Icy markets for Strip high-rises melts a touch

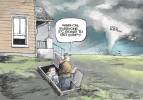

Wall Street analysts and Las Vegas real estate professionals say a slight thawing in the frozen Strip high-rise residential market might be taking place.

A very slight thawing.

We’re not talking global warming, folks.

A comprehensive report by a Las Vegas-based gaming industry advisory firm said sales of high-rise condominiums and hotel-condo units within the Strip residential market increased over the last three months of 2009.

Real estate professionals agreed that the market picked up a bit.

However, the bulk of the sales were either bank-owned or foreclosed-upon condominium units at prices far below the stratospheric figures sought at the market’s peak a few years ago.

“I really doubt we have seen the bottom of the price market,” said Grant Govertsen, a principal with Union Gaming Group and the primary researcher behind “High-Rise Blues II: From Bad to Worse,” which was written for the firm’s clients.

Govertsen said Strip condominium projects would need to experience several more months of increased sales before observers would commit to endorsing a market rebound.

“I don’t think anyone is willing to say that we have reached a floor on pricing,” Govertsen said.

June Stark, a Las Vegas Realtor specializing in the Strip’s high-rise condominium market, agreed. She said tracking activity within the luxury condominium business resembles a giant W: Prices and sales have a tendency to go up, come crashing down, and go back up again.

In December, there were 120 sales closings on high-rise condominiums and condo-hotel units within the Strip residential market. The month followed triple-digit sales closings in October and November.

“There has been some sales velocity and I think it’s because the prices are so low right now,” Stark said.

She cited several recent examples.

A 1,350-square-foot condominium at the Sky Las Vegas, originally priced at $801,000, is in escrow for a little more than the asking bid of $270,250. Another Sky unit, with an original cost of $1.1 million, recently sold for $359,000.

Stark said the sales velocity and interest in recent months are “significant.” But he added that buyers are always asking about comparison-price windows over a 10-day period to see whether their deals are holding up.

The largest influence on the Strip high-rise residential market is the MGM Mirage-owned CityCenter. The $8.5 billion development, which includes three residential buildings with 2,400 luxury condominiums, added 22 percent more inventory to the Strip’s already glutted high-rise offerings.

Before CityCenter, the Strip corridor had 8,700 units, 36 percent of which were unsold and still held by the developer. Ten percent were in default and 1 percent were bank-owned.

With CityCenter in the mix, 59 percent of the market is available.

Govertsen said calling the Strip’s high-rise business “disastrous” would be an understatement.

The market grew 12-fold between 2006 and 2008 when the economy began to sputter. Of the 23 projects looked at by Union Gaming (not including the three CityCenter buildings), only 12 have sold at least 90 percent of their inventory and only one began its closing process after 2006.

“Those who came late to the game have been left holding the bag,” Govertsen said.

Now, CityCenter is the market with the most expensive high-rise residential units on the Strip.

Even after a 30 percent price reduction that was implemented in October, CityCenter’s condominium-only units price out to $1,120 per square foot at Mandarin Oriental and $700 a square foot at Veer Towers.

On the Strip, Union Gaming found the average condominium is being listed for $252 a square foot, meaning Mandarin Oriental’s 227 units have prices 344 percent higher than the market average and prices for Veer’s 670 condominiums are 178 percent above the competition.

The 1,495 condo-hotel units at Vdara average $840 per square foot, 172 percent above the $309 per-square-foot average for the entire Strip condo-hotel market.

“CityCenter has a number of factors going for it and it clearly deserves to be the market premium,” Govertsen said. “It’s up to its contract holders to decide how to proceed forward.”

CityCenter began closings at the Mandarin Oriental in January. Veer closings were expected to begin this month while Vdara closings are slated to begin in March.

As of the end of January, buyers had closed on just two Mandarin Oriental units for a combined $4.95 million. The units were 2,008 square feet and 2,904 square feet, which averaged out to $1,008 per square foot.

Las Vegas attorney Mark Connot, who represents a “significant number” of CityCenter buyers, said some of his clients have received closing letters but the process is slowgoing. CityCenter brought in a national mortgage company to provide financing to speed closings.

“Some of my clients have received closing-date extensions, and we’ve had limited discussion with MGM Mirage,” he said.

Tony Dennis, the head of the CityCenter residential division for MGM Mirage, said there has been a spike in CityCenter interest since the development opened two months ago. It’s still early to tell whether that will translate into condominium sales. In December, roughly 1,100 of the project’s units were available.

“(CityCenter) is more distinctive than all other offerings given its integrated master-planned urban concept, center-Strip location, product design, quality, amenities and services,” Dennis said in an e-mail. “Not all demand is the same. CityCenter caters to and draws most of our buyers from long-standing relationships and referrals. This affinity allows us to tap into demand that is loyal to us and knows we deliver value at our pricing.”

In some ways CityCenter has spurred sales of units in other developments, such as the MGM-Turnberry Signature towers behind the MGM Grand.

In December, the three towers accounted for almost 36 percent of the Strip’s one-month high-rise sales and 35 percent of the sales between October and December.

Stark said the project’s location adjacent to MGM Grand and within walking distance of CityCenter has made Signature a lower-priced alternative. Units that once sold for $500,000 to $1 million are selling for $134,000 to $200,000.

“CityCenter has created a demand for Signature,” Stark said. “It’s not as dense, guard-gated with great views.”

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871.