Housing report: More pain ahead

The first two waves of mortgage losses are mostly behind us but three more waves are coming, two of them in the housing market and one in commercial real estate, an executive for a New York investment firm said Friday.

There’s more pain to come, said Whitney Tilson, principal of T2 Partners and publisher of a June report on the housing and credit crisis.

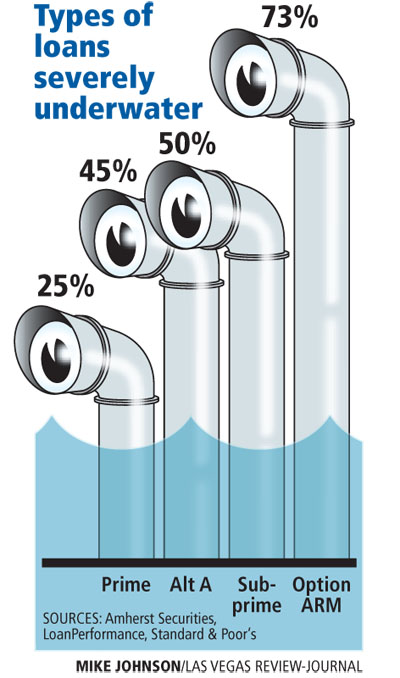

While the majority of mortgage defaults so far have been subprime borrowers, more middle- and upper-income homeowners are starting to walk away from their mortgages, he said from New York.

Roughly one-fourth of homeowners with a mortgage owe more than the home is worth, making them much more likely to default. Among those who purchased in the past five years, 30 percent are underwater. The figures are worse in bubble markets such as Las Vegas, where 61.4 percent of buyers in the last five years are underwater, according to Moody’s Economy.com.

The early wave of defaults came from fraud and speculation, starting in late 2006 when home prices started to fall, Tilson said.

The next wave was borrowers who went into “payment shock” when their adjustable mortgage rates reset. Two-year teaser subprime loans written in early 2005 started to reset in early 2007, though those defaults are tapering off as low interest rates mitigate the shock.

Tilson, author of “More Mortgage Meltdown,” is now seeing the third wave of prime loans defaulting due to job losses and home price declines. Prime loan default rates have jumped from 0.5 percent to 4.5 percent in the last year, he said.

In California, the average mortgage owed on homes in foreclosure is $412,000, while the average appraised value of those homes is only $235,000. That’s going to cause a lot of people to walk away from their obligation, Tilson said.

“The average person in foreclosure in California is 43 percent underwater, so it’s not like these people are close to the edge and you can save them with a loan modification,” he said. “These people are deep, deep underwater. Are you going to keep paying when you’re that far underwater?”

A fourth wave of prime jumbo loans, second liens and home equity lines of credit started to swell in early 2008, again created by job losses and home price declines.

When both the husband and wife were working, they could afford a big mortgage, Tilson said. Now, with 10 percent unemployment and some 3.5 million job losses, they’re tightening their belts.

“It’s not just unemployment, it’s underemployment, people taking cuts in pay and working fewer hours. So what you’re seeing is the middle and high end start to tip over,” he said.

Wave No. 5 involves losses among loans outside the housing sector, the largest being $3.5 trillion in commercial real estate. Commercial mortgage delinquency rates have doubled since early 2008.

Tilson thinks housing prices will reach the fair market value trend line when they fall 40 percent from their peak based on the S&P Case-Shiller index, which implies a further decline of 5 percent to 10 percent from the first quarter.

“It’s almost certain that prices will reach these levels,” Tilson said. “The key question is whether housing prices will go crashing through the trend line and fall well below fair value. Unfortunately, this is very likely.”

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.