“In my opinion, the banks are far from blameless as their greed made them ignore proper lending practices and on occasion they bent or broke the rules and regulations,” Connot said. “But to determine who should bear the blame and the ultimate legal responsibility for these claims is a tough call. Legally, I think the homeowners will have a tough battle. Whether banks will end up bearing any legal responsibility remains to be seen.”

Fuleihan said she’s now representing herself after her attorney decided not to pursue litigation because judges are siding with the banks and dismissing these cases “right and left.”

Jim Stout, who filed the case on Fuleihan’s behalf, said that’s generally true. He said he’s filed about 20 of these type suits in Clark County, which are among thousands filed nationally.

“No verdict I’ve seen has come out in favor of the homeowner to any extent in the United States,” Stout said. “That’s what judges are looking for — a mandate from Washington or a headliner verdict from a higher court in California or New York.”

Stout said a “cram-down” mortgage reduction mandate was removed from Obama’s foreclosure prevention plan. He said he’s also read reports of 60 percent default risk on trial loan modifications. The government program requires a trial period during which customers must make three payments at the new reduced rate and submit documents necessary to finalize the modification.

Fuleihan wants to know why the government hasn’t required banks to cram down mortgage balances. The government and Federal Reserve bailed out the banks and not the people, she said.

“She’s 100 percent right,” Reid acknowledged. “We tried on different occasions on housing legislation to have a cram-down, but couldn’t get it done and the reason is because, oh, did the banks ever fight this and fight this. They don’t want to be told what to do.”

Meanwhile, the number of foreclosures will surely keep growing, said Mark Baker, mortgage broker for Meridias Capital, a Las Vegas company originating residential loans and specializing in refinancing.

“As far as loan (modifications) and the banks keeping people in their homes, I am not seeing that at all,” Baker said. “I have talked to so many people lately that are walking (from their mortgage) because of loan mods not working and attorneys that were modifying their loans not being able to perform.”

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.