Las Vegas home values keep going down

Looking at this year’s tax assessments, local property owners won’t feel as if they have to stoop over and pick up that loose change on the ground.

Better pick it up anyway. The long decline in home prices may lighten the tax load for Las Vegas homeowners, but it’s also left 75 percent of them "underwater," or with negative home equity, meaning they owe more than their home is worth, First American CoreLogic valuation service reported.

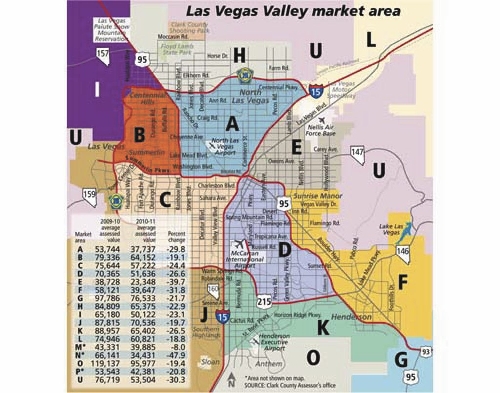

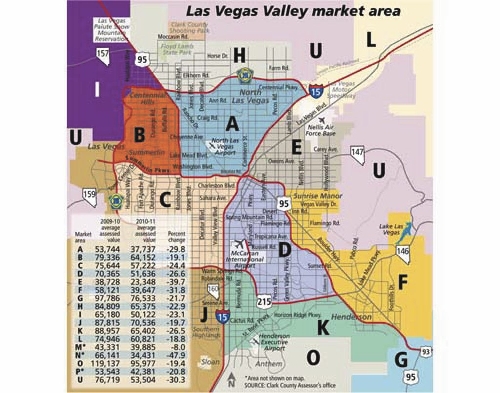

From Mount Charleston to Lake Las Vegas, every area of the valley has been hit hard, housing analyst Dennis Smith of Home Builders Research said. The median resale home price was $126,000 in June, a steep tumble from the peak of $285,000 in 2006, he reported.

"I don’t think there is one particular area that got hit the hardest," Smith said. "I would suggest it’s almost subdivision to subdivision. You could look at the other side of the equation and say, ‘Which owners are benefiting the most?’ "

Many property owners appealed before the state Board of Equalization and had their valuation and tax assessments lowered, even if it wasn’t by the full amount they wanted, he said.

Tax assessments for 731,000 Clark County parcels dropped to $1.8 billion in 2010-11, compared with $2.2 billion the previous year, the assessor’s office reported.

"It’s not just housing," Smith said. "It’s also land. The percentage of land was just as significant as a lot of the residential or commercial properties."

The largest decrease in average assessed values came in east Las Vegas, where values fell 39.7 percent to $23,348 in 2010-11 from $38,728 the previous year, the assessor’s office showed.

Other areas with substantial decreases include the section along Boulder Highway to older Henderson (down 31.8 percent to $39,647) and central Las Vegas from Bonanza Road to Centennial Parkway (down 29.8 percent to $37,737).

Assessed value is calculated at 35 percent of taxable value, said Michele Shafe, assistant director for the Clark County Assessor’s Office. For example, the $38,728 average assessed value in east Las Vegas would compute to $110,651 taxable value.

Shafe said she’s getting fewer calls this year because both assessed values and taxes have been reduced significantly. She was bombarded with calls a couple of years ago when home values started declining, but taxes continued to increase after being capped at 3 percent during the housing boom.

A reduction in property taxes doesn’t necessarily correlate to the rising percentage of underwater homes in Las Vegas, Smith said. Most of those homes were financed at peak values, which have fallen further than anyone could have envisioned, he said.

A substantial proportion of borrowers with subprime and Alt-A — alternative documentation — loans have negative equity in their homes, ranging from about 9 percent in Denver to more than 90 percent in Las Vegas, a 2009 study from the U.S. Government Accountability Office showed.

Anyone who purchased a home in Las Vegas from the late 1990s forward is probably even at best, assuming they didn’t take out a second mortgage.

Homes in some of the newer subdivisions such as Aliante in North Las Vegas, Mountain’s Edge in the southwest valley and Providence in the northwest have lost anywhere from $100,000 to $200,000 in the last four years.

Residential listing service Zillow.com showed Las Vegas home prices at $126,000 in May, down 12.2 percent from a year ago. Henderson home prices decreased 16.7 percent to $149,000, North Las Vegas dropped 11.8 percent to $122,500, and Boulder City fell 28.9 percent to $146,000.

The strongest community in the Las Vegas metropolitan area is Summerlin South, where home prices slipped only 4 percent and the average of $228,600 is by far tops in the valley. Among the worst areas are Winchester, down 29.2 percent to $91,300; Sunrise Manor, down 27.7 percent to $90,400; and Paradise, down 21.2 percent to $117,000, Zillow reported.

The highest depreciation rate in 2009 came in ZIP code 89109, just east of the Strip from Sahara to Tropicana avenues, where median prices dropped 60 percent to $129,000, Las Vegas-based SalesTraq reported. Next was 89146, around Sahara Avenue and Jones Boulevard, down 57 percent to $110,000.

Three ZIP codes (89145, 89106 and 89104) experienced decreases of 40 percent or more, and seven ZIP codes — including Lake Las Vegas — had prices drop by 30 percent or more.

"The last time I worked at Lake Las Vegas, a few months ago, I noticed their decline rate was at a more rapid pace," real estate appraiser Debbie Huber said. "A lot of that was from the bankruptcy case and a fear-driven thing. It’s just a matter of what point in the cycle the neighborhoods are at."

Huber said she’s no longer being asked to calculate negative adjustments for time, which is a change from recent appraisal policy. Lenders want her to use more current sales from the last four months instead of the last six months, she said.

John McClelland, research director for Coldwell Banker Premier Realty, tracked the concentration of foreclosures and notices of default in the Las Vegas Valley. Those are excellent indicators of downward price pressures in a specific area, he said.

More than 11 percent of homes in ZIP code 89118 in the southwest valley received a notice of default in the second quarter. Real estate-owned, or lender-owned, homes accounted for 9.5 percent of the housing stock in 89109, where home prices fell 60 percent last year.

"I think some of these are compelling," McClelland said. "You can see where the REOs are distributed and no location is spared."

Areas with a high proportion of age-restricted homes fared better, presumably due to larger down payments or cash purchases, fewer refinances and better neighborhood conditions, he said.

REOs are selling at greater discounts than short sales or traditional sales and most price measures do not adjust for the difference in days on the market, what one Fed economist calls "liquidity adjusted pricing." Short sales can take several months just for lender approval, while REOs typically close escrow in about 40 days.

Much depends on the seller’s motivation, McClelland said. A bank may not want to wait as long to sell a home and will lower the price for a faster sale.

"These factors should concern anyone attempting to model this market, including automated valuation models, which are often used in (tax) assessments," he said.

CoreLogic’s home price index for April showed the first annual increase in three years, though the "shadow inventory" of bank-owned homes yet to be released on the market and the expiration of the homebuyer tax credit may cause further declines.

The shadow inventory is expected to peak this summer and could take three to four years to clear out, many analysts predict.

That’s a problem for Las Vegas, the nation’s leader with one in every 15 homes in some stage of foreclosure in the first half of the year. The inventory of homes on the Multiple Listing Service has crept upward this year, putting pressure on sellers to further reduce asking prices.

"Our forecasts for the inventory of homes for sale have risen as interest rates are expected to rise, tax credits expire and slower-than-expected sales over the winter due to the weather are all adding to the inventory," CoreLogic said in its report.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.

Home values map detail