Las Vegas existing-home sales soar in June

Single-family home sales increased 8 percent in June from the same month a year ago, while median prices slipped 11.1 percent to $124,500, the Greater Las Vegas Association of Realtors reported Friday.

Counting condo and townhome sales, it was the third-highest month on record for existing-home sales in Las Vegas at 4,540, compared with 4,265 a year ago, the Realtors group reported.

“Of course, we’d love to see home prices going up like they did the previous month, instead of down slightly, as they did this month,” said Paul Bell, president of the association. “But that seems to be the way things are going as we continue to bounce along the bottom.”

Home sales traditionally increase during the summer, but June’s sales numbers were even better than expected, Bell said.

“I got a call from the London Daily Telegraph and I told them Vegas is on the front lines of recovery,” he said Friday. “This is a very good indicator. This just confirms what an active housing market we have.”

Values continue to decline, but low-priced and deteriorating properties are being cleared out by investors who generally restore those homes and rent or resell them, Bell said. About half of all existing homes sold in June were purchased with cash, down from 51.4 percent in May.

Bell said he’s seeing a lot of interest from international buyers, including those in the Far East, Canada and Europe, as well as domestic buyers from California, New York and the upper Midwest.

Real estate-owned, or bank-owned, homes accounted for 47.2 percent of June sales, compared with 43.8 percent in May, and their median price was $109,000.

More than one-fifth (21.6 percent) were short sales, or lender-approved sales for less than the principal mortgage balance, at a median price of $129,000. Local housing analysts predicted short sales would overtake foreclosures, but they’ve actually fallen from their peak of 34 percent last year.

Bank of America has its own version of the government’s Home Affordable Foreclosure Alternative program, which has been largely ineffective in prompting banks to approve short sales, said Realtor Tim Kelly of ReMax Extreme. Homeowners get a waiver on the balance due on the mortgage, wiping out any worries about a deficiency judgment, and they receive $2,500 cash at closing.

“A no-brainer for most homeowners,” Kelly said about the program that started in June. “I have a home that sold in 2006 for $200,000 and I have it listed for $33,900. Bank of America did an appraisal and that was the fair market value. Amazing.”

Master-planned communities such as Green Valley, Summerlin and even Mountain’s Edge are starting to see an uptick in median prices, Bell said. Other areas of the valley where homes were built in the 1950s and ’60s are seeing prices from $15,000 to $75,000, though those homes may need quite a bit of restoration to get them in reasonable condition, he said.

Prudential Realtor Sam Wagmeister showed a prospective buyer a 1,600-square-foot, single-story foreclosure home Friday in the southwest Las Vegas Valley, around Rainbow Boulevard and Robindale Road, for $155,000, but they ended up looking elsewhere.

“It needed a lot of work. The appliances had been stolen, the door hardware was stolen. It required more work than he wanted to get involved with,” Wagmeister said.

The median price of local condos and townhomes sold in June was $59,900, down 14.4 percent from one year ago.

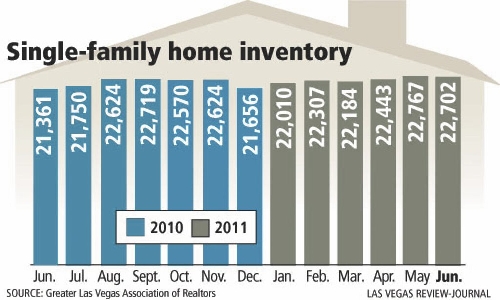

The number of single-family homes listed for sale on the Multiple Listing Service continues to climb from a year ago, up 6.3 percent to 22,702 in June. Condo and townhome listings fell 12.5 percent.

Realtor statistics are based on data collected through the MLS, which does not account for homes sold by builders or for-sale-by-owners.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.