Las Vegas home prices fall below 2000 levels with no relief in sight

Maybe this is the Final Four.

Home values in Las Vegas, Atlanta, Detroit and Cleveland are now below January 2000 levels, according to a report released Tuesday.

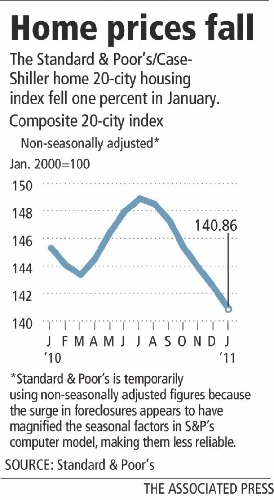

The Standard & Poor’s/Case-Shiller 20-city index shows price declines in 19 cities from December to January. Eleven of them are at their lowest level since the housing bust, in 2006 and 2007. The index fell for the sixth straight month.

The only market where prices rose was Washington, D.C., where homes prices gained 0.1 percent month over month.

"The housing market recession is not yet over, and none of the statistics are indicating any form of sustained recovery," said David Blitzer, chairman of the Index Committee at Standard & Poor’s.

The pain is not uniform, however. It is worse in cities where foreclosures and short sales are dominating the market and pushing home prices down. That includes Detroit and Cleveland, which are struggling with weak local economies. And it includes Las Vegas, Miami, Phoenix, and Atlanta, which are also reeling from overbuilding during the housing boom.

Las Vegas has led the nation in foreclosures since the subprime mortgage crisis emerged, knocking down home prices 60 percent from their peak.

The median new-home price fell 9.2 percent from a year ago to $188,900 in February, the lowest it has been since 2002 when it was $183,557, Las Vegas-based SalesTraq reported.

SalesTraq figures say the median existing-home price is down 5.4 percent to $110,000, roughly the same as 20 years ago or 1991.

Housing analyst Larry Murphy of SalesTraq said the Case-Shiller index is a "wonderful tool" to compare home prices across the board in 20 cities, but it doesn’t include auction sales and doesn’t show how the market "shakes out" for itself.

"They’re only off by a few years — like 10 years or something," he said.

Murphy predicted more pain.

"We’re not out of the woods yet. I’m standing by my prediction of still a couple more years. We’ve still got a lot of foreclosure shadow inventory in the pipeline."

RealtyTrac Inc. forecast that foreclosure filings might climb about 20 percent in 2011, reaching a peak for the housing crisis.

In the latest report, California cities are faring better. San Diego was the only city besides Washington, D.C., where home prices have risen year over year.

The Case-Shiller gauge, which was created by economists Karl Case and Robert Shiller, is based on a three-month average, which means the January data was influenced by transactions in December and November.

TOUGH MARKET TO SELL

What does that mean for local buyers and sellers?

It’s a tough environment to sell a home in Las Vegas right now, but you can get a property sold, said Mark Stark, owner and broker of Prudential Americana Group.

The key is finding a Realtor who understands the market and does their homework, he said.

"You can’t toss a house on the market, and it sells. You need someone to do an evaluation of what’s going on in that area. Everybody says prices are going down. I can show you areas in town where prices are going up. It depends on the location, the price range, the product type, the amenities," Stark said.

But the pain is acute for homeowners.

Las Vegas homeowner Greg Adamour said he would like to see people become more proactive in motivating banks and politicians to initiate economic reforms.

"They exacerbated the problem, and now they don’t care. They’re ambivalent," said Adamour, who bought a house at Rhodes Ranch 10 years ago for $415,000 that he now is trying to short-sale for $340,000. It once appraised for more than $900,000.

"It’s very unfortunate for us baby boomers who invested in the system. We feel like we’ve been exploited," he said.

GOVERNMENT ROLE UNDER SCRUTINY

As long as the government continues to handle the foreclosure crisis the way it has, there will never be enough aggregate demand in the housing market to put a floor under prices, said Leonard Tekaat, a retired economic analyst in Bakersfield, Calif.

With Freddie Mac and Fannie Mae in federal conservatorship, servicers of mortgage loans don’t have enough options to offer struggling homeowners, Tekaat said.

Former Freddie Mac economist Arnold Kling testified Tuesday before the Senate Banking Committee that the most urgent need for housing finance policy today is to ration the use of government-subsidized mortgage credit.

"There is a way to guarantee reliability of mortgages that does not require a government agency," said Kling, a member of the financial markets working group at George Mason University. "The solution is for most borrowers to make down payments of 20 percent, which was typical before the madness of the last two decades.

"What should we say to someone who wants to buy a $200,000 house but has only $5,000 saved up? In most cases, we should say the same thing we would say if they wanted $200,000 in poker chips in Las Vegas or $200,000 worth of stock. We should just say no," Kling said. "With good loans, the mortgage finance business will take care of itself."

Most economists don’t see a rosy road ahead.

"Prices will continue to move downward probably for the rest of the year," said David Semmens, a U.S. economist at Standard Chartered Bank in New York. "They won’t turn around until you have consumers feel that housing is genuinely cheap and until they feel a lot more secure in their labor-market position."

The Associated Press and Bloomberg News contributed to this report.

Have a story to share?Follow us on Facebook and tell us how the housing crisis has affected your life.