Price-slide slowdown signals housing bottom is near

Las Vegas home prices, in free fall for years, showed signs of hitting bottom in the first half of 2011, the Las Vegas-based housing research firm SalesTraq reported Tuesday.

The median price of a resale home in Las Vegas dropped to $106,000 in June, down 13.8 percent from a year ago, but down only $200 from May and $900 from April.

Existing-home sales skyrocketed to 5,564 in June, the most since August 2005, though 45 percent of those sales were of real estate-owned, or bank-owned homes, SalesTraq reported.

“Foreclosures have absolutely defined the Las Vegas housing market,” SalesTraq President Larry Murphy said Tuesday.

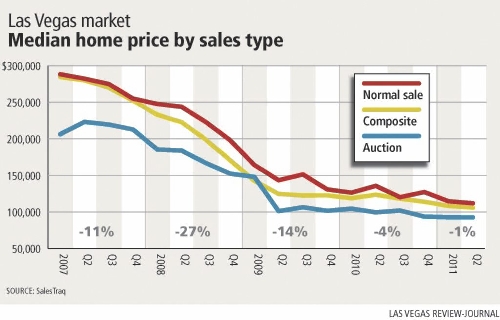

Home prices have fallen more than 60 percent from their peak in 2006 — the steepest drop of 27 percent coming in 2008 alone — and are now at their lowest level since 1990. But the rate of decline slowed to 14 percent in 2009, 4 percent in 2010 and 1 percent so far this year, SalesTraq found.

Murphy also notes that the gap between the median price of a home in a conventional sale and one sold through a foreclosure auction has narrowed.

“The overall effect has been that we’re all in the toilet together,” Murphy said.

The new-home market is improving, however. Sales of new homes picked up to 362 in June, compared with 291 in May, though it pales in comparison to June 2010, when 972 new homes closed escrow to beat the deadline for the federal tax credit, which was later extended by Congress.

Median new-home prices increased 7.4 percent to $200,826 in June, Home Builders Research reported.

The sheer volume of the foreclosure mess can’t be fixed in what would be considered a normal period of time, Home Builders Research President Dennis Smith said Tuesday.

Banks have improved the short-sale process in recent years, reducing the time it takes to approve a sale for less than the principal mortgage balance. That helps clear the inventory of foreclosed homes that have been a drag on the market.

A new law in Nevada requires banks to respond to a short-sale offer in 90 days and to state the exact amount of any deficiency judgment. Also, second-lien holders have only six months to file for a deficiency judgment instead of six years.

SalesTraq reported 904 short sales in June at a median price of $115,000; 671 auction sales at a median of $92,500; 2,503 real estate-owned sales at a median of $103,000; and 1,486 nondistressed sales at a median of $111,900.

Murphy said the housing market won’t recover as long as there’s a surplus inventory of foreclosure homes coming down the pipeline, and he doesn’t see that changing for another two to three years.

“When you ask the question of where’s the bottom, you’ve got to say we’re getting close to it, but the fact is we’ve had five consecutive years of declining home values and we might have six,” Murphy said. “But I’ve got to think we’re going to bottom out and come back up to normal.”

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.