Las Vegas new-home sales slip in July

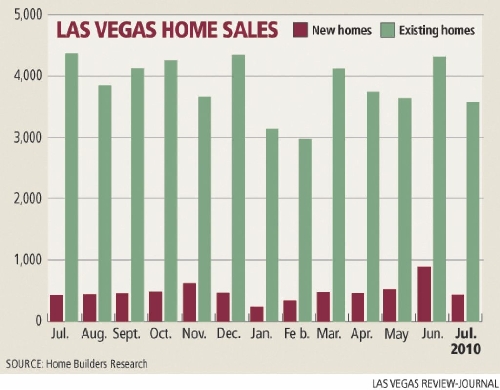

Las Vegas’ new-home sales tailed off to 409 in July, less than half of the previous month’s sales, though the total for the year is up 22.6 percent to 3,405, Home Builders Research reported Monday.

New-home sales increased primarily because of the federal tax credit that expired at the end of April, which means the second half of the year is probably going to be sluggish, housing analyst Dennis Smith said.

"It did provide a short-term jolt upward, like a shot of caffeine in the morning," he said. "However, like the caffeine, it wore off. Now what?"

July’s median new-home price was $210,360, an increase of $3,811, or 1.8 percent, from the same month a year ago, Home Builders Research reported. It’s the highest median price of the year.

The 86 high-rise condos that closed escrow during the month, more than one-fifth of total sales, drove the price upward with an average of $715,687. CityCenter was by far the top seller with 71 closings, including 13 at more than $1 million.

The resale market remained steady in July with 3,592 recorded escrow closings at a median price of $123,400, up 1.3 percent from a year ago. The resale price has ranged from $120,000 to $125,000 for the past 14 months, Smith noted.

There were 371 residential permits pulled in July, bringing the year-to-date total to 3,233, a 58.8 percent increase from the year-ago period.

Las Vegas-based SalesTraq housing research firm reported 408 new-home sales and 4,128 existing-home sales in July, a 1.5 percent increase and 19 percent decrease, respectively, from the same month a year ago.

The median new-home price of $210,000 is down by just $745, or 0.4 percent, from a year ago, while the existing-home median price of $120,000 is down 1.6 percent from a year ago.

SalesTraq showed 994 short sales, or homes sold for less than the mortgage owed, at an average price of $125,000; 378 auction sales at an average of $98,000; 1,540 real estate-owned, or bank-owned, sales at an average of $115,000; and 1,216 regular sales at an average of $120,000.

Smith of Home Builders Research said July’s numbers were "OK at best" with no surprises.

"Potential buyers have no sense of urgency," he said. "Consumers aren’t convinced that prices will not go lower."

Thirty-year fixed mortgage rates are down to 4.5 percent, but the drawback is qualifying for those loans, Smith said. About half of existing-home sales in July were cash-only transactions, indicating a large number of investors and also illustrating the problem in financing.

"We can’t expect to see sales consistently improve if obtaining credit remains so difficult," Smith said. "Have you tried to qualify for a new-home loan or refinance lately? Consumers are seemingly being punished for the greed and mistakes of many of the larger lending institutions."

An August report from St. Petersburg, Fla.-based Raymond James & Associates showed a 21 percent decline in Las Vegas single-family home sales in July from the year-ago period, largely due to a drop-off in demand after the tax credit expired. Inventory of listings grew 8 percent to 27,789 units.

"We remain concerned about the potential for future price declines given Las Vegas’ large foreclosure pipeline," the Raymond James report said.

The Mortgage Bankers Association showed Nevada with 24.4 percent of mortgages in some form of delinquency or foreclosure in the first quarter, second only to Florida’s 25.3 percent and well above the national average of 11.9 percent.

Raymond James estimated a statewide backlog of 124,000 foreclosures that will eventually need to be addressed.

The 1,907 foreclosures reported by SalesTraq in July is up from 1,549 in June, but down 12 percent from 2,161 in July 2009. Five of the first seven months have shown a decrease in foreclosures, though the 2010 total will probably come close to matching last year’s 20,426 foreclosures.

Congress has talked about another homebuyer tax credit, but should concentrate less on origination and more on saving existing homeowners, said Sylvia Alayon, senior vice president at Consumer Mortgage Audit Center.

"The short-term solution is keeping them in their home by lenders working with homeowners to agree on an affordable monthly payment," she said. "The long-term solution is jobs. If you don’t have a job, you can’t afford your home."

Alayon said the sense of urgency should come from the Obama administration in creating jobs because the current economic environment could result in serious damage to the real estate market.

"The only thing that will truly be a turning point for getting out of the great housing recession is job creation," housing analyst Smith said. "As much as some would like us to believe that big government spending will do this, to date it has been woefully inadequate."

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.