Area housing market won’t completely recover until 2012

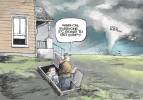

The housing market in Las Vegas won’t fully recover until the first quarter of 2012, facing challenges this year similar to last year, high foreclosure rates and stagnant new-home sales, a housing analyst with The Concord Group said Friday.

Marta Borsanyi, principal of the Newport Beach, Calif.-based real estate firm, defines full recovery as three to four new-home sales a month per subdivision and low single-digit price appreciation.

A year ago, Borsanyi predicted a full recovery by the fourth quarter of 2011, but she’s pushing it back three more months because the downtick in 2009 housing activity was greater than expected.

Demand for new housing functions as the “lever” for recovery, Borsanyi said.

New-home sales declined 45 percent last year and are down 75 percent from the normal conditions seen in 1996 to 2001, when they averaged about 24,000 a year. They dropped from 45,000 at the peak of the housing bubble in 2005 to just 4,500 in the past 12 months.

Long-term demographic fundamentals remain strong for Las Vegas, positioning the new-home market for recovery when population and employment begin to increase again — and they will, Borsanyi said. The base of 700,000 households is projected to grow by 2.5 percent, or about 18,000 households, over the next five years.

However, current economic struggles, poor consumer sentiment and high foreclosure rates will prevent new-home demand from reaching intrinsic growth levels until 2011, she said.

In the meantime, Borsanyi expects to see some velocity increase in new-home sales, possibly late this year, assuming employment projection accuracy and relief in the credit markets.

“We are bottoming out, probably in October,” Borsanyi said. “After that, things will go up, and I think it will be a healthy clip if there will be employment growth. That is the key.”

Employment in Southern Nevada is about 850,000, down 9 percent, or 90,000 jobs, from its peak.

New-home prices fell 18 percent to $250,000 in 2009, including a 3 percent decline in the third quarter, The Concord Group reported in its Las Vegas Housing Market Outlook. The percentage decline is much higher than other U.S. housing markets, with only the Inland Empire region of Southern California showing a steeper decline (22 percent).

Borsanyi said she expects to see new-home volume slowly ticking up this year, with an 18-month lag in prices.

“It won’t be hard to get there in one to two years,” she said. “In the recovery process, if you go back four different cycles of development, it always starts with volume before prices. It was 18 months in the Inland Empire before prices started to kick in.”

Borsanyi said new-home prices are depressed because of “very negative comps,” or comparable sales of equal-sized homes in the same area.

Demand for finished residential lots is projected to precede the Las Vegas housing recovery by about 12 months, starting in the first quarter of 2011, the housing analyst said. Entitlement and repositioning strategies need to begin 12 months before that in order to prepare the lots for delivery.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.