New homes back in play for Las Vegas buyers

While foreclosure sales continue to drag the median existing home price down in Las Vegas, the new home market is starting to show progress, housing analyst Dennis Smith of Home Builders Research said Wednesday.

The median resale price dropped $3,000 in August to $122,000 and is down 39 percent from a year ago, Home Builders Research reported.

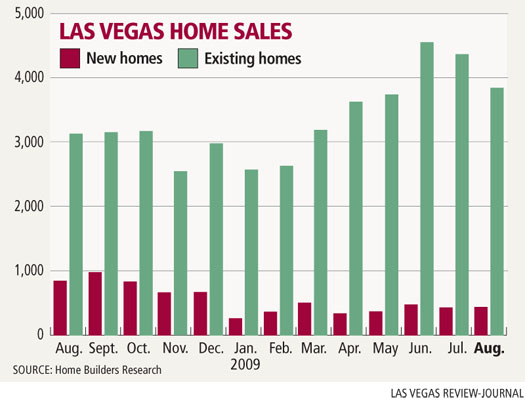

Sales of existing homes declined to 3,833 closings in August from 4,371 in July. Resales for the year are up 52 percent at 28,468 units.

Smith said he’s hearing that Realtors still have interested buyers and investors looking at real estate-owned, or bank-owned properties. However, good homes are difficult to find and they continue to have multiple offers written on them, he said.

That’s driving some buyers to look at new homes, many of which offer floor plans under $100 a square foot, competitive with foreclosures.

“After looking at foreclosures, Realtors will take their clients to view the possibilities in the new home segment,” Smith said. “It is usually a much easier escrow, less stressful than going through foreclosed houses and, in certain instances, they get a higher commission.”

Home Builders Research reported 426 new-home sales in August, compared with 407 sales in the previous month. New-home sales have decreased 57 percent to 3,167 for the year.

The median price of a new home rose for the third straight month to $210,00. It’s up $3,451, or 1.7 percent, from July, and down $46,000, or 18 percent, from a year ago.

Smith said the new home segment is moving forward, albeit very slowly.

“Forward, meaning stabilizing,” he said. “To most in the industry, or those who used to be in it, it couldn’t be much worse. Our read from home builders is they feel stuck in a vacuum and can’t find a way out.”

Homebuilders have cut overhead more than anyone thought was possible, Smith said. He knows people who were let go after 20 years or more working for homebuilders, contractors, title companies and mortgage lenders.

Larry Murphy, president of Las Vegas-based SalesTraq, said the summer sales rush is coming to an end, and he wouldn’t be surprised to see prices come down another $2,500 to $3,000.

“We seem to have a steady supply of repos coming on the market every month,” Murphy said. “I said earlier this year we could hit $100,000 (median price) and we’re not that far away.”

The housing market in California is also stabilizing, according to a September survey of 269 home building executives by John Burns Real Estate Consulting. That’s usually a good sign for Nevada.

“For the first time since we began our home builder executive survey 15 months ago, more California builders reported raising prices than those who reported prices were flat or down,” said Jody Kahn, vice president of Irvine, Calif.-based John Burns Real Estate Consulting.

The survey’s commentary underscores the positive effect of federal intervention, though most builders also expressed concern about their prospects for the next six months as the Nov. 30 expiration of the federal tax credit approaches.

Other challenges cited include competition from foreclosures, appraisal problems, lack of job creation and a void in financing for future projects.

Robyn Yates, broker and owner of Windermere Prestige Properties in Henderson, said Fannie Mae loans are getting more difficult for approval. Tougher underwriting guidelines are geared to prevent mortgage fraud, she said.

“It’s just more of the same restrictions and making sure people really qualify,” Yates said. “It’s one more indication that it’s going to be challenging for buyers to get a loan.”

The biggest change for Las Vegas homebuyers is verification and documentation of tip income, she said. Also, stock options can no longer be counted for reserves and relocating families can’t use the “trailing” spouse’s projected income.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.