Nevadans facing eviction in April told to ‘take action’

Help is still available for Nevadans facing eviction for nonpayment of rent, according to Clark County officials.

County Commissioners Tick Segerblom and William McCurdy III as well as Las Vegas City Councilwoman Olivia Diaz hosted a virtual town hall Wednesday evening to offer residents advice on navigating the eviction process and deliver an update on the CARES Housing Assistance Program.

The event took place exactly two weeks before the state and federal eviction moratorium is expected to end. Starting April 1, landlords will be able to move forward with the eviction process against tenants who have been unable to pay rent because of the coronavirus pandemic.

‘Take control of the situation’

Jim Berchtold, attorney at Legal Aid of Southern Nevada, emphasized several times during the town hall that tenants must take action.

“Evictions are scary, but there is something you can do about them,” Berchtold said. “The best thing you can do is to take action. You have to try and take control of the situation.”

He said a renter who receives an eviction notice must file a response either in person at the courthouse or online. If a tenant fails to respond, then an eviction will be granted automatically. Berchtold added that about 75 percent of eviction cases are granted because a tenant refuses to respond to a notice.

Tenants whose evictions have been placed on hold because of the moratorium should look up their case to check the status because in some courts those orders could be enforced on April 1, “meaning the constable will come out and lock you out,” Berchtold said.

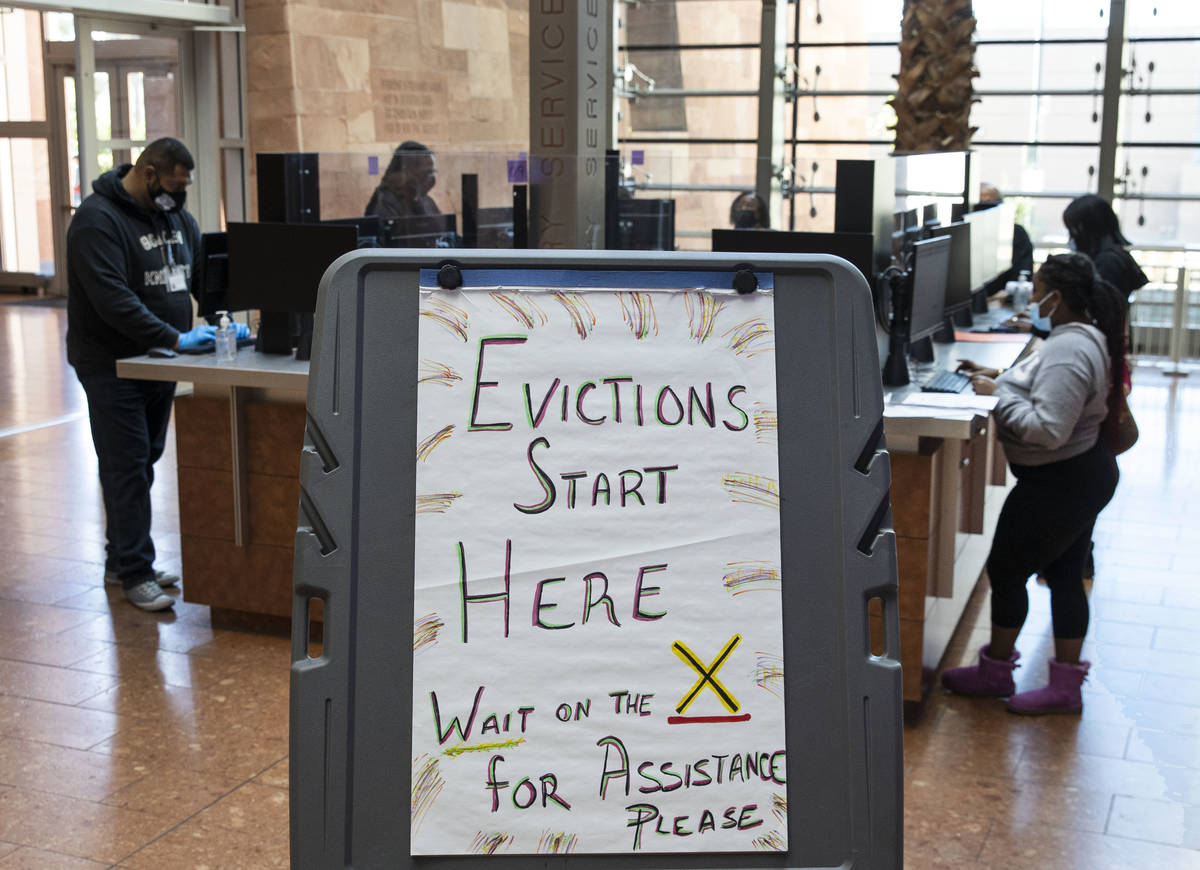

He said Nevadans navigating the eviction process can reach out to Legal Aid for help by calling its eviction hotline at 702-386-1070 or visting www.lacsn.org. Residents can also visit the Civil Law Self-Help Center inside the Regional Justice Center to receive guidance and access any necessary eviction and housing forms.

It’s unclear if either the state’s eviction moratorium or the federal order implemented by the Centers for Disease Control and Prevention will be extended past March 31.

Gov. Steve Sisolak reinstated Nevada’s moratorium in December. Like the CDC’s order, Nevada’s moratorium requires eligible tenants to opt in by signing a declaration form and giving it to their landlord. The directive was established to protect residents unable to pay their rent due to the coronavirus pandemic though many landlords say the months-long protection has made them shoulder the financial burden.

Rental assistance

Assistant County Manager Kevin Schiller said rental assistance is available for tenants and landlords through the CHAPS program.

While he noted funds for the program were exhausted in December 2020, it has received additional funds totaling about $161 million “that will be utilized for rental assistance.” He estimates the funds will be able to help about 40,000 households.

Schiller said the program had a waitlist of 12,000 applicants in December and since then an additional 9,000 have been submitted.

The recent passage of President Joe Biden’s American Rescue Plan has expanded the eligibility, meaning more families could qualify for rental assistance.

“We anticipate a flood (of applicants) and another flood if the moratorium is lifted,” Schiller said.

He said tenants with pending applications should check their application online as the new eligibility requirements might require new verification documents.

“Look at the website to see if the documents now required you’ve provided,” he said. “If you applied two months ago, you’re probably close in the processing queue but make sure (your application is) complete.”

Contact Subrina Hudson at shudson@reviewjournal.com or 702-383-0340. Follow @SubrinaH on Twitter.