Home prices keep falling in January

Home prices started the year nearly as dismally as a year ago by falling 5.6 percent in January, the Greater Las Vegas Association of Realtors said Tuesday.

Realtors showed a median single-family home price of $118,000, based on 2,931 units sold during the month. The median price drop is slightly lower than the 7.4 percent drop in January 2010.

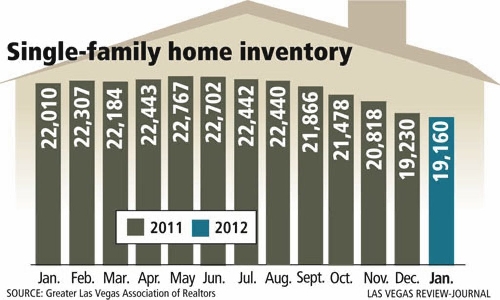

Inventory of homes on the Multiple Listing Service continued its steady decline to 19,160 in January, down 12.9 percent from the same month a year ago. The number of available units without contingent or pending contracts fell 35.8 percent, to 8,001.

Association President Kolleen Kelley said the downward trend may change due to a new state law that has slowed notice of default filings.

"We’ll feel the full effect of AB 284 in April or May and we’ll see prices go back up," Kelley said.

Bryan Kyle of First Serve Realty in Las Vegas said there will be plenty of inventory to come as banks work through foreclosure legalities.

"I wouldn’t be surprised to discover that the banks will continue to artificially control the amount of homes coming on and off the market," he said.

About half of the homes sold in Las Vegas are cash transactions with no mortgage, suggesting heavy activity from investors who turn them into rentals. That’s not necessarily a bad thing, Kelley said.

"I kind of have an optimistic view. I look out into the future when these people will eventually sell the homes and they’ll be owner-financed," she said. "If interest rates go up, that could be a real possibility because investors can’t get the return on investment like that on a monthly basis. And if lending criteria stay as high as (they are), it’s probably something that we could see sooner rather than later."

Bank-owned homes accounted for 45.5 percent of all existing home sales in January, while 28.1 percent were short sales, which occur when a home sells for less than is owed on the mortgage.

Las Vegas is going through a process in which former homeowners are becoming renters, with about half of bank-owned sales going back on the market as rentals, Coldwell Banker Premier Realty CEO Bob Hamrick said.

Families that had to move from foreclosed homes are looking to rent similar properties, so institutional hedge funds are putting $100 million into buying bulk single-family rental homes, he said.

"I consider this the most opportunistic market in Las Vegas history," Hamrick said at a January housing outlook. "We have to have sellers and we’ve got motivated sellers. They’re banks."

Kyle said he couldn’t recall the last time he had a local buyer.

"We see offers coming in from all over the country. I think that will continue," the broker said. "I’m not a believer that we are looking at another 10 percent (price) drop. I personally do eight or 10 bank price opinions every week and I just don’t see that happening."

The Realtors association reported 660 condominium and townhome sales in January, down 6.4 percent from the same month a year ago. Median condo prices sank 15.3 percent to $55,000.

Association data are based on sales through the Multiple Listing Service and may not include sales by owner, new-home sales or those without a Realtor.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.