Low on lenders, Nevada small businesses struggle to find cash

During the grand opening for his business, John Pinnington said nobody would have ever known that at the time he was living in a house with no electricity and showering in the back yard with a 5-gallon bottle of water.

“Ten thousand dollars would have helped,” he said, adding that he tried to get loans. “But everyone (bankers) said, ‘Well people usually need $250,000 to start a business.’ I said, ‘Look, just give me $2,500. That will help me.’ But I couldn’t get any money.”

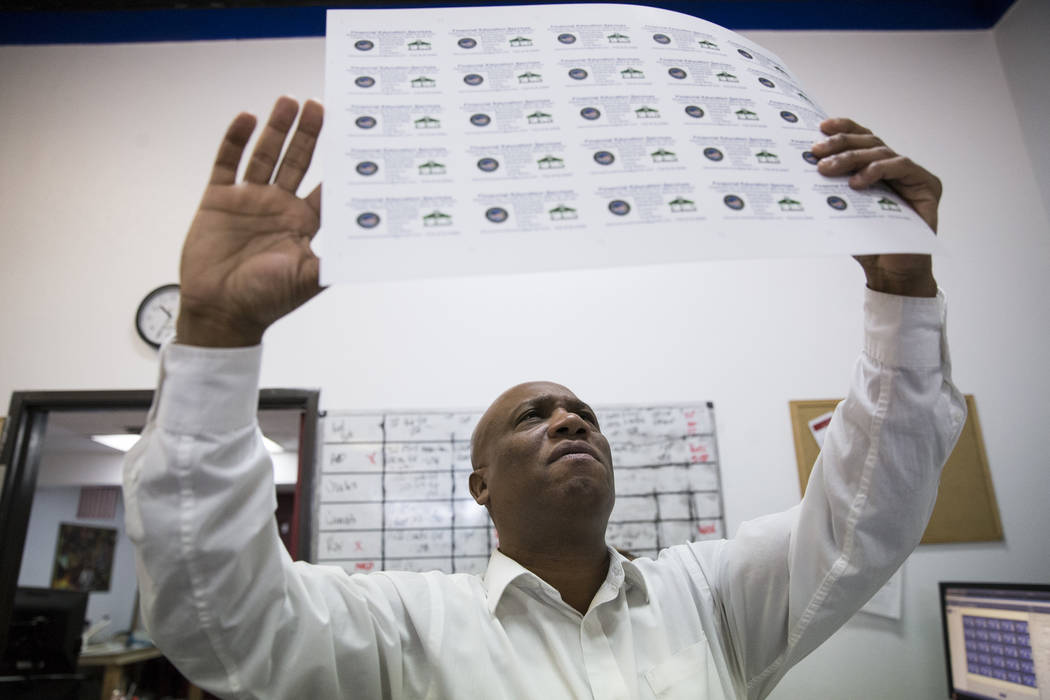

After working as a bodyguard for about 14 years, Pinnington opened AA Printing Service in 2011 in Las Vegas with no prior printing experience, using $1,100 of the $4,500 he had in the bank to self-finance the business.

“It was a decision whether to pay my mortgage or keep the money for my business,” he said. The money helped him to buy printing supplies and lease printing equipment and office space.

A LENDING VACUUM

Pinnington isn’t the only small-business owner in Las Vegas who has struggled to find local microlenders — financial institutions willing to lend businesses up to $50,000, according to the U.S. Small Business Administration.

Shavonnah Tièra Collins, managing director of RedFlint — a business incubator, community education center and startup accelerator in Las Vegas — said angel investors and equity-based crowd funding are trying to fill that gap, but it’s still not enough.

Some of the startups that Redflint helped to get off the ground are “definitely” leaving Las Vegas, Collins said.

“They’re looking for capital, and they’re not finding it here. And then a few (related to the hospitality and gaming industry) are staying because this is their primary market for their customer base,” she said.

According to a study released last month by the consumer finance website ValuePenguin, Nevada is friendlier to midsize and large businesses than it is to small businesses. That is in part because of a need for more lenders, said Rebecca Wessell, ValuePenguin small business product manager.

“If you’re looking at Nevada just purely from a regulatory environment, it might be that Nevada has more small-business friendly policies than other states,” Wessell said. “Like, is it easy to get my permits and licenses? But lending and private resources for small businesses is a separate thing.”

Accounting for city population, Las Vegas was ranked the third-worst city for small-business owners in the study. Boulder, Colorado, on the other hand, earned the top spot out of 200 cities.

Boulder has over five times fewer corporate, subsidiary and regional managing offices and more than triple the amount of mortgage and non-mortgage loan brokers.

Brian Maddox, director of Nevada operations with Clearinghouse Community Development Financial Institution, said there is a local “void” in microlending.

Clearinghouse CDFI serves low-income and underserved communities with loans still starting around $250,000.

“There are a couple of organizations that lend of the micro-level here in the Valley, but it’s just not enough to support the kind of demand that exists here,” Maddox said.

MAKING A DENT

Accion is one of those organizations. Headquartered in Albuquerque, New Mexico, Accion opened a Las Vegas office in 2014.

Erin McDermott, market manager and regional lending officer for Accion in Nevada, said the company chose to expand to Nevada for reasons that include the area’s proximity to Accion’s existing service area and strong entrepreneurial activity, as rated by the Kauffman Index of Entrepreneurship.

In its first year in Nevada, Accion reported it disbursed more than $1.3 million to 114 businesses. Last year, Accion reported disbursing more than $1.9 million to 166 businesses.

“In 2015 we saw nearly 400 applications in Nevada, and in 2016 that number jumped to nearly 500,” said Accion Media and Communications Specialist Brinn Pfeiffer. “Our lending numbers tell us that there’s great potential across the state of Nevada.”

Pinnington learned of Accion at the Urban Chamber of Commerce in 2015. By then, he had several loans from alternative online lenders, though he declined to say which ones. His first loan was for $8,000 in 2013.

It was a last-resort option, he said, and although they were high-interest loans, they helped him to build credit history, he said. Pinnington said Accion helped him to refinance and consolidate his existing loans. If only there were a local lender like Accion that he knew about sooner, he said.

“We went (to Accion) and we said, ‘Take a chance on us,’” he said, adding that Accion gave him $10,000. “They said, if you pay this down within three to six months, we’ll come back to you again, so we did that. Now we’re starting to get away from the hard money.”

a false assumption

Maddox said the more local microlenders and resources for small-business owners, the better, but there is still a ways to go.

“It’s good to tell the story of the types of loans we’re making,” Maddox said. “In the traditional market, these loans are deemed to be risky, and it’s assumed that these loans have a high default rate and that they are not profitable,” Maddox said. “Our default rate is less than 1 percent, which is stellar in the industry.”

Contact Nicole Raz at nraz@reviewjournal.com or 702-380-4512. Follow @JournalistNikki on Twitter.

MICROLENDERS IN LAS VEGAS INCLUDE:

Nevada Business Opportunity FundDisbursed about $1.4 million in 2016

— Average loan amount: about $25,000

AccionDisbursed about $1.9 million in 2016

— Average loan amount: about $11,200

Prestamos CDFIDisbursed about $100,000 in micro loawns in 2016

— Average loan amount: about $23,000