Give Nevada credit, would you?

Real estate broker Forrest Barbee believes the free market generally works best without government interference. But he can’t dispute that a tax credit for first-time homebuyers is doing what it was meant to: spur home sales.

“I just can’t fight the evidence,” Barbee said.

The evidence comes from the Internal Revenue Service, which says that 20,222 Nevada first-time homebuyers have applied for the tax credit of up to $8,000 for the tax year 2008 as of Sept. 18.

“That’s a third of all the sales, new and resale, for that one-year period. That’s a pretty sizable number,” said Barbee, corporate broker at Prudential Americana Realty and a director of the Greater Las Vegas Association of Realtors.

“It certainly suggests to me that an awful lot of people are taking advantage of this tax credit,” Barbee said.

Underlining the point, the General Accountability Office on Thursday reported that Nevada had the highest number of taxpayers seeking the tax credit, followed by Utah and Arizona.

Most of the Nevada taxpayers taking the credit bought homes last year and applied for a $7,500 tax credit signed into law by President Bush, IRS spokesman Raphael Tulino said. That law gave first-time buyers 15 years to repay the $7,500 without interest.

A smaller portion of the people counted by the IRS bought a home this year and have filed amended returns to take the more generous $8,000 tax credit off their 2008 tax return, he said. President Obama signed the law with the higher tax credit. Taxpayers can keep the $8,000 tax credit if they keep the house as their main residence for three years.

Barbee assumes that most of the first-time homebuyers this year will take the tax credit on their 2009 tax return, rather than file amended returns for 2008.

No one knows how many first-time buyers took advantage of the tax credit this year, but analysts suggest the number may be big enough to boost the state’s stalled economy.

Jason Unger, 32, a single flight attendant who bought a home through Prudential Americana Realty, hasn’t filed for a tax credit yet but plans to take the tax credit on his 2009 return.

“The $8,000 tax credit was definitely a motivator for me to buy a house,” Unger said.

He paid $128,000 for a foreclosed four-bedroom, 21/2-bath single family house near the South Point. The same house would have sold for about $350,000 a couple of years ago, he said

Unger intends to use some of the tax credit for improvements, such as a swimming pool or hot tub and new flooring.

Sarah Orenich, 28, and her long-time boyfriend, J.R. Medenwaldt, have put money in escrow for a house and hope to get the $8,000 tax credit with the added benefit of a low-rate mortgage and low price for the house.

“This is the perfect time for a first-time homebuyer to get into the market,” said Orenich, a brokerage administrator at Prudential Americana Realty.

They agreed to pay $140,000 for a three-bedroom, 21/2-bath bath home built in 2004 near Jones Boulevard and the Las Vegas Beltway.

Barbee believes the tax credit programs may have provided key support to housing sales in Southern Nevada last year when consumer confidence was lower.

“It kept housing going, and the market would have been worse without (the tax credit),” agreed Realtor Don Wiemer of Sellstate NRES. However, “for everybody that bought a house only for (the tax credit), I think there are five people buying because the price got so low,” Wiemer said.

Another official agreed.

“Our sense is that (the tax credit) hasn’t really been that big of a factor,” said Bradley Beal, chief executive officer of Nevada Federal Credit Union.

Nov. 30 is the deadline for the $8,000 tax credit for buying a home, but Senate Majority Leader Harry Reid, D-Nev., co-sponsored a bill that would extend the tax credit for six months.

Contact reporter John G. Edwards at jedwards@reviewjournal.com or 702-383-0420.

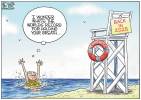

WHAT’S A 4-YEAR-OLD DOING BUYING A HOUSE?WASHINGTON — The rush to implement a tax credit for first-time homebuyers opened the program up to potential fraud by people who hadn’t bought a home or already owned one, Congress was told Thursday.

J. Russell George, Treasury Inspector General for Tax Administration, questioned the eligibility of some 100,000 claims out of the 1.5 million who have sought to take advantage of the $8,000 tax credit incorporated in the economic stimulus package enacted last February.

He said claimants include those who could possibly be illegal immigrants and that 580 people seeking the first-time homebuyer credit were under the age of 18. The youngest taxpayers receiving the credit were 4 years old, his office said.

George and an Internal Revenue Service official testifying before a House Ways and Means Committee subcommittee stressed that many of the questioned claims may eventually be found to be legitimate after further examination.

But the hearing raised concerns as Congress considers whether to extend, or even expand, the popular program that is set to expire at the end of November.