Las Vegas home sales spike in March

Home sales jumped in March, largely driven by cash investors taking advantage of sliding prices, the Greater Las Vegas Association of Realtors reported Friday.

Realtors sold 3,384 single-family homes during the month, a 30.6 percent spike from February and 6.6 percent increase from the same month a year ago.

The median price fell to $125,590, down 1.6 percent from the previous month and a 7.4 percent drop from a year ago.

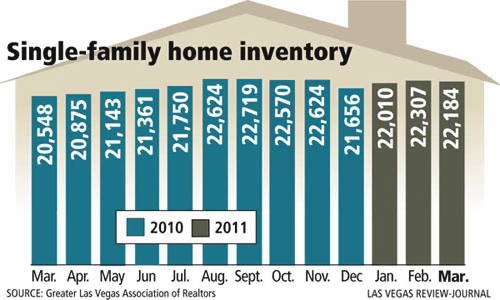

Overall inventory remained stable at 22,184 units listed for sale, though it’s up 8 percent from a year ago. The number of units listed without contingent or pending offers rose nearly 50 percent to 11,334, according to GLVAR statistics.

Home sales were already at a strong pace to start the year and increased significantly in March, Realtors association President Paul Bell said.

“As for the slight decrease in median home prices last month, I think real estate investors are influencing that statistic because they tend to buy lower-priced homes, which are generally owned by banks,” he said.

Records show that 51.4 percent of existing homes sold in March were purchased with cash. That’s down from 53.8 percent in February. Still, Las Vegas has one of the highest percentage of cash buyers in the nation, Bell said.

As long as local home prices remain affordable and lending standards remain relatively stringent, Bell said he expects this percentage to hover near record levels as investors play a dominant role in the local housing market.

Anthony Sanders, a scholar with the Mercatus Center and professor of real estate finance at George Mason University, said there is definitely a chance that a double dip could occur in housing, given that recent data show little support for housing.

“The Las Vegas housing market has suffered tremendously in recent years. But the one advantage that Las Vegas has over other sand-patch areas like Arizona and California is that there is a natural attraction to Las Vegas — the most famous entertainment complex in the United States,” Sanders said.

“In fact, its natural attraction also contributed to the housing bubble. But once prices have fully corrected and the economy begins sustainable growth, Las Vegas is poised for a better comeback than most other sand-patch areas.”

Bell said he’s noticed a lot of bidding for foreclosure properties at $40 to $60 a square foot. Buyers will invest another $10 to $30 a square foot to restore the home to livable conditions, he said.

The Realtor sees potential for some 2,000 foreclosures to come onto the market in Las Vegas, though many are owned by Fannie Mae and Freddie Mac. The government-sponsored enterprises are slow to bring those properties to market, typically taking 90 to 120 days, Bell said.

“Properties are being vandalized and stripped, so there’s a major concern right now with the lag time that financial institutions will take to foreclose,” he said.

Some programs allow for properties to be rented until market values recover, Bell said.

Steve Ayres of ReZults Realty said 500 to 1,000 foreclosure properties are scheduled for trustee sale every day at Nevada Legal News. He expects to buy and sell about 150 of them this year.

“Without the nucleus of people flipping properties, homes here would be worth even less than they are now,” Ayres said. “What we’re essentially doing is buying a foreclosed property, putting life into it with a crew that cleans it up while providing a tax base during the worst economy in the state of Nevada.”

Short sales, or homes sold for less than the principal mortgage balance, have also proven to be good deals. They accounted for 23.6 percent of March home sales, GLVAR said. Foreclosures were 47.6 percent of sales.

The median price of 932 condominiums and townhomes sold in March was $61,000, down 2 percent from February and down 10.6 percent from one year ago. Sales were up 19.5 percent and 14.5 percent, respectively.

The monthly Realtors’ statistics are based on transactions tracked through the Multiple Listing Service and do not necessarily include sales by owner, newly constructed homes sold by builders and other transactions not involving a Realtor.

A report from San Francisco-based Trulia.com shows that home sellers slashed $24 billion from price listings on the real estate website in the past year. Most sellers cut their asking price by 8 percent after 79 days on the market. Thirty-five percent of them will make a second reduction.

Detroit offered the steepest discounts at 19 percent, followed by Miami and Columbus, Ohio, at 11 percent each. Las Vegas comes in at No. 9 on Trulia’s list for average days on the market (54) before the first reduction.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.