Home energy audit rules add paperwork but let buyers and sellers opt out

Regulations that went into effect Jan. 1 regarding energy consumption audits probably will add to the stack of paperwork that comes with buying a house, rather than bring business to companies that specialize in performing those audits, local Realtors believe.

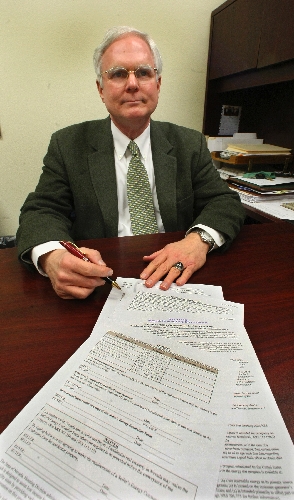

The energy audit typically costs $300 to $500 and can be waived if both the buyer and seller agree, said Paul Bell, president of Las Vegas Greater Association of Realtors.

"It’s just an option between both parties. That’s all it is," Bell said. "There’ll be a few (audits). I just don’t think many people are going to be interested in it. It’s just really difficult to gauge. A lot of investors are buying. They’re not that interested."

The energy evaluation form should be completed and signed by the seller, not the real estate agent. If the seller chooses to have an energy evaluation performed by a certified inspector, the inspector will complete and sign the form.

The audit is to be paid for by the seller, but that’s negotiable, Bell said.

Legislators intended to create greater awareness of energy efficiency with the regulation, and there will be some retrofitting of older homes by owner-occupants, he said.

"The type of buyers at Spanish Oaks or Scotch 80s, maybe for that client, but for entry-level buyers and investors fixing up homes, the market is already addressing many of those needs," Bell said.

The Nevada Association of Realtors opposed mandated home energy audits and succeeded in limiting the legislation. Sellers are required to disclose home energy consumption on a form created by the Nevada Office of Energy, but that form can be waived.

The association’s website, www.nvar.org, provides information on how to complete the energy consumption evaluation form.

According to Nevada Revised Statute 113.115, passed by the Nevada Legislature in 2007 and amended in 2009, the form does not need to be completed where a transaction for conveyance of residential property is by foreclosure; between any co-owners of the property; by a person who takes temporary possession or control of the property solely to facilitate its sale; or if the seller and purchaser agree to waive the requirements for the evaluation.

Also, if an evaluation of a residential property was completed within five years of entering into an agreement to purchase the property, the seller may use that evaluation.

Les Lasarek, owner of Home Energy Connection in Las Vegas, said the energy audit can be done by the homeowner at no associated cost. It’s a simple form that mainly looks at utility bills, he said.

"What’s the value to the homeowner to see utility bills if you’re a couple moving into a home occupied by five people with the swimming pool pump running all day?" Lasarek asked. "My argument is they really watered it down. This is a starting point. Why not have some meat in it?"

Lasarek said the federal government is working on a pilot program for rating all homes that is "significantly more rigorous" than Nevada’s evaluation. It would require a quantitative building analysis by certified Home Energy Rating System inspectors.

"My concern is the voice of real estate lobbyist organizations is not representative of all agents," Lasarek said. "I know agents that have had audits done on their own homes. Part of the real estate agents’ creed is whatever information they have on a home, they’re supposed to disclose, like Carfax when you go to buy a car."

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.