Builders anticipate bleak ’08

U.S. homebuilders meeting in Las Vegas said the housing market probably will weaken in 2008 as foreclosures rise and banks tighten lending standards.

Demand has deteriorated in many markets, limiting the prospect of a rebound in new home sales, chief executive officers for D.R. Horton and Beazer Homes USA said Tuesday at a JPMorgan Chase & Co. conference at Mandalay Bay.

Next year "is going to be worse than ’07 for us and for the industry in general," said Donald Tomnitz, CEO of Fort Worth, Texas-based D.R. Horton, the fourth-largest U.S. homebuilder.

The housing slump that began in 2005 has erased about $36 billion in stock market value for the largest 15 homebuilders this year through Monday. New home sales dropped 23 percent in the year through September.

California and Florida housing markets continue to weaken and the Las Vegas market is "soft," Tomnitz said. New home sales in Phoenix will likely worsen in 2008, he said.

Ryland Group of Calabasas, Calif., has cut inventory by an estimated $373 million in 2007 to contend with the slump, CEO Chad Dreier said at the conference.

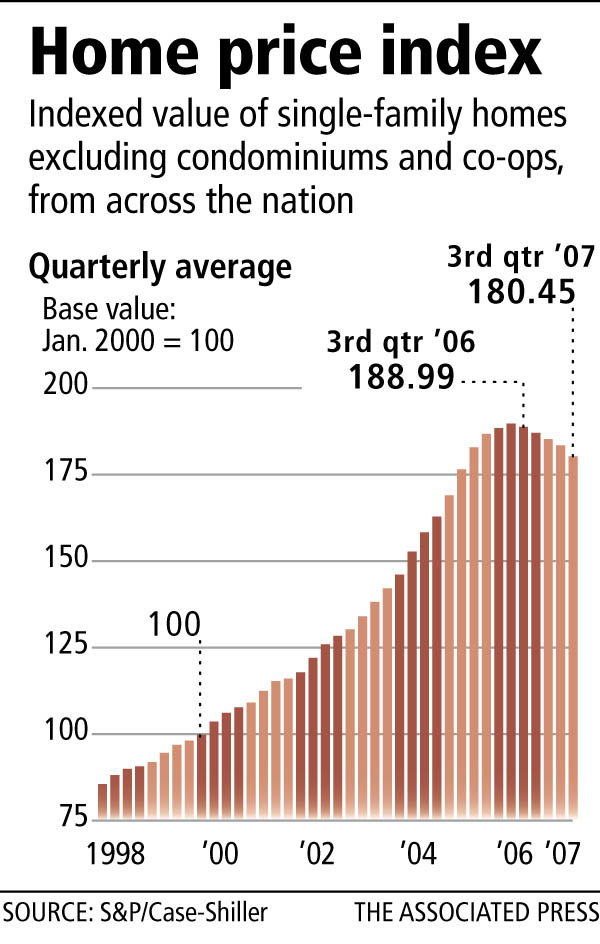

Separately, a new report showed that U.S. home prices fell 4.5 percent in the third quarter from a year earlier, the sharpest drop since Standard & Poor’s began its nationwide housing index in 1987 and another sign that the housing slump is far from over, the research group said Tuesday.

The S&P/Case-Shiller quarterly index tracks prices of existing single-family homes across the nation compared with a year earlier.

The index also showed that prices fell 1.7 percent from the previous three-month period, the largest quarter-to-quarter decline in the index’s history.

A separate S&P index covering 20 U.S. metropolitan areas showed a home price drop of 4.9 percent in September from a year earlier. Only five metro areas — Atlanta, Charlotte, N.C., Dallas, Portland, Ore., and Seattle — showed an increase in prices, but S&P noted that the pace of increases is slowing.

Tampa and Miami led the index with the biggest year-over-year declines at 11.1 percent and 10 percent, respectively. It also showed drops in San Diego of 9.6 percent; Detroit, 9.6 percent; Las Vegas, 9 percent; Phoenix, 8.8 percent; and Los Angeles, 7 percent. The S&P’s 10-area index decreased 5.5 percent in September from 2006.

On Thursday, the Washington-based Office of Federal Housing Enterprise Oversight is to release its third-quarter index of U.S. home prices.

The government’s calculation of home prices has remained in positive territory. It is calculated on loans of $417,000 or less that are bought or backed by government-sponsored mortgage companies, Fannie Mae and Freddie Mac — excluding many of the riskier loans that have soured this year.

Housing in Las VegasMore InformationGROUPS AGREE TO WORK ON FORECLOSURE ISSUE DETROIT — A mortgage industry group agreed Tuesday to help the nation’s mayors raise public awareness about ways to avoid foreclosure as part of an effort to address the U.S. housing crisis. The agreement was announced following a meeting in Detroit organized by the U.S. Conference of Mayors and attended by mayors from across the country. The mortgage bankers association also plans to help cities get access to information on homes in foreclosure to ensure those properties don’t blight neighborhoods. "The foreclosure crisis has the potential to break the backbone of our economy," Douglas Palmer, mayor of Trenton, N.J., and president of the mayors group, said following the meeting at the MGM Grand Detroit. THE ASSOCIATED PRESS