How many Californians have moved to Nevada since 2020?

Nearly 158,000 people relocated to Nevada from California since 2020, making up 43 percent of all new residents to the Silver State during the past four years, according to data from the Nevada Department of Motor Vehicles.

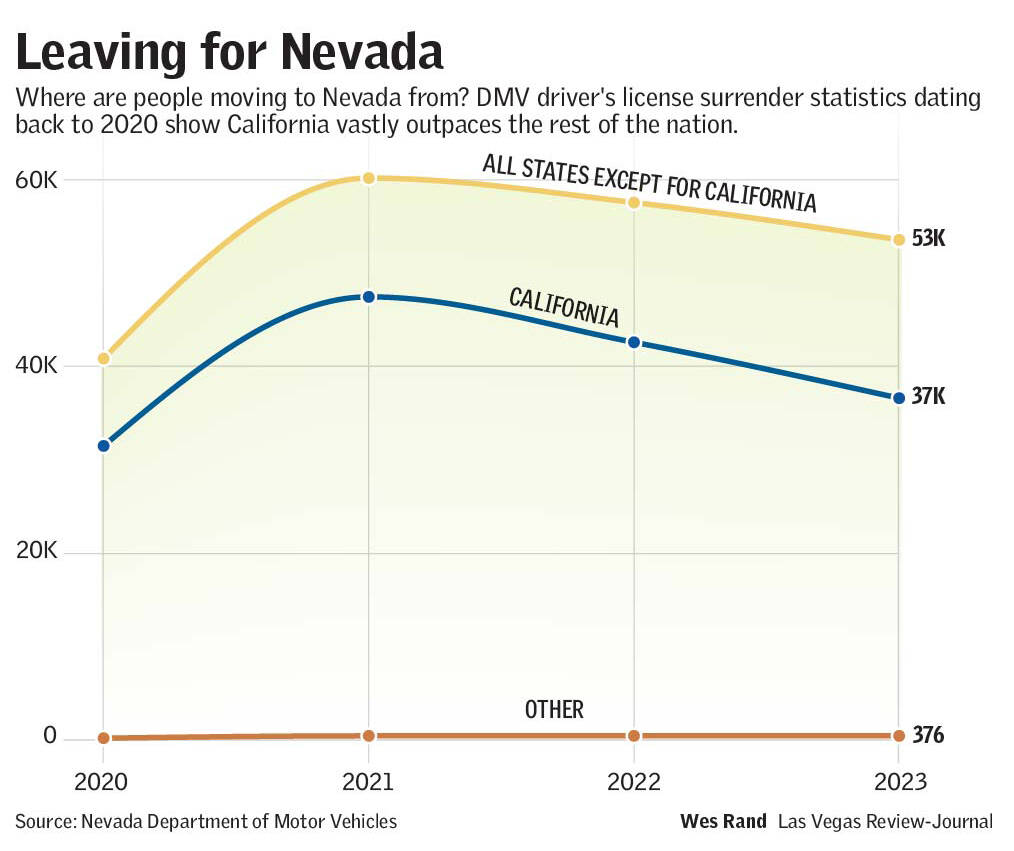

Over the past four years, ending 2023, the most California residents moved to Nevada in 2021 (47,376), followed by 2022 (42,569), according to driver’s license surrender data obtained from the DMV by the Las Vegas Review-Journal. The total number of new residents to Nevada from 2020 through 2023 based on the data was 369,878, with 211,893 coming from other states besides California.

California has long been a driving force for Nevada’s population, accounting for approximately a third of all new residents going back decades. Californians are moving to Nevada, and specifically the Las Vegas Valley, seeking cheaper houses or rent and lower taxes and because of the region’s strong job growth following the pandemic.

And this exodus is having a noticeable impact on California’s population. The U.S. Census Bureau reported in March that California is losing population, appearing to have hit a peak in 2020 at 39.5 million. Its population now sits at 38.9 million.

UNLV Lee Business School population projections, which are prepared for local governments every year by the Center for Business and Economic Research, show that despite the influx of new residents from California, Clark County’s population actually dropped in 2021 by 43,591 net residents and that Clark County and Nevada’s overall population growth rate is slowing, but is still adding approximately 115 residents a day to its population base.

Clark County declined to comment for this article but said through a spokesperson that they “don’t have any specific engagement focused on Californians.” Clark County makes up approximately 70 percent of Nevada’s population.

Stephen Miller, research director at UNLV’s Center for Business and Economic Research said it’s important to know that the Las Vegas Valley is still in a growth phase.

“We’re still growing above the national average,” he said. “But what’s happening is in the long run we will converge more towards the national average. There’s a convergence process that goes on as you get bigger, think of China, as you get bigger it’s harder to grow faster because you have a bigger base.”

According to a StorageCafe study that was published late last year, Nevada has the nation’s sixth-highest rate of net migration — the difference between the number of new residents and the number of people leaving — with over 14 newcomers for every 1,000 residents, according to the study that combines data from the census and the Bureau of Labor Statistics.

The largest percentage of new residents are millennials from California, but Miller said there is also the aging baby boomer cohort to take into account.

“One of the main reasons some people come here (from California), is they’ve retired and want to escape the taxes and when they sell their house they have this huge equity they can take out and come and buy a house here at a much lower price and situate themselves in a much better position.”

UNLV projections have Clark County adding 33,000 residents this year, bringing the overall population to 2.4 million. The county is expected to hit another peak wave in terms of population growth in 2026, adding 56,000 net residents to its base, and then tapering off slowly from there. This bump is equated to a potential boom in jobs brought on by both the Brightline West high-speed rail station nearing completion and the potential for a large casino, resort and basketball stadium being built in South Las Vegas and the encompassing jobs brought forth by both projects.

Clark County should break 3 million residents sometime before 2050, and by 2080 the population is expected to be somewhere around 3.4 million.

Housing woes continue

Housing prices have clearly suffered in Nevada because of this dichotomy between the economy of California, which would be the fifth largest country in the world, according to GDP statistics, said Charles Dougherty, a senior economist at Wells Fargo. He said the remote work wave kicked off by the pandemic unlocked a lot of California workers from their desks and allowed them to relocate, thus driving up prices in Las Vegas.

“There is an economic story here too,” he said. “Nevada has seen considerably faster economic growth since the pandemic, and if you look at the jobs numbers, jobs have come back, whereas California has been a bit more sluggish, so I think a combination of things, strong job growth, real estate affordability, lower cost of living, fewer regulatory constraints, these are all playing into this story.”

Clem Ziroli, a licensed real estate broker and a candidate for Nevada Assembly District 34, said the disparity between the two state’s purchasing power is good for Nevada residents looking to sell their homes but bad for Nevada residents looking to buy.

“Californians are coming to Nevada with more cash for down payments and in some cases paying all cash for homes, as they are generating premium pricing for the property they sell in California,” he said. “This effect is driving prices up in Nevada. Unfortunately, the rising home prices are creating a disadvantage for Nevadans who wish to enter the market for the first time.”

Clark County is short approximately 85,000 affordable housing units, according to the National Low Income Housing Coalition, and both residential real estate and multifamily brokers say a chronic lack of supply may only worsen because of heightened interest rates dampening the construction pipeline now that the pandemic building boom is over.

The median price for a single-family residential house in Las Vegas is up more than $100,000 since the start of the pandemic and currently sits at $426,000, according to Redfin.

Miller said his 2019 research on forecasting home prices in Los Angeles, Las Vegas, and Phoenix showed Los Angeles home prices were already having a substantial effect on Las Vegas home prices.

“Well, the interesting thing is most people think that population growth means it’s better for the economy, but what population growth tends to do is reduce the standard of living, which is real GDP per capita over time.”

Contact Patrick Blennerhassett at pblennerhassett@reviewjournal.com.