Local median home prices rise in May

Five straight months of rising median home prices in Las Vegas are not enough to convince housing analyst Dennis Smith that the market has recovered.

He wants to see at least 10 months of price increases in a 12-month period.

The median price of an existing single-family home rose to $118,000 in May, up $3,000 from the previous month and up 6 percent from a year ago, the Home Builders Research president reported Monday.

“The key thing there is they’ve gone up five consecutive months. That’s a trend,” he said. “We’re seeing positive changes, but it’s not fixed yet because of underwater mortgages. It goes back four or five years ago when we said the only thing that will fix it is principal reduction.”

Smith said the price increase is to be expected with the shortage of single-family home inventory, which fell to 2,553 listings without a contingent or pending offer as of last week. The lack of resale inventory has been attributed to implementation of a state law that makes it tougher for banks to foreclose.

What’s amazing about the real estate analysis is that the average price of listings without an offer is $570,000, including 280 homes for more than $1 million.

Frank Nason of Residential Resources said most buyers are looking for homes priced at less than $250,000 and certainly less than $500,000, leaving high-end properties – including some listed at more than $15 million - to drive up the average price of unsold homes.

The segment of homes in the sweet spot for both investors and owner-occupants – $100,000 to $200,000 – is drying up, Nason said. There were only 721 of those listings without an offer.

“Demand at the lower end has just left the higher end of the market, a lot of homes in Seven Hills, Anthem, Southern Highlands and Summerlin,” he said.

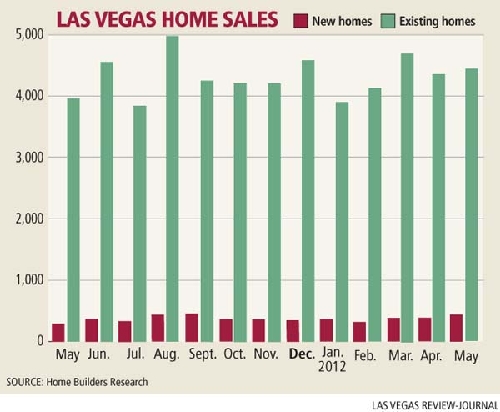

New-home builders are taking advantage of the shrinking inventory. They sold 401 new homes in May, bringing the five-month total to 1,617, a 23 percent increase from a year ago, Home Builders Research reported.

That follows a national trend in which Americans bought new homes in May at the fastest pace in more than two years.

The Commerce Department said Monday that sales of new homes nationwide increased 7.6 percent in May from April to a seasonally adjusted annual rate of 369,000 homes. That’s the best pace since April 2010, the last month that buyers could qualify for a federal home-buying tax credit.

Even with the gains, the annual sales pace is less than half the 700,000 that economists consider healthy.

Yet the increase follows other signs that show the housing market is improving nearly five years after the bubble burst.

Builders are slowly gaining confidence in the market and starting to build more homes. Mortgage rates have plunged to the lowest levels on record, making homebuying more affordable. Prices remain low and have started to stabilize.

Las Vegas-based SalesTraq reported 413 new-home sales at a median price of $197,945, up 2 percent from a year ago. Median price dipped slightly from April, but improved on a per-square-foot basis to $96.18.

Recent increases in asking price will be reflected in coming months as new homes are built and enter the market, SalesTraq analyst Brian Gordon said.

New-home sales are expected to increase going forward as builders pulled 654 new home permits in May, a 50 percent increase from the same month a year ago, SalesTraq reported.

Higher permitting volume combined with increased asking prices show homebuilders’ confidence is growing, something that has been lacking in recent years, Gordon said.

“In response to anemic resale inventories, homebuilders are ratcheting up production,” he said. “The recent shift has all of the telltale signs of a market in recovery. A closer look, however, suggests a more troubling condition exists where banks are hesitant to foreclose on seriously delinquent homeowners and more people are living in homes they are not paying for.”

A large portion of contracted homes that have yet to close are pending bank approval on short sales, or sales for less than the principal mortgage, Gordon said.

“While short sales are becoming increasingly relevant and accepted by lenders, more time is required before we see resolutions for hopeful home sellers trying to get out from under their debt burden,” he said.

About 60 percent of Las Vegas mortgages are underwater, compared to a national average of 25 percent, Santa Ana, Calif.-based real estate analytics firm CoreLogic reports.

So what happened to fears that Las Vegas would become a “ghost town” with so many vacant homes in the neighborhoods?

“I never thought it was a ghost town,” Smith said. “I had people who came here and wanted me to show them our ghost town. Vacant homes were bought by investors. They fixed them up and flipped them or they’re renting them. You still might find homes that are occupied and not making payments.”